(**) Disclosure: This post may contain affiliate links, meaning our company, JCHQ Publishing will get a commission if you decide to make a purchase through the links, but at no additional cost to you.

To become a notary loan signing agent in Missouri, an applicant must meet the state-eligibility requirement, submit a notary public application to the Missouri Secretary of State, complete a notary training course, pay the registration fee, purchase a surety bond and other business supplies.

So what does a loan signing agent do in Missouri? When people are getting a mortgage to purchase a house, or they need to refinance their property, there will be loan documents involved. Your role as a notary loan signing agent is to facilitate the signings of loan documents with the borrower and witness them in signing the paperwork.

You also need to verify the identity of the signers, place the notary stamp on the signed documents, then send them back to the escrow or title company.

But keep in mind that you should NOT be providing legal advice, and you cannot explain the terms of the loan documents to the borrower.

In this guide, you’ll find the steps to become a notary loan signing agent in Missouri. How much do Missouri loan signing agents make? What does it take to work in this profession? And other helpful career info.

Note that this guide is for general information only and not to provide any professional advice. Although I’ve tried to put down info as accurate as I could possibly find, you should always refer back to the Missouri Secretary of State and the State law.

So let’s go through the notary loan signing career in Missouri.

Would you like to learn how to make $75 to $200 per signing appointment? You must check out the Loan Signing System from Mark Wills. (**) This is one of the best training programs for loan signing agents. Many students have achieved remarkable business success after taking this program.

7 Steps to Become a Notary Loan Signing Agent in Missouri

Step 1: Meet the basic requirement

- At least 18 years of age;

- U.S resident alien or registered voter of the county which the applicant will be commissioned;

- Legal resident of the same country which you’ll be commissioned;

- If you are a non-resident of Missouri, then you must have an employee address in the county for which you are commissioned;

- Able to read and write English

Step 2: Complete the notary training course

Rather than calling it a course, I would say it is more like a test or an exercise.

You’ll be given two pages of the Secretary of State’s Office Written Notary Training Course. In there, you’ll answer 30 multiple-choice questions.

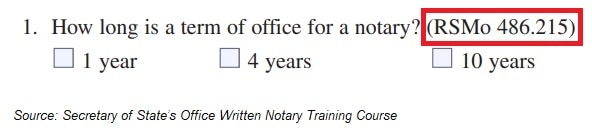

Those are the fundamental questions about the notary public profession and the standard of practice. For example, how long is a term of office for a notary? What is the required notary bond amount?

Yet, getting familiar with the materials Missouri Notary Public Handbook is always a good thing. (I’ll also talk more about this Handbook later in this post). But it is unnecessary to look all over the place for the answers.

Beside each question of the Training Course, you would see an RSMo code. These are the Missouri statutory sections number.

What you need is to go to the Missouri Revisor of Statutes website and type in the section number. Then the correct answer would appear.

You can complete the notary training course online, which I highly recommend doing so. It’s a lot quicker, more convenient, and using less paper is always good for the environment.

But if you insist on using the paper format, you could download the Written Notary Training Course. Actually, I think the RSMo codes are only shown on the paper exercise. So you could open the file and take a look first.

Then upon completion, you could mail it to the Missouri Secretary of State along with the Notary Public Application, which I will discuss in the next step.

Step 3: Submit the Notary Public Commission Application

You need to fill out the Application for Commission as a Notary Public (Form Comm. 51). The questions on the application are pretty strict forward—for example, your name, business address, driver license, background info.

There is a filing fee of $25. That could be paid with a credit card, but there will be a $1.25 convenience fee. You could also pay with a cheque or money order, payable to Director of Revenue.

Once again, I highly suggest you to consider applying online. You may do so at the Missouri Secretary of State website. Here’s their registration guide in case you need it.

But if you decide to mail in the required documents, you can also send it to the Secretary of State Office. The mailing address is on the form. Just remember to attach the completed Written Notary Training Course.

