(**) Disclosure: This post may contain affiliate links, meaning RealEstateCareerHQ.com will get a commission if you decide to make a purchase through the links, but at no additional cost to you.

Escrow services are essential to a real estate transaction. An escrow office is an unbiased third party working between a buyer and seller. Your role is to secure the property and review documents to ensure the terms of the sale are fulfilled on each end. You will hold the funding and distribute them accordingly once all the required documents are validated.

An escrow agent license is for those who want to set up an escrow company. To become an escrow agent in Utah, you must:

- Complete the Company Form (MU1);

- Obtain a Certificate of Authority/Good Standing Certificate;

- Provide financial statements;

- Set up an escrow bank account;

- Complete the Individual Form (MU2);

- Obtain a surety bond;

- Submit documents and license fee to the NMLS;

- Submit requirements outside of NMLS;

- Study the Utah Code Chapter 7-22

On the other hand, an escrow officer is an employee working for an escrow or title insurance company.

To become an escrow officer, you must be hired by a licensed escrow agent. Typically speaking, you are required to have at least 3 to 5 years of escrow/closing experience. You must also comply with the State Laws and regulations.

The escrow industry in Utah is regulated by the Utah Insurance Department, and the license is issued by the Nationwide Mortgage Licensing System (NMLS).

In this guide, you’ll find out the steps to obtain an escrow agent license in Utah, the requirements to become an escrow officer, income updates, and FAQ about this profession. I’m confident that this valuable info may lead you to make a better-informed career decision.

But before we start, I want to give a brief disclaimer. This post is not intended as legal advice or state/federal escrow training. It is for general information only. Please check with your state whether escrow officers/agents are utilized in the closing process. Always follow your State laws and best practices.

A Table Summary to Become an Escrow Agent in Utah

| Course | Exam | Surety Bond | Application Fee | Other Requirements |

|---|---|---|---|---|

| No | No | $10,000 to $50,000 | $100 | Financial Statements, Certificate of Good Standing Certificate |

9 Steps to Become an Escrow Agent in Utah

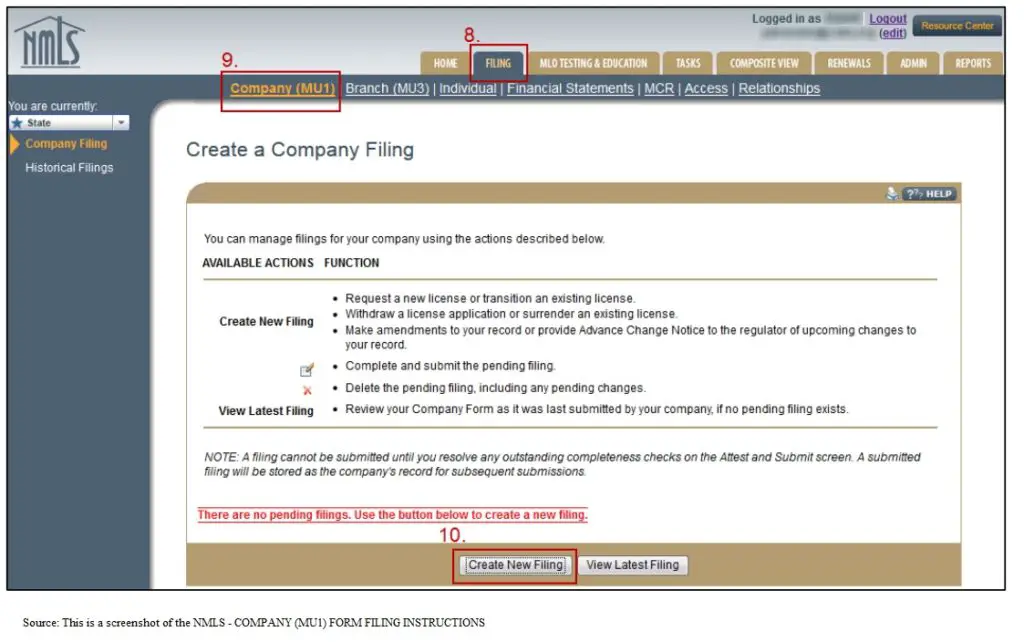

Step 1: Complete the Company Form (MU1)

This form serves as the application for the license. You may find it after creating an online account through the Nationwide Mortgage Licensing System (NMLS).

