(**) Disclosure: This post may contain affiliate links, meaning RealEstateCareerHQ.com will get a commission if you decide to make a purchase through the links, but at no additional cost to you.

Now that you have been a real estate sales agent for awhile, you might be thinking the next step in growing your business. Although you could continue servicing individual clients on the frontline, you may also make your real estate practice scalable by becoming a real estate broker. You’ll be providing support and resources to other agents. In return, you may receive a split of their commission for every piece of business they close.

But do brokers make more than real estate agent? Yes, brokers generally earn more than real estate agents. According to the Bureau of Labor Statistics (May 2018), the average annual income for real estate brokers is $78,940, while it is only $61,720 for real estate agents.

However, there are a lot more angles to cover about this career earning topic. In this post, I’ll show you the income difference between agents and brokers in different states, the type of brokers that are making the most money. You will also find convincing reasons why being a broker could earn more income and other aspects which influence the profitability of these professions.

I’m very excited to share all these with you. So without further ado, let’s get started!

How Much is the Broker and Agent Income Difference in Different States?

| State | # of Real Estate Agents | Real Estate Agent Annual Average Income | # of Real Estate Brokers | Real Estate Broker Annual Average Income | Agents to Broker Ratio | How Much Brokers are Making More than Agents |

|---|---|---|---|---|---|---|

| Alabama | 1640 | $53,870 | 270 | N/A | 6.07 | N/A |

| Alaska | 160 | $78,190 | N/A | $74,320 | N/A | -$3,870.00 |

| Arizona | 4240 | $66,360 | 1730 | $65,460 | 2.45 | -$900.00 |

| Arkansas | 850 | $41,100 | 250 | $62,440 | 3.40 | $21,340.00 |

| California | 9610 | $73,450 | 5700 | $86,000 | 1.69 | $12,550.00 |

| Colorado | 3980 | $67,350 | 2900 | $60,680 | 1.37 | -$6,670.00 |

| Connecticut | 890 | $70,380 | 80 | $101,930 | 11.13 | $31,550.00 |

| Delaware | 530 | $50,100 | N/A | $76,560 | N/A | $26,460.00 |

| District of Columbia | 920 | $56,460 | 140 | $74,740 | 6.57 | $18,280.00 |

| Florida | 18480 | $58,730 | 3010 | $65,230 | 6.14 | $6,500.00 |

| Georgia | 10400 | $50,450 | 710 | $60,130 | 14.65 | $9,680.00 |

| Hawaii | 350 | $65,720 | 250 | $74,650 | 1.40 | $8,930.00 |

| Idaho | 620 | $57,490 | 120 | $47,490 | 5.17 | -$10,000.00 |

| Illinois | 4040 | $52,800 | 1780 | $103,430 | 2.27 | $50,630.00 |

| Indiana | 3020 | $47,430 | 730 | $83,090 | 4.14 | $35,660.00 |

| Iowa | 820 | $54,610 | N/A | $65,030 | N/A | $10,420.00 |

| Kansas | 910 | $48,520 | 120 | $56,040 | 7.58 | $7,520.00 |

| Kentucky | 2030 | $48,680 | 50 | $61,120 | 40.60 | $12,440.00 |

| Louisiana | 1170 | $53,020 | 180 | N/A | 6.50 | N/A |

| Maine | 380 | $64,690 | 160 | $72,150 | 2.38 | $7,460.00 |

| Maryland | 2620 | $57,450 | 720 | $96,030 | 3.64 | $38,580.00 |

| Massachusetts | 2800 | $67,470 | 900 | N/A | 3.11 | N/A |

| Michigan | 2140 | $51,870 | 780 | $72,390 | 2.74 | $20,520.00 |

| Minnesota | 1740 | $46,620 | 540 | $60,860 | 3.22 | $14,240.00 |

| Mississippi | 780 | $60,450 | 70 | $65,430 | 11.14 | $4,980.00 |

| Missouri | 2100 | $53,440 | 1760 | $59,780 | 1.19 | $6,340.00 |

| Montana | 380 | $47,290 | 160 | N/A | 2.38 | N/A |

| Nebraska | 700 | $51,010 | 200 | $64,300 | 3.50 | $13,290.00 |

| Nevada | 2360 | $62,000 | 280 | $88,460 | 8.43 | $26,460.00 |

| New Hampshire | 320 | $49,810 | 120 | $70,180 | 2.67 | $20,370.00 |

| New Jersey | 2570 | $63,790 | 530 | N/A | 4.85 | N/A |

| New Mexico | 960 | $52,660 | 110 | $98,350 | 8.73 | $45,690.00 |

| New York | 4870 | $116,460 | 1550 | $85,190 | 3.14 | -$31,270.00 |

| North Carolina | 4840 | $59,920 | 3700 | $64,740 | 1.31 | $4,820.00 |

| North Dakota | 260 | $61,430 | 40 | $70,130 | 6.50 | $8,700.00 |

| Ohio | 6140 | $45,340 | 730 | $75,080 | 8.41 | $29,740.00 |

