(**) Disclosure: This post may contain affiliate links, meaning RealEstateCareerHQ.com will get a commission if you decide to make a purchase through the links, but at no additional cost to you.

I’m sitting in my home office now and thinking back how did my real estate agent come up with the listing price when he sold one of my properties. I remember he showed me some figures for multiple houses in the same neighborhood. Later on, I found out the method is called the “Comparative Market Analysis (CMA).”

What is a Comparative Market Analysis (CMA) in real estate?

Comparative Market Analysis (CMA) is a report that estimates the home value based on similar properties in the neighborhood. During the process, real estate agent would compare the sold prices, current listing prices, and make appropriate adjustment to comparable (comp).

In this article, you’ll find out why creating a CMA can be helpful to your clients and your business, what are the steps to generate one, what are its limitation.

As part of the requirement to stay in good standing with the Licensing Commission, you must complete the required Continuing Education. The Colibri is an online school that I like and received excellent feedback from its students. You may check out their CE courses here. (**)

Why Do You Need to Create a Comparative Market Analysis?

As a real estate agent, when a client contacts you to sell their home, you cannot just randomly pick a number as the listing price.

If the listing price is too high, the market will not accept it. You will just be wasting your client’s time and your effort in listing the property.

If the listing price is too low, then your client could be losing out ten of thousands of dollars.

A comparative market analysis can help you:

- Develop a thorough understanding of the property, the market trend, and its neighborhood

- Form an educated estimate of the home value

- Provide supporting numeric evidence which backs up your suggested listing price

- Broadens the perspective to your clients so their decision could be based on factual evidence rather than purely sentimental.

- Effective negotiation with potential buyers since you can clearly illustrate the property value

On the other hand, if you are representing buyers, the CMA could give them a clear idea of the property they are interested in. It helps them to come up with a reasonable offer price so that they will not overpay.

Furthermore, this is a great chance to demonstrate the value of your professional services to your client.

How to Do a Comparative Market Analysis?

1) Define Screening Variables

Although you can never find two properties that are exactly the same, by limiting your search to the ones that have similar pre-defined features as the subject property, your CMA would be more sound and meaningful.

Here’s the list of variables you could use to refine your search:

Compare Properties Within the Same Neighborhood

First of all, you should focus your searches to only comparable within the same area. It should have the same ease of transportation, access to schools, supermarket, parks, community facilities as the subject property.

Any discrepancy could lead to variation in the price, where you would need to make an adjustment in your analysis report.

The most would be within 1 to 3 miles of your client’s house.

Compare with Same Type of Properties

There are many kinds of properties. (i.e., condo, townhouse, house, duplex, multiplex). Each one would provide a different living style and hence would have its unique targeted buyers. For instance, millennials who just started their career might prefer a smaller size condo unit. Not only it is more affordable, but the exercising facilities are also an attractive feature.

On the other hand, a family with young children would prefer a more spacious house. It provides more storage rooms for their kids’ belongings such as toys, bicycle, skis, clothing, etc. Therefore, you should only choose the same type of property when doing the evaluation.

Compare with Same Level of Property Management

Properties such as condo units are managed by property management companies. It frees up the workload of homeowners (i.e., mowing the lawn, shoveling snow), maintain the common area and enhances security. In return, the residents would need to pay the management fees.

However, some property buyers would prefer a freehold unit. They can DIY these tasks and do not need to pay any management fees. Especially for real estate investors, the constant outflow in management fees could be a huge turnoff.

I have seen similar townhouses in the same neighborhood. They are priced very differently with and without property management.

Compare Properties with Similar Age

You should choose properties that are within 15 years of your subject property. The reason is the properties of different ages would have completely different repair needs.

For example, a newly-built house usually would have fewer maintenance issues in the short-run. All the items are brand new, and the property should be built under the most updated building code.

Whereas for older houses, there could be significant repair needs to be done. (i.e., windows, roof, furnace, flooring). Sometimes, its electrical wiring or building materials might not be up to today’s standard, since the requirement was different when the house was originally built.

The management fees are also a lot lower for newer condo building than older ones.