In there, you need to provide:

- Primary contact employees (i.e., company contact and consumer compliant contact)

- Resident/Registered agent

- Trader name if you are not operating the business under your legal name

If you answer “Yes” to any questions regarding a court order, regulatory action, civil settlement, you must provide Disclosure Explanations. It helps the regulators to understand the nature of the event, thus lead to a proper review of your application.

Step 2: Obtain a Certificate of Authority/Good Standing Certificate

A certificate of good standing is proof that your company is properly registered with the state and is permitted to engage in business activities. It also shows that all the required documents are satisfied, and the registration fees are paid for.

You may get it from the Utah Division of Corporations and Commercial Code or the Utah Department of Commerce.

Step 3: Provide financial statements

The Department requires that your company be solvent. You need to prepare financial statements that include an income statement, balance sheet, statement of cash flows. The financial statement needs to show that your company has a net worth of more than $50,000 or 10% of average daily escrow liabilities.

The statements need to be audited and prepared by a Certified Public Accountant (CPA) using the Generally Accepted Accounting Principles.

They also have to be dated within 90 days of your fiscal year-end. However, if your company is a startup, you may submit an initial statement of condition.

Step 4: Set up an escrow bank account

Since your company will secure funding for real estate transactions, the Department needs to know the bank account info. It needs to be a federally insured depository institution.

When you are completing the Company Form (MU1), you need to provide the bank’s name and address where escrow funds will be maintained.

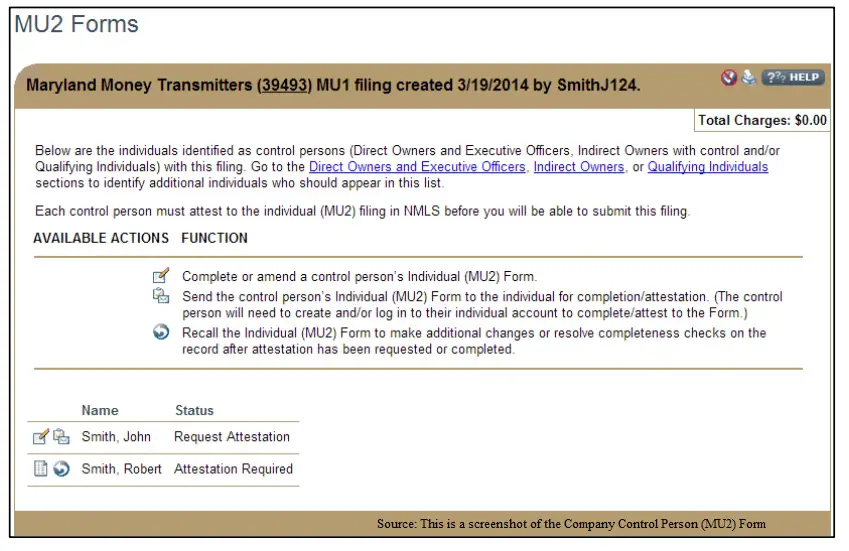

Step 5: Complete the Individual Form (MU2)

Since your escrow company will handle a significant volume of money for real estate transactions, the regulators need to know the director owners, executive officers, indirect owners as control persons, and qualifying individuals.

When you’re filing at the NMLS, you need to complete an Individual Form (MU2). Keep in mind that an applicable control person needs to attest to the form before you can submit it along with the Company Form (MU1).

Step 6: Obtain a Surety Bond

The surety bond is to protect your client against your wrongdoing, which results in financial damage. Then they can file a claim against the surety bond.

The name of the principal insured must be the same as the legal name of the applicant. Also, the beneficiary of the bond has to be the State of Utah. The required amount of surety bond depends on your monthly average escrow liability.

| Monthly Average Escrow Liability | Bond Requirement |

|---|---|

| Up to $10,000 | $10,000 |

| $10,001 – $20,000 | $20,000 |

| $20,001 – $30,000 | $30,000 |

| $30,001 – $40,000 | $40,000 |

| Above $40,000 | $50,000 |

The premium depends on numerous factors, such as your credit score.

But keep in mind that the surety bond is to protect the consumer and not you as an escrow officer. If you want coverage for your business, you may look into Error and Omission Insurance. (E&O)

Step 7: Submit documents and license fee

Once all the documents are in good order, you may submit them through the NMLS. The system has the functionality where you can upload the required document (i.e., Financial Statements)

The license fee is $100. You may pay it with a credit card (VISA, MasterCard) or ACH. Debit cards are not acceptable unless there has a MasterCard or Visa logo on it.