| Oklahoma | 3660 | $54,880 | 460 | $61,410 | 7.96 | $6,530.00 |

| Oregon | 1170 | $49,850 | 1500 | $79,490 | 0.78 | $29,640.00 |

| Pennsylvania | 5950 | $64,490 | 840 | N/A | 7.08 | N/A |

| Puerto Rico | 350 | $64,610 | N/A | $37,730 | N/A | -$26,880.00 |

| Rhode Island | 160 | $84,280 | N/A | N/A | N/A | N/A |

| South Carolina | 5370 | $53,790 | 1100 | $71,360 | 4.88 | $17,570.00 |

| South Dakota | 320 | $62,660 | N/A | N/A | N/A | N/A |

| Tennessee | 1600 | $51,100 | 330 | $71,850 | 4.85 | $20,750.00 |

| Texas | 17580 | $70,520 | 2170 | $96,630 | 8.10 | $26,110.00 |

| Utah | 1820 | $63,480 | 420 | $49,440 | 4.33 | -$14,040.00 |

| Vermont | 40 | $55,920 | 90 | $62,410 | 0.44 | $6,490.00 |

| Virginia | 7530 | $66,230 | 1510 | $85,690 | 4.99 | $19,460.00 |

| Washington | 8190 | $63,860 | 610 | $69,280 | 13.43 | $5,420.00 |

| West Virginia | 380 | $63,620 | 50 | $46,430 | 7.60 | -$17,190.00 |

| Wisconsin | 2220 | $49,360 | 460 | $97,970 | 4.83 | $48,610.00 |

| Wyoming | 150 | $75,570 | 50 | N/A | 3.00 | N/A |

As you could see in the table, the average income of real estate brokers is higher than agents’ in many states. There are 23 states where brokers are making five digits more than agents. For example, Iowa, Kentucky, California, Nebraska. Illinois has the greatest income differential, where the broker average earning is $50,630 more than agents.

On the other hand, the average earning of salespersons is actually higher than the broker in some states. (i.e., Idaho, Utah, West Virginia, Alaska, New York, Colorado). I really wasn’t expecting that so I dug a little deeper into the figures.

I found that most of these states have a relatively lower agent-to-broker ratio. To give you an example, agents in Colorado has a higher average income than brokers. For every broker, there is only 1.37 agent. Therefore, if you were a broker and only have 1 to 2 agents in your office, then their business volume may not justify all your fixed costs.

However, there are also states with low agent-to-broker ratio, but the broker is also making a handsome profit. Apparently, the ratio is just one of the indications, and many other factors could also affect the profitability of a real estate broker.

To name a few, is the broker is still actively in servicing individual clients? How efficient is the broker allocating the firm resources? Is there high competition between brokerage firms in fighting to recruit top-producing agents?

Also, the type of brokers you become could be another determining factor in contributing to the level of your income. This is what we will be covering in the next section.

Which Type of Real Estate Broker Make the Most Money?

Before we dive into the income figures, let’s briefly go through the different types of real estate brokers.

Here are the three most common type of real estate brokers:

1) Principal or Designated Broker: They are the owner of the real estate office. Sometimes, we call them “broker-owner.” According to the regulation, every brokerage is required to have one. Generally speaking, they are the one who is contributing investments to the company (i.e., paying salary, lease, marketing expense).

2) Managing Broker: Their role is to manage the day-to-day activities of the real estate brokerage. For example, recruiting, training, and supporting agents. Some “broker-owners” may assume this role, but others may delegate this position by hiring a managing broker.

3) Associate Broker: Instead of operating their own office, associate broker places their business with another broker. You may wonder why someone would choose to do so. The reason is that not every licensed broker has the capital or experience in running a brokerage.

If your underlying agents are not bringing enough business to justify for all the office expenses, then it could be better off collaborating with another broker.

(I also wrote more about the role of different real estate brokers in this article. Make sure to check it out.)