Compare Properties with the Same Number of Bedrooms and Bathroom

Generally speaking, a house with a greater number of bedrooms and washrooms would be more desirable. It gives an impression to potential buyers that the property is more spacious.

Most property researching websites allow you to filter your search by selecting the number of bedrooms and bathrooms. But keep in mind, rooms can be easily partitioned. You should review the square footage when comparing the properties.

Consider the Parking Availability

In a city with a high population density, the scarcity of parking spot could become a valuable asset to a property. A condo unit with additional parking spot could easily have a five-digits increase to its selling price.

If the comparable has different garage size than your subject property, then you should adjust accordingly in your comparative market analysis.

Compare Properties with Similar Size

As mentioned above, you can’t solely rely on the number of bedrooms/bathrooms in determining the size of the property. Instead, you should look at the square footage of the house.

Try to find comps that have size (+ or – )10% of your subject property. For example, if your listing property is 2000 sq ft, then you should look for comparable that has a size range from 1800 to 2200 sq ft.

Consider the Lot Size

Even when two adjacent properties have identical features, they could have a different lot size. It usually happens when one unit is located on the corner lot.

Many homeowners appreciate the extra land space and as they can use it to install a shed, a wooden deck, a backyard playset, or place a BBQ set.

Therefore, they are willing to pay an additional premium to the selling price.

Use Figures that are Less than 3 Months Old

A comparable property that was sold at a good price one year ago might no longer be relevant to your current listing. The reason is many things could happen during the time which could drastically affect home prices. For instance, there could be interest rate changes, and new mortgage rules being introduced.

Even seasonality could have an impact on real estate activity. During a cold and snowing winter, usually, there will be fewer potentials buyers, while less inventory in the market.

2) Conduct Online Research

The next step is to do an online search for properties in the neighborhood. There are several websites you could use. (i.e., Zillow.com, Realtor.com).

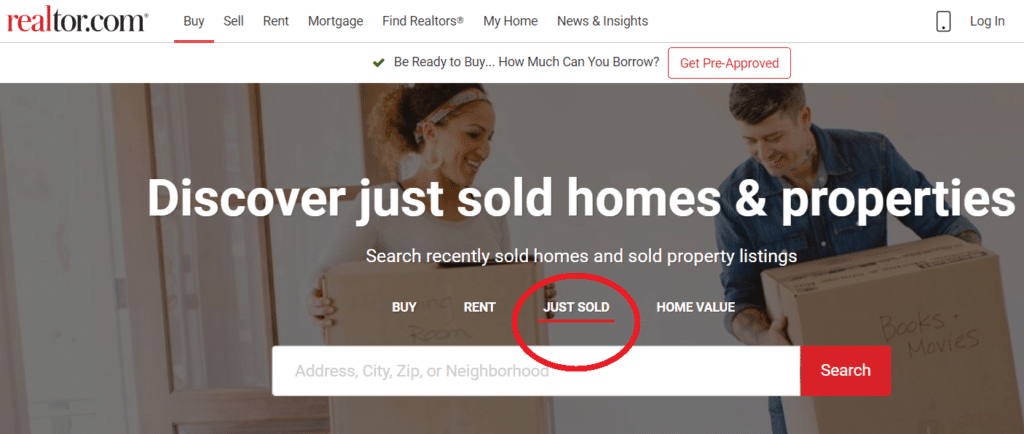

Let’s take a look at realtor.com.

When you first go to the site, you could enter the zip code of your subject property. I would use the “Just Sold” figures, as those were the transactions that really occurred. In other words, the market did accept those prices.