However, there will be a 2.5% service fee for a debit/credit card transaction.

Step 8: Submit other requirements

Some requirements cannot be submitted through the NMLS. You need to email them to dfi@utah.gov. They include:

- Authorized agents (delegates) locations: (name, address, phone number)

- Business relationship with a title company or associated business entity

- Average monthly escrow liability

Step 9: Study the Utah Code Chapter 7-22

Although there is no education or exam required to become an escrow agent in Utah. it is essential to know the rules and regulations. A great way is to study the Utah Code, Chapter 7-22, Regulation of Independent Escrow Agents.

It is a 4 pages pdf file which covers the following topic:

- Definitions — Exemptions

- Authorization required

- Registration — Fees — Qualifications — Rulemaking

- Net worth requirements

- Bond required

- Accounts to be maintained — Records open to inspection — Retention of records

- Examinations

- Segregation of accounts — Duties specified by agreement — Duties generally

- Priority of claims in case of insolvency

I’ll leave the link in the reference section below.

How much does it cost to run an escrow services business in Utah?

Although the escrow agent application fee is only $100, there are many other expenses to run an escrow company in Utah – for example, surety bond premium, banking fees, business insurance, E&O coverage, and other business supplies.

Here’s a resource page with a list of incredible business tools that I like.

How to become an escrow officer in Utah?

Just a recap, an escrow officer is an employee working for an escrow or title insurance company.

To become an escrow officer in Utah, you need to be employed by a licensed escrow agent. As I reviewed job postings on multiple online forums, many employers required you to have at least 3 to 5 years of escrow/closing experience.

As an escrow officer, you must be familiar with the escrow regulations. You should review the Utah Administrative Code Title R592 – Title and Escrow Commission.

Connecting with other peers in Utah is a great way to understand the escrow industry!

You could do so by joining a trade group such as the Utah Land Title Association. Begin with a friendly conversation. Let them know that you are starting your career as an escrow officer, ask them if they have any tips or advice for newbies to the industry.

In addition, you should network with other professionals in the real estate field. Mortgage agents, lenders, notary loan signing agents, and realtors can all provide you with valuable insight.

This will be very helpful to your career building in the long haul. Here is a list of real estate professional groups on our resource page. I hope this could be helpful to you.

How much do escrow officers make in Utah?

Escrow officers in Utah make $47,160 on average. The income range usually falls between $38,171 and $57,170. (+) The earning would depend on your skill level, location, and years of experience.

Furthermore, the type of property that you specialize in working with may also impact your income.

As I’m reviewing the income figures, Commercial Escrow Officers in Utah have a higher average annual income of $62,813. The mostly earn between $43,000 to $83,686. (-)

Source: (+) Salary.com – Nov 25, 2020; (-) ZipRecruiter.com- Dec 04, 2020

Is there a demand for escrow services in Utah?

Some states require an attorney to handle the real estate closing and not an escrow office. The good news is, according to the First American Title, Utah is not an attorney state.

As of Jan 16, 2020, there are 8 registered escrow agents in Utah. I also see many job listings for escrow officers in Utah. However, they tend to look for applicants with at least 3 to 5 years of escrow industry experience. You may get a foot in the door by working as an escrow assistant first.

Furthermore, according to the Utah Association of Realtors, there were 54,274 homes sold in Utah in 2019. As long as people buy and sell properties in the state, there is a demand for escrow officers in Utah.

Where can I obtain more details about escrow agent license in Utah?

You may contact the Utah Department of Financial Institutions:

- Phone: (801) 538 – 8830

- Fax: (801) 538 – 8894

- Email: dfi@utah.gov

Reference:

- Utah Code Chapter 7-22 – Regulation of Independent Escrow Agents (source)

- Utah Department of Financial Institutions – Escrow agents (source)

- Utah Insurance Department – Title & Escrow (source)

- Utah Administrative Code – Title R592 – Title and Escrow Commission (source)

- NMLS

- UT-DFI Escrow Agency Registration New Application Checklist (Company) (source)

- Suretybonds.com – Utah Escrow Agent Bond (source)

- Salary.com – Escrow Officer Salary in Utah (source)

- ZipRecruiter.com – Commercial Escrow Officer Salary in Utah (source)

- Utah Association of REALTORS (source)

- First American Title- Your Guide to Real Estate Customs by State (source)

- legalzoom- What is a Certificate of Good Standing? (source)