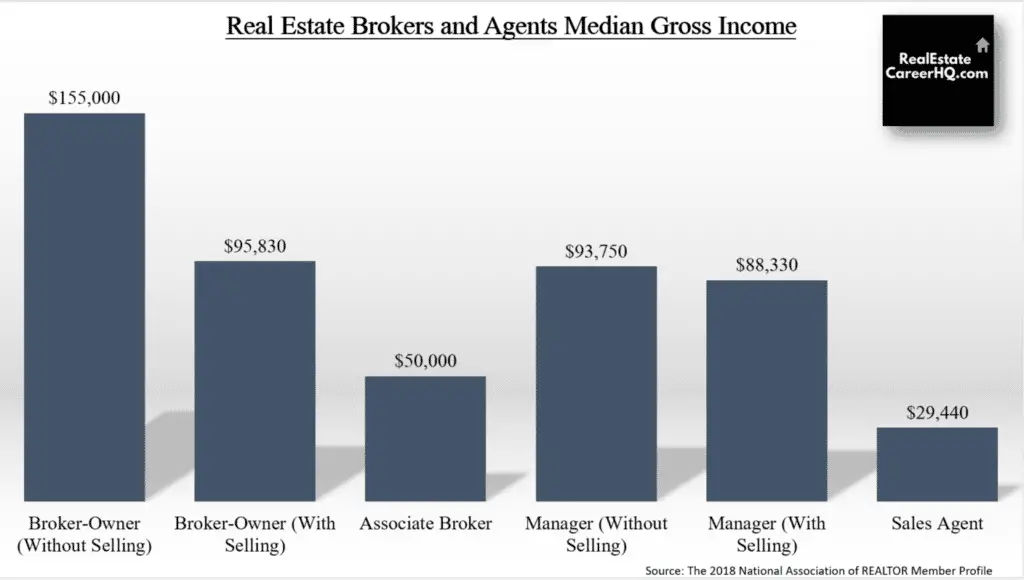

Let’s see how much income each kind of brokers is making:

I got these figures from the National Association of REALTORS (NAR). They are one the the largest real estate association in the world.

According to their stats, Broker-Owner has the highest average earning among all the real estate brokers. They have an annual median income of $155,000.

As you could see, whether a broker involves “selling” does have an impact on their earning. “Selling” implies to those who are still active in closing deals.

Although you may think those who are active in “selling” should make more money, it is the opposite. For example, Broker-Owners who are not actively working with individual clients is earning significantly more than those who are. If you want to have a scalable business, then you need to spend more time in strategically planning for it. You must learn to delegate tasks to other staffs or agents.

Does Being an Agent or Broker Give You Better Chance in Earning Six Figures Income?

I understand that this is an important milestone for many of you. Therefore, I extracted some data from the NAR report and came up with the chart below.

As you could see, regardless of the type of brokers you are planning to become, you’ll have a lot better chance of making six-figures income as a broker.

Top 4 Reasons Why Brokers are Making more than Sales Agents

Although it is clear that brokers are earning more than sale agents on average, they do not magically achieve this outcome by merely having a broker license. There are some logical reasons behind it.

1) Less inexperienced brokers than agents

Even though you could work harder in growing your real estate business at a quicker pace, it still takes time to go through the learning curve. Moreover, gaining trust from clients and building a solid customer base does not happen overnight.

Many of the new agents may not be making a lot of income at the early stage. However, they do make up a significant percentage of the agent demographic.

To illustrate my point, let’s take a look at the chart below.

| Main Function in Firm | Under six years of experience |

|---|---|

| Broker owner (without selling) | 8% |

| Broker owner (with selling) | 7% |

| Associate broker | 31% |

| Manager (without selling) | 14% |

| Manager (with selling) | 21% |

| Sales Agent | 52% |

As you could see in the table, more than half of the agent population has less than six years of industry experience. On the other hand, a much smaller portion of brokers has so little experience. Part of the reason is that to become a broker, most states would require you to have at least 2-3 years of real estate experience.

Usually, one would only upgrade to a broker license if they genuinely believe this is a profitable business. After all, it does require substantial investment and time.

On the contrary, the turnover rate for agents in the first few years is extremely high. But there is also a massive number of new entrants every year. Therefore, there are some degree of survivor bias in the broker and agent income comparison.