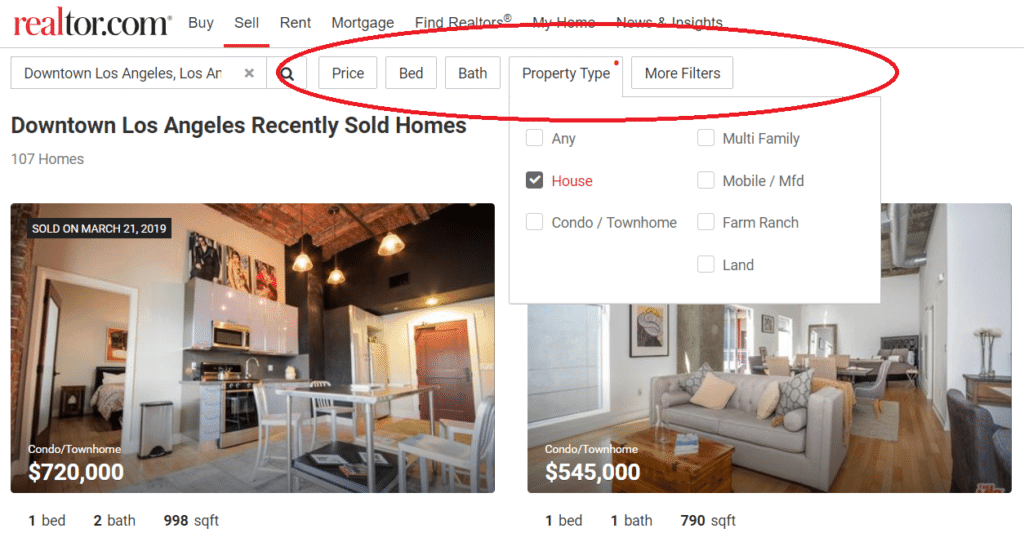

To refine your search, you could key in the variables in the filter. The realtor.com contains the screening feature for most of the variables we just talked about.

There are several reasons why I really like realtor.com over other websites.

- Data sources are more credible because they are entered by licensed real estate agents and pulled from the MLS.

- A wide range of useful data such as the history of selling prices, property tax, nearby schools.

3) Collect Data of Comparables

The more comparable you could find, the more you can know about the market in the neighborhood. Having five to six comps would be a good start to work with.

You should collect details such as the property address, the asking price, sold price, date sold, size of property and others.

Here’s an example of a CMA Data Collection Sheet.

| Address | Date Sold | Price Sold | Asking Price | Days Listed | # of Bedrooms | # of Bathroom | # of Parking Spot | Size (in Square Feet) | Special Notes |

|---|---|---|---|---|---|---|---|---|---|

| 123 ABC Street | 01-Jan-19 | $500,000 | $480,000 | 10 | 3 | 2 | 2 | 1200 | Average Condition. |

| 456 XYZ Ave | 15-Dec-18 | $440,000 | $450,000 | 30 | 3 | 1.5 | 2 | 1050 | Located very close to a gas station. |

| 222 Happy Cres | 02-Feb-19 | $515,000 | $510,000 | 15 | 4 | 2 | 2 | 1400 | Just changed the roof last year. |

| 1000 DEF Ave | 10-Mar-19 | $490,000 | $500,000 | 20 | 3 | 1 | 2 | 1150 | Ease of transportation. Close to highway. |

| 321 Unknown Drive | 07-Nov-18 | $430,000 | $445,000 | 22 | 3 | 1.5 | 1 | 1000 | Upgrade kitchen counter top 2 years ago. |

Depending on the type of clients you are working with, you might need to collect additional data. For instance, if your client is an investor, he/she could require an estimation of the rental income and the vacancy rate of their interested property.

But the above is just a reference, you should check with your real estate broker for a formal Comparative Market Analysis chart.

4) Calculation for Estimating the Home Value

Now, you have collected the price figures of several comparable. It’s time to apply them in estimating the value of the subject property.

Although generally speaking, the more bedrooms or bathrooms, the more expensive a property would be, this might not always be the case. For instance, two properties could have exactly the same size, just because one has partitioned more bedrooms do not always lead to higher prices.

For this reason, you should use the price per square feet when estimating the home value. You simply use the property sold price divided by its square footage.

Let’s continue with the CMA example we used previously.

| Address | Price Sold | Size (in Square Feet) | Price per square feet |

|---|---|---|---|

| 123 ABC Street | $500,000 | 1200 | $416.67 |

| 456 XYZ Ave | $440,000 | 1050 | $419.05 |

| 222 Happy Cres | $515,000 | 1400 | $367.86 |

| 1000 DEF Ave | $490,000 | 1150 | $426.09 |

| 321 Unknown Drive | $430,000 | 1000 | $430.00 |

The next step is to find out the average price per square feet of this comps. You would add all the price/square feet together, then divided by the number of comparables.

In this example, the average price per sq ft would be ($416.67 + $419.05 + $367.86 + $426.09 + $430.00) divided by 5 = $411.93.

After finding the average price per sq ft, then you would multiple this with the size of your subject property.

Suppose the size of your subject property is 1300 sq ft, then the home value is estimated to be $411.93 multiply by 1300, which is $535,514.20.

5) Review Original Listing of the Comparable

To conduct a thorough analysis, you should try to find out what are the key difference between the comparable and the subject property. This way, you could make an adjustment accordingly.

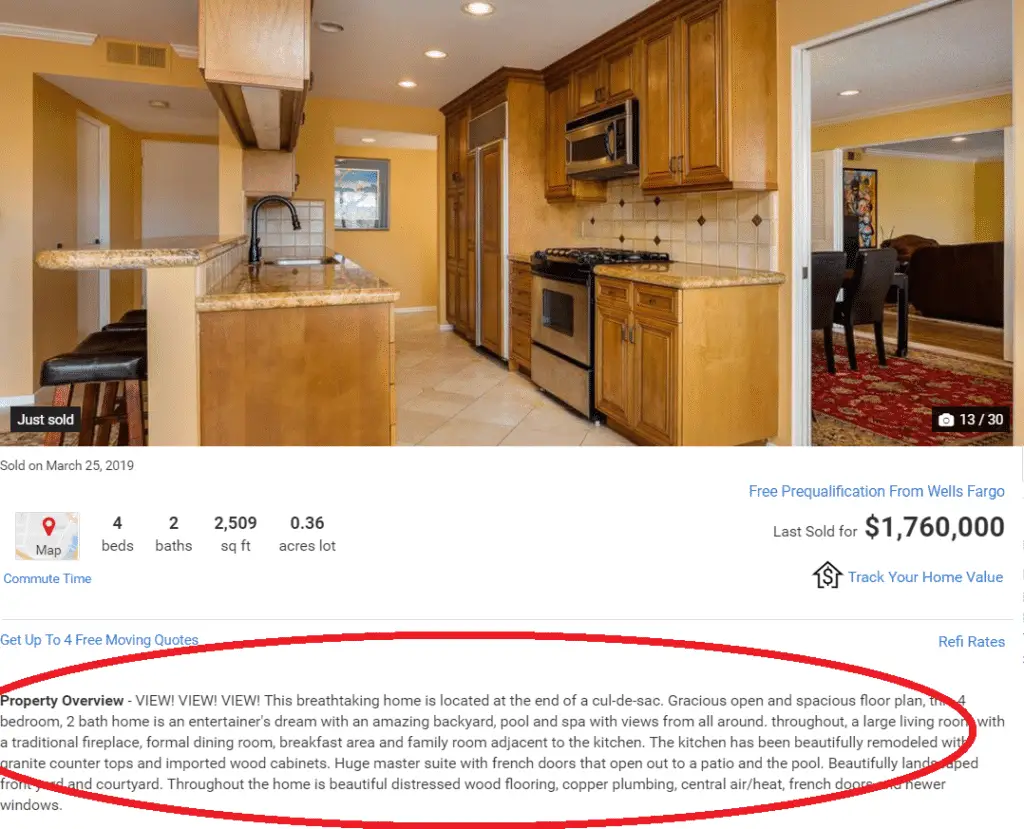

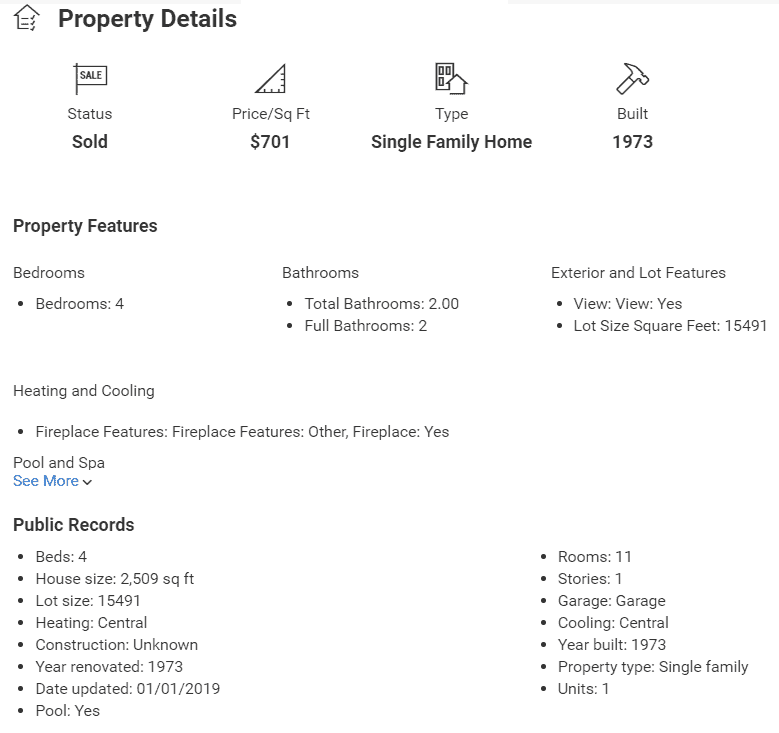

If possible, check the original listing of the comps. (If the property was just recently sold, it could still be kept online). Read carefully at property description, details and photos. You might be able to find out details why their price per sq ft is different from the subject property. (i.e.: The sold property has upgraded their flooring into hardwood)

Below are screenshots from the realtor.com

6) Walk Through the Neighborhood

Of course, the best would be to walk through the neighbor of all the comps in person. However, if it is not a feasible option, having a virtual tour through Google Street View would be a great alternative.

Not only you could see the exterior of the property, but you also get to know what is in its surrounding. For example, a house with a beautiful view of a park or ocean would be pleasant to look at.

On the other hand, I remember one time I was comparing two similar houses on the same street. The asking price of one was significantly lower. After I had a walk through Google Street View, I immediately understood why. The cheaper property was located directly next to a gas station.

But keep in mind, the pictures on the Google Street View may not be up to date. So it is always to better to walk through the neighborhood in person.

7) Future Property Price Forecast

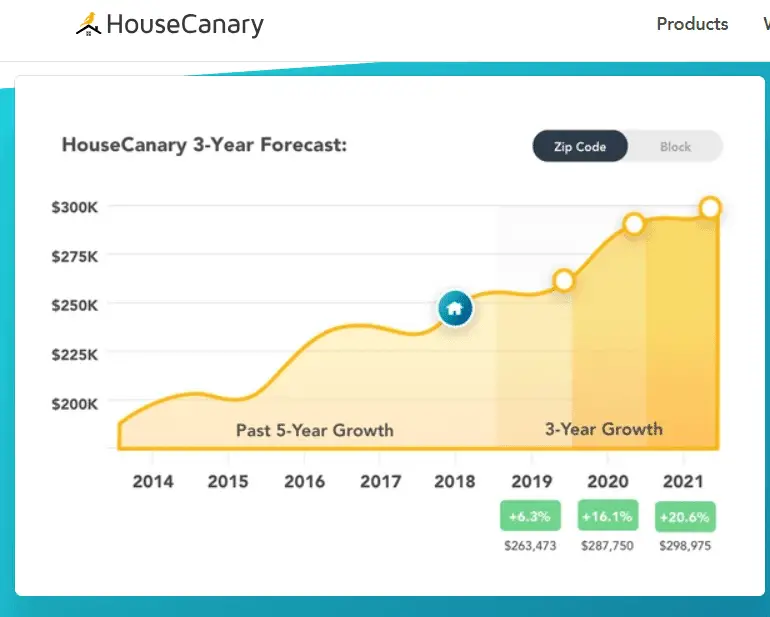

Although no one can guarantee the future, there are sophisticated tools you could use to reasonably forecast the future price of your subject property. One of them is the HouseCanary home valuation software. Once you entered the zip code of your subject property, it would predict how prices will change over the next 3 years.

If you find it suitable, you could incorporate it into your CMA report as a way to back up the value of your listing property.

8) Review the Estimated Figures on Popular Websites

Your clients or potential buyers are likely to search the estimated price of the subjected property on websites such as Zillow.com or Trulia.com. You should review them ahead of time. Prepare to explain the discrepancy between your suggested listing price and their numbers.

9) Review Other Numeric Figures

When you cannot find so many comparables with recent sold prices, you might need to accompany your analysis with other figures. However, you must understand the logic behind each number.

Current Listing Price- This is the price that the seller is asking for. However, this might not be a good indicator of the home value, because it is simply a price you don’t know whether there is any buyer at this price point.

Pending Sale Price – This is the price that both the buyer and seller are agreed upon. They are just waiting for the closing day of the property. It is a more meaningful figure since this is the price the market already accepted.

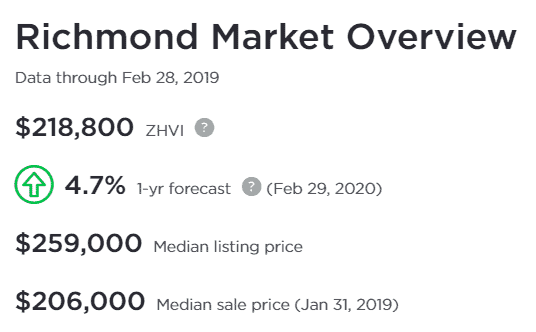

I was researching the housing market in Richmond, Virginia. As you could see there is a huge gap between the median listing price and the median sale price. This usually happens when there is a heavy tilt toward the buyer’s/seller’s market.

FAQ about the Comparative Market Analysis

1) Is a CMA the same as an appraisal?

No, a comparative market analysis is different from an appraisal. A comparative market analysis is created by a real estate agent for their clients. It is usually used for determining the listing price of a property. It would involve reviewing details such as the sold price, listing price and pending sales price of comparable.

On the other hand, an appraisal is performed by a licensed/certified real estate appraiser. Although it also takes into consideration of comparable, there are different approaches involved. (i.e., the cost approach)

Lenders tend to require an appraisal for underwriting the mortgage, but not the CMA.

2) Can I charge for a CMA?

Although the CMA is an extremely valuable analysis, real estate agents generally would include it as a complimentary value-added service. So far, I have not seen any real estate agents who charge separately for this analysis.

The Bottom Line about CMA

A well-constructed Comparable Market Analysis (CMA) is a helpful tool for your clients. Not only it provides many useful data to them, but you could also demonstrate your value as their professional real estate agent.

However, you must understand that CMA also has its own limitation. Even though the subject property could be the same size as a comparable, it doesn’t necessarily mean their prices would be the same. Many unconventional variables could affect the selling price. For example,

- The property is located near a railway track which makes it very noisy and dusty

- It has been a major crime scene.

- A celebrity had been living in the property before.

- Sellers was motivated to turn over the house because they need to relocate urgently.

Although it is important to find out as many details as possible, you should keep the CMA simple, where your clients would find it easy to read and digest.

Through the Comparative Market Analysis, you could educate your clients in making their informed decision.

Looking to succeed in the real estate industry? Subscribe to our exclusive email list today and gain access to expertly curated real estate guides from industry leaders, as well as discounted CE courses and the latest industry updates. From marketing strategies to virtual staging techniques, our handpicked resources cover everything you need to know to stay ahead of the game. Click here for more details!

(**) Affiliate Disclosure: Please note that some of the links above are affiliate links, and at no additional cost to you. Our company, JCHQ Publishing will earn a commission if you decide to make a purchase after clicking on the link. Please understand that we include them based on our experience or the research on these companies or products, and we recommend them because they are helpful and useful, not because of the small commissions we make if you decide to buy something through the links. Please do not spend any money on these products unless you feel you need them or that they will help you achieve your goals.

Disclaimer: The information in this post is for general information only, and not intend to provide any advice. They are subjected to change without any notice, and not guaranteed to be error-free. Some of the posts on this site may contain views and opinions from individual not related to JCHQ Publishing. They do not necessarily reflect our view or position.