Step 4: Purchase a surety bond

The Missouri Secretary of State requires you to purchase a $10,000 surety bond with a 4 years term. You must get it from a licensed surety such as a notary bonding company, an insurance company, or a notary organization.

Once you submit the application to the Secretary of State Office, the surety bond issuer must execute it within 90 days.

Note that the surety bond is to protect those for whom the notary public performs a notarization, but not you as a notary public. If you need coverage for your professional services, you should consider getting an Error & Omission insurance (E&O).

I just checked with a surety bond issuer. Their $10,000 bond amount comes with E&O coverage. Below are the available options.

| Bond Type | Bond Amount | Cost |

|---|---|---|

| Notary Bond $10,000 Errors & Omissions | $10,000 | $50 |

| Notary Bond $20,000 Errors and Omissions | $10,000 | $70 |

| Notary Bond $30,000 Errors and Omissions | $10,000 | $90 |

Source: suretybonds.com

Step 5: Receive the notary public commission certificate

Once the Missouri Secretary of State approves your commission, you must get it qualified at the county’s clerk office within 90 days. Else, they will cancel your commission.

You need to go there in person and remember to bring along the $10,000 surety bond.

In there, the clerk or deputy will administer the oath of office. Then you’ll submit a handwritten specimen of an official signature on the oath of office.

Afterward, the county clerk will return the bond, your official signature and oath of office back to the Secretary of State. The clerk or deputy will then provide you with the commission certificate.

Note that the signature MUST match the exact name typed on the commission certificate. Therefore, you should review to make sure all the details are correct. (e.g., your name, county of residence, commission dates).

Step 6: Get the notary business supplies

Notarized seal & stamp that meets the industry standard

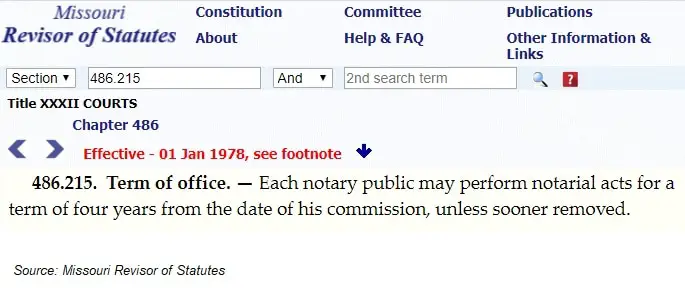

You may notarize documents with an engraved embosser seal or a black inked rubber stamp seal. You could purchase them from an office supplies company. If you do, they usually would require your notary public commission certificate.

Make sure that the stamp or embosser stamp would meet the requirement of the Missouri Secretary. It needs to be in black ink and contain the following information:

- Your exact name as appears on their commission certificate;

- The assigned commission number;

- Thee phrases: “Notary Seal,” “Notary Public,” “State of Missouri.”

You also need another stamp which contains certain information such as the expiration date and the county for which you are commissioned. The information must not be smaller than eight-point type. Below is a sample from the Missouri Notary Handbook for your reference.

Keep a good record of your notarized acts

You are required to keep a journal of your notarized acts. It is an essential part of good business practice and also serve as proof that you have taken reasonable steps to identify the signer of a document.

Consider using a permanently bound journal because their pages are more difficult to remove or lose than loose-leaf pages. You may find it at local office supply stores, or through notary organizations.

You should record the list notarial acts in chronological order. Also, in your notary journal, it is better to take note of:

- Date of the notarization;

- Type of notarization (e.g, acknowledgment or jurat;)

- Type of document;

- Name and address of the signer;

- Identification used by the signer;

- Amount of notary fee;

- Signature of the signer.

You must keep both the notary seal and journal in a locked and secured area, where only you have direct and exclusive control of it. (e.g. a locked drawer or cabinet.)

Step 7: Incorporate electronic notarization into your practice

One thing I really like about this industry in Missouri is the availability of notarizing documents digitally. Doing so could bring you great convenience to streamline your business practice.

Although you still need to meet the signer in person, a rubber stamp or an impression type seal is not needed for an electronic notarization. This allows documents to electronically notarized rather than in traditional pen and ink.

You just need to make sure your notarized acts comply with the rules.

(1) A notary may use an electronic seal in the performance of a notarial act.

(2) In using an electronic signature and seal in the performance of a notarial act, the notary public must adhere to all applicable laws of this state that apply to notaries public.

(3) When a notarial act requires an electronic record to be signed, the principal must appear in person before the notary public.

(4) A notary public must keep in the sole control of the notary any system used to produce the notary’s electronic signature and seal.

(5) The electronic signature and seal of a notary public shall contain the

notary’s name exactly as indicated on the notary’s commission, and the electronic seal must contain all elements of a notary seal required by law and meet all other statutory requirements of this state regarding notary seals.

(6) If an electronic signature or seal is used in the performance of a notarial act, a notary public shall complete an electronic notarial certificate that is attached or logically associated with the notary’s electronic signature and seal.Quote from the Missouri Notary Handbook

(7) The secretary of state shall publish on the secretary’s website the name of duly commissioned notaries and commission number of notaries for the purposes of being capable of independent verification.

Not only that, this is a lot more convenient for record-keeping and delivery of completed documents, but less paper usage is good for the environment too. Here’s a post on how to run a paperless office.

How much do notary loan signing agents make in Missouri?

The average annual income of Loan Signing Agents in Missouri is $40,768. The income typically ranges between $25,934 to $52,732. Top earning loan signing agents in Missouri are making over $78,666.

As a notary, you could work on different documents, but the loan signing in the real estate market could be a lucrative niche.

Top 10 Highest Paying Cities for Loan Signing Agents in Missouri

| City | Annual Salary |

|---|---|

| St. Joseph | $47,907 |

| St. Louis | $45,710 |

| Lee’s Summit | $45,258 |

| Kansas City | $45,111 |

| O’Fallon | $43,217 |

| St. Charles | $42,939 |

| Joplin | $42,858 |

| Independence | $42,051 |

| Columbia | $41,182 |

| Springfield | $39,992 |

Source: ZipRecruiter – March 13, 2022

Can you make over $10,000/month as a loan signing agent? Be sure to check out our notary earning guide. You’ll find a case study where a loan signing agent has built her business to such a successful figure.

Is there demand for notary loan signing agent in Missouri?

As long as people are obtaining mortgages or refinancing their homes, there would be a demand for notary loan signing agents in Missouri.

All originated mortgages in Missouri

| YEAR | RECORDS |

|---|---|

| 2017 | 145,419 |

| 2016 | 165,943 |

| 2015 | 147,519 |

| 2014 | 120,463 |

| 2013 | 178,486 |

| 2012 | 204,935 |

| 2011 | 154,134 |

| 2010 | 182,546 |

| 2009 | 211,924 |

| 2008 | 169,405 |

| 2007 | 218,490 |

Source: Consumer Financial Protection Bureau – Home Mortgage Disclosure Act (HMDA) (May 10, 2020)

Furthermore, some states are “Attorney states,” which means only an attorney can handle the closing paperwork. Whereas, others are “Escrow States” where a loan signing agent can do the work.

According to the First American Title, Missouri is a not an “Attorney State,” which is good news if you are interested in starting a notary loan signing business.

Career tips from Calvin Darville, an incredibly successful loan signing agent

” I would advise them to make sure they get training before entering the industry. I heard countless horror stories about the errors that incompetent notaries make.

I’ve even experienced some myself in my short span as a signing service owner. If a loan package isn’t executed correctly, it could literally blow a million-dollar deal. So my advice is definitely to get the proper training to limit errors.”

– Calvin Darville, President at Comfortable Closings

Here’s an interview I did with Calvin, where he shared his journey from being an Injured Football Player to a Successful Notary Loan Signing Agent. Be sure to check it out.

What education do you need to become a Missouri notary public?

To become a notary public in Missouri, you’ll need to complete a the Notary Training Course. A good place to learn about this profession is by reading the Missouri Notary Handbook. It is a 72 pages guide published by the Missouri Secretary of State.

Here are the topics being covered:

- Explanation of $25 Application Fee

- Revised Statutes of Missouri, Chapter 486 (Notaries Public)

- Code of State Regulations, Title 15

- Ch. 100 (Notary Commissions)

- Code of State Regulations, Title 15

- Ch. 110 (Electronic Signatures and Seals)

- General Information

- Application and Appointment

- Qualifying at the County Clerk’s Office

- Term of Office

- Notary Public Bond

- Embosser Seal and Rubber Stamp

- Journal

- Reapplying

- Fees

- Amended Commissions (Name change, county change,

- address change)

- Non-resident Notary Change of Employment in Same or

- Different County

- Stolen or Lost Notary Public Seals or Notary Journal

- Destroyed, Broken, Damaged, or Inoperable Notary Seals

- Resignation of a Notary Commission

- Official Misconduct

- Applicable Law

- Possible Disqualification

- Executing Witness .

- Fees Allowed for Swearing in Notaries

- Court Reporters Qualified to Give Oaths

- Other Notary Information

- Proper Notarization

- Sample Affirmations

- Sample Individual Acknowledgment

- Sample Jurat

- Sample Certificate of Facsimile

- Instructions for Completing Sample Affirmations

- How to Obtain Applications

- Glossary

- Document Certification Information

I’ll leave a link of this handbook in the reference section at the end of this post.

Is there a exam to become a notary in Missouri?

No, there is no examination requirement to become a notary public in Missouri.

How much does it cost to become a notary loan signing agent in Missouri?

It costs approximately $147 to become a notary loan signing agent in Missouri.

Here’s the estimated breakdown:

- Application fee ($25)

- Notary Bond with E&O coverage ($90)

- Notary seal ($17)

- Business journal ($15)

There could be other expenses involved, such as travel expenses, electronic signature vendor, printer, papers and other business supplies.

How long does it take to become a notary loan signing agent in Missouri?

The Notary Training Course can be completed in a day. Getting the surety bond and filling out the notary application can be done in a day or two.

I checked on the Missouri Notary Handbook. It says that once they receive your documents, they would process either on the same or the next day. For regular mail, you could send them to

- Commissions Office

- Secretary of State’s Office

- PO Box 784 Jefferson City, MO 65102-0784

For express mail option, you could send them to

- Commissions Office

- Secretary of State’s Office

- 600 W. Main St., Room 322 Jefferson City, MO 65101

On the other hand, walk-in customers would receive same-day processing. Their office hours for walk-in services are from 8:00 am to 5:00 pm.

They have several office locations which are:

- Commissions Office James C. Kirkpatrick State Information Center 600 W. Main St., Room 322 Jefferson City, MO 65101

- St. Louis: 815 Olive St., Suite 150 St. Louis, MO 63101 (314) 340-7490

- Kansas City: 615 E. 13th St., Room 513 Kansas City, MO 64106 (816) 889-2925

- Springfield: 149 Park Central Sq., Suite 624 Springfield, MO 65806 (417) 895-6330

So give or take, it would take approximately 1 to 2 weeks to become a notary loan signing agent in Missouri.

Can a felon be a notary loan signing agent in Missouri?

Having a conviction for a felony may impact the application to become a notary loan signing agent in Missouri. The Missouri Secretary of State needs to make sure that you are a person with credibility, truthfulness, and integrity to fulfill the responsibilities of the position.

In the Missouri Notary Handbook, it says that there could be possible disqualification to become a notary public for persons convicted of a felony.

However, I don’t think that having a felony would mean they would automatically decline your application. Because on the “Application for Commission as a Notary Public,” it asks you to provide further details about the conviction or misconduct.

13. Have you been refused a commission as a notary public or had a commission revoked? (If yes, attach a separate letter indicating reason and date.)

YES NO14. Have you ever been convicted of or pled guilty or nolo contendere to any felony? (If yes, attach a list and supporting documentation of such convictions or pleas of guilt or nolo contendere.)

YES NO15. Have you ever been convicted of or pled guilty or nolo contendere to any misdemeanor incompatible with the duties of a notary public? (If yes, attach a list and supporting documentation of such convictions

Quote from Application for Commission as a Notary Public

or pleas of guilt or nolo contendere.)

If they would decline you instantly, then there’s no reason that they would ask for further documentation. Therefore, I believe that would depend on the severity and nature of the conviction. The Missouri Secretary of State should review it on a case-by-case basis.

How to renew notary in Missouri?

You need to renew the notary commission every four years. Similar requirements (e.g., submission application) discussed above would apply.

To avoid an interrupted business period, it’s better to send in your notary public application at least six months before your current notary commission certificate is expired.

Also, upon renewal, you’ll need to get a new notary seal and destroy the old one so that it would not be misused.

Can I notarize for a family member in Missouri?

You must not notarize any documents where you have any financial or beneficial interest in the transaction. Therefore, notarizing a document for any family member could call into question, and such practice should be avoided.

I have more questions about being a notary loan signing agent in Missouri, where could I obtain more details?

You may contact the Missouri Secretary of State:

- Commissions

- PO Box 784, Jefferson City, MO 65102

- Toll-Free (866) 223-6535 or (573) 751-2783

Disclaimer: The information in this post is for general information only, and not intend to provide any advice. They are subjected to change without any notice, and not guaranteed to be error-free. Some of the posts on this site may contain views and opinions from individual not related to JCHQ Publishing. They do not necessarily reflect our view or position.

(**) Affiliate Disclosure: Please note that some of the links above are affiliate links, and at no additional cost to you. Our company, JCHQ Publishing will earn a commission if you decide to make a purchase after clicking on the link. Please understand that we include them based on our experience or the research on these companies or products, and we recommend them because they are helpful and useful, not because of the small commissions we make if you decide to buy something through the links. Please do not spend any money on these products unless you feel you need them or that they will help you achieve your goals.

Reference:

- First American Title- Your Guide to Real Estate Customs by State (Source)

- Missouri Secretary of State -Notary & Commission (Source)

- Missouri Notary Handbook (Source)

- Salary.com – Notary Signing Agent Salary in Missouri (Source)

- ZipRecruiter – Loan Signing Agent Salary in Missouri (source)

- Consumer Financial Protection Bureau – Home Mortgage Disclosure Act (HMDA) (Source)

- Suretybonds.com – Missouri Notary Bond (Source)

Hi my name is Robbin I’m a notary, and I would like to know how can I take the course to be a loan signing agent thank you

Hi Robbin, you can check out the “Loan System System” from Mark Wills. I talked to many signing agents, and they highly rated this training program. Here’s a review I wrote. https://realestatecareerhq.com/loan-signing-system-review/

You can also take a look at the certificate program offered by the National Notary Association (NNA). Here’s another review I wrote. In there, I also interviewed a notary who took the program.

https://realestatecareerhq.com/certified-notary-signing-agent/

I hope this helps.

Is a Certification, Test, or anything required for the State of Missouri to be a Loan Signing Agent. I see several programs for sale ,but are they a requirement?

Hi Bethany, there is a test with 30 multiple-choice questions. It can be completed online. The full details is listed in Step 2 of this post.

Another certificate program you may look into is the one offered by the National Notary Association (NNA). Many lenders prefer to work with signing agents with this credential.

Here’s another review I wrote. In there, I also interviewed a notary who took the program.

Furthermore, you can check out the “Loan System System” from Mark Wills. I talked to many signing agents, and they highly rated this training program. Here’s a review I wrote. https://realestatecareerhq.com/loan-signing-system-review/

Hope it helps.