2) Not every real estate agent is going all-in

Throughout the years of encountering professionals in the real estate industry, I’ve met many agents who have another occupation. For example,

- a teacher who is only active selling properties during the summer holiday season

- a government employee who wants a part-time business to supplement his existing income

- a real estate appraiser who also holds a salesperson license

This divided attention obviously would have an impact to their real estate revenue. However, this is not the case for real estate brokers. To be honest, I haven’t met anyone where their broker business is not generating their primary source of income.

When I reviewed the data from the NAR report, sales agents are only working 35 hours per week on average, whereas brokers are spending 40 to 50 hours per week.

3) Broker business model is a scalable

As a real estate agent, each sale would require your direct involvement. But you only have 24 hours per day, so there is really a limit to the number of transactions you could facilitate in a year. Even though you could hire an assistant in helping out, most of the work still needs your attention.

However, it is not the case if you are a broker-owner. Your workload of having more agents may not increase as drastic as you may think. For example, holding a training session for ten agents could be the same as for twenty agents. If you are doing a webinar, you could virtually be providing the training to hundreds of agents all at once.

Furthermore, once your systematic approach is proven to be profitable, you may outsource the tasks by hiring a manager in running the office. Then you could replicate the process and expand your business into different regions.

4) Brokers may have a better commission rate

If you are a salesperson, then the real estate brokerage would take a cut of all the commission that you make. Well, unless you are a top producer who has reached the capped commission amount. But still, the initial business you submitted before the capped commission would be shared with the firm.

However, if you are the principal broker and the sole owner of the firm, then you could keep 100% of the commission from your sales.

Furthermore, as we discussed earlier, brokers tend to have more experience and work longer hours than sales agents on average. Even for broker associates, they could be bringing more deals to the firm. This higher business volume allows them to negotiate for a better commission rate.

The Bottom Line

Generally speaking, real estate brokers are earning more than salespersons. But I’m not saying the broker profession is more superior than the agents. They both serve an essential role in the real estate industry.

Some people do not like to run their business in such a complex scale. They want to keep it simple and only deal with their clients. Therefore, staying as a real estate salesperson could be a good fit for them.

Besides, the greater power comes with greater responsibility. If you were setting up a real estate brokerage, there are tremendous extra expenses you need to take care of. For example,

- Office rent

- Technology and software subscription

- More expensive license fees

- Higher E&O premium

- Office supplies and expenses

- The payroll of administrative staffs

- Thousands of dollars in surety bonds

Not only that, but you’ll be accountable for all the business activities of your associate agents.

However, if you want to transition your practice from front-line sales into a more back-end strategic execution role, then the broker route is worth considering.

So do you like this article? If so, please share it with your friends and colleagues.

Looking to succeed in the real estate industry? Subscribe to our exclusive email list today and gain access to expertly curated real estate guides from industry leaders, as well as discounted CE courses and the latest industry updates. From marketing strategies to virtual staging techniques, our handpicked resources cover everything you need to know to stay ahead of the game. Click here for more details!

Related Questions

1) How to become a real estate broker?

To become a real estate broker, you’ll need to complete the pre-licensure education, pass the broker exam, register with the regulatory board in your state. You also need to fulfill the 2 to 3 years of work experience as a real estate agent

You could click here to check out the specific broker license requirement in your state.

2) What is the hourly wage of a real estate broker?

According to the Bureau of Labor Statistics (May 2018), the hourly wage of a real estate broker is $37.95.

However, many tasks are done outside of regular business hours. (i.e., taking the continuing education courses.) Unless you only conduct these business activities on pre-determined office hours, it could be difficult to keep track of the hourly wage accurately.

3) What determines the income of a real estate agent?

Industry experience, work hours, amount of repeat customers, and your level of dedication are factors that could influence your earning as a real estate agent. Here’s a Real Estate Agent Salary Guide, where I revealed specific numbers on each of these income factors.

(**) Affiliate Disclosure: Please note that some of the links above are affiliate links, and at no additional cost to you. Our company, JCHQ Publishing will earn a commission if you decide to make a purchase after clicking on the link. Please understand that we include them based on our experience or the research on these companies or products, and we recommend them because they are helpful and useful, not because of the small commissions we make if you decide to buy something through the links. Please do not spend any money on these products unless you feel you need them or that they will help you achieve your goals.

Disclaimer: The information in this post is for general information only, and not intend to provide any advice. They are subjected to change any notice, and not guaranteed to be error-free. For full and exact details, please contact your real estate broker/ the regulatory commission in your state/ or the associated company and organization.

Reference: