(**) Disclosure: This post may contain affiliate links, meaning RealEstateCareerHQ.com will get a commission if you decide to make a purchase through the links, but at no additional cost to you.

How to become a notary loan signing agent in Arkansas? To become a notary loan signing agent in Arkansas, applicant must submit the application to the Business and Commercial (UCC) Services. This is the division of the Secretary of Arkansas State. You also need to pay the filing fee, purchase the notary seal and journal.

When people are getting a mortgage to purchase a house, or they need to refinance their property, there will be loan documents involved. Your role as a notary loan signing agent in Arkansas is to walk through the set of loan documents with the borrower and witness them in signing the paperwork.

You would also need to verify the identity of the signers, place the notary stamp on the signed documents, then send them back to the escrow company.

But keep in mind that you should NOT be providing legal advice, and you cannot explain the terms of the loan documents to the borrower.

In this guide, you’ll find the steps by steps to become a notary loan signing agent in Arkansas, income updates. What does it take to work in this profession? And other helpful details about this profession.

Would you like to learn how to make $75 to $200 per signing appointment? You must check out the Loan Signing System from Mark Wills. (**) This is one of the best training programs for loan signing agents. Many students have achieved remarkable business success after taking this program.

9 Steps to Become a Notary Loan Signing Agent in Arkansas

Step 1: Meet the basic requirement

- At least 18 years of age

- Legal resident of Arkansas

- Able to read and write English

Step 2: Purchase a surety bond

The State Law requires you to purchase a $7,500 notary bond. You must get it from a surety insurance company that is authorized to conduct business in Arkansas. You could search for them online.

The name on the surety bond must match the one on your official seal. Therefore, it is better to use the name that you are comfortable with. For instance, if you usually don’t sign your middle name, then don’t put it on your bond application.

Note that the surety bond is to protect those for whom the notary public performs a notarization, but not you as a notary public.

If you need coverage for your professional services, you should consider getting an Error & Omission insurance (E&O).

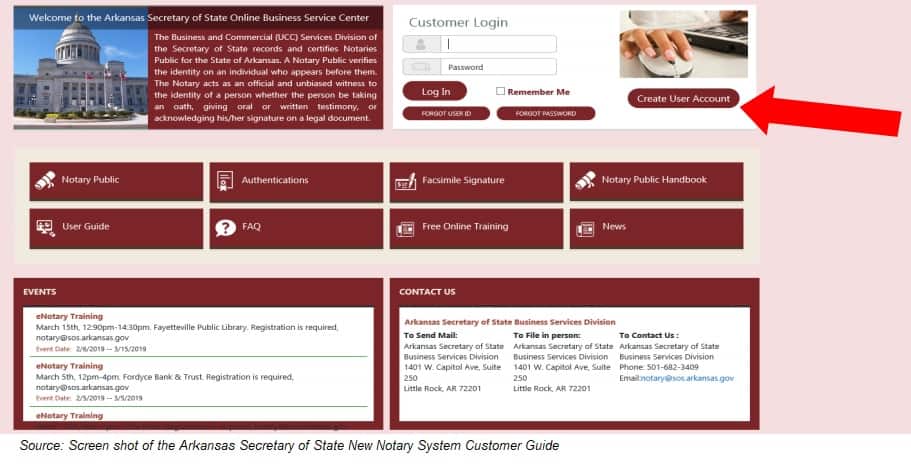

Step 3: Create an online account

You would register at the Arkansas Secretary of State Online Business Service Center. It will prompt you to enter your personal information and the surety bond details.

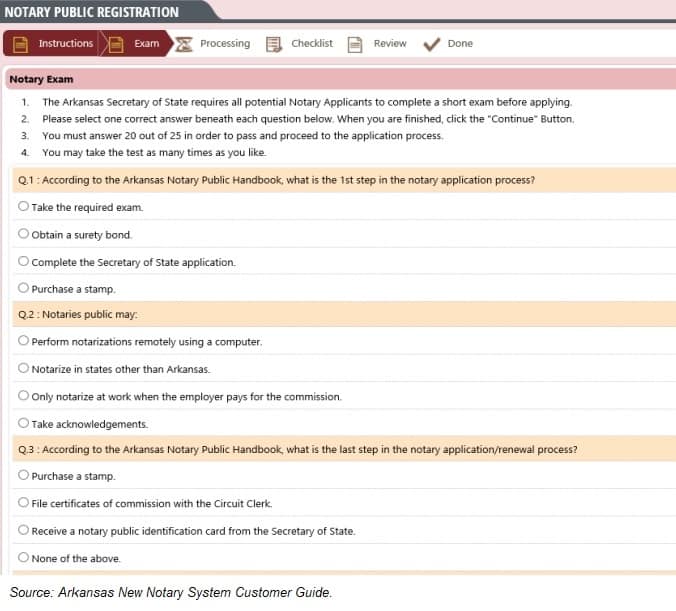

Step 4: Pass the online exam

You’ll need to write a multiple-choice exam. There will be 25 questions, and the passing score is reaching at least 80%.

A good way to study is to go through the materials in the Arkansas Notary Handbook, Notary Public, and eNotary FAQ. (You could find their links in the reference section of this post.)

In addition, you could find free online notary training at the Notary Management System.

Keep in mind that you can only write the exam twice in every 12 months.

Here are some sample questions of the Arkansas Notary Exam

Step 5: Register at the Arkansas Business and Commercial (UCC) Services

Once you pass the exam, you’ll be directed to the application page and complete the registration process. You must do that on the spot, else, you’ll need to retake the exam.

Make sure to input your name on the application exactly as it appears on your surety bond. Then print out the application and get notarized by a notary in good standing in the State of Arkansas. You could find them on the Notary Management System website.

Prepare a $20 cheque or money order payable to ” Secretary of State’s Office.” This is for the application fee.

Once you gathered all the documents (including the surety bond), you may mail them to:

- Arkansas Secretary of State Business & Commercial Services Division

- 1401 W. Capitol Avenue, Suite 250 Little Rock, AR 72201

Step 6: Review the oath of certificates

After the Arkansas Notary Commission receives your application, it typically takes them 2-4 weeks of processing them. Then it would take about 7-10 business days to mail the oath of certificates to your home.

To avoid the risk of rejection:

– Ensure that the notary who notarizes your application is in good standing and that they correctly notarize the affidavit at the bottom of the application.

– Ensure that the name printed on the bond, printed on the application, and signed on the application match. All three names must be identical.

Arkansas Notary Public & eNotary Handbook

Step 7: Handling the Oath of Commission Certificates

There will be three copies of such certificates. After you review them and confirm all the details are correct. (e.g., your name, county of residence, commission dates), then you’ll bring them to the recorder of deeds in your county of commission. In most instances, it is the circuit clerk, but sometimes it could be the county clerk.

You’ll sign all these certificates in front of the clerk and officially swearing and affirming that you will faithfully perform your duties as a notary public. Then the clerk will also sign these documents.

One copy will be filed at the clerk’s office along with the original bond. You’ll keep one for your own record. As for the last one, you need to return it to the Secretary of State.

Then you will be given a certificate of commission and notary public identification card.

Step 8: Get the notary business supplies

To start the notary loan signing business, you’ll need get a notary stamp. Many stamp makers need to see a completed oath certificate and the ID card before issuing the seal of office.

Seal of office

Each notary public must have a seal of office, which can be either a rubber stamp or a metal embosser. The seal MUST be in blue or black ink and include the following information:

• The notary public’s official name as written in his/her official signature

• The notary’s county of commission – the county where his/her bond is filed

• The words “Notary Public” and “Arkansas”

• Notary public’s commission expiration date

• Notary public’s commission number The seal of office may NOT include: • Great Seal of the State of Arkansas

• Outline of the State of Arkansas

Arkansas Notary Public & eNotary Handbook

The notary seal needs to be clear and legible. This way, even its photographic reproduction can be clearly seen. If you will be using an embosser, it also needs to be in blue or black ink.

As for journal, although the law does not require you to keep a record of your notary acts, it is a good business practice in doing so. This well-documented journal could be a piece of helpful evidence should you be called upon to testify in court.

In your notary journal, it is better to take note of:

- When was the date of the notarial act?

- What had been done?

- What are the documents involved?

- Who is the person whose signature was notarized, and what is their address?

- The list of fees received

- A note section where you could add personal annotations

Step 9: Register as an eNotary

One thing I really like about this industry in Arkansas is the availability of eNotary. This is an optional step but could bring you great convenience to streamline your notary practice.

Although you still need to meet the signer in person, this allows documents to electronically notarized rather than in traditional pen and ink.

Not only that, this is a lot more convenient for record-keeping and delivery of completed documents, but less paper usage is good for the environment too.

To do so, you’ll complete the Online Application for Electronic Notary Commission. Once again, there is a $20 filing fee. Then you must take a class and examination in person.

To ensure your documents could be handled securely, you are required to conduct the eNotary business using an approved Electronic Solution Provider.

At the time I’m writing this post, the following companies are on the approved list:

- docVerify

- pavaso,

- World Wide Notary,

- Erecording Solutions,

- simplifile

You may check out their current list here.

How much can you make as a notary signing agent in Arkansas?

The average annual income of Loan Signing Agent in Arkansas is $41,799. The income typically ranges between $26,437 to $53,755. Top earning loan signing agents in Arkansas are making over $80,192.

Top 10 Highest Paying Cities for Loan Signing Agents in Arkansas

| City | Annual Salary |

|---|---|

| Jonesboro | $48,614 |

| Fort Smith | $44,032 |

| Bentonville | $43,858 |

| Rogers | $43,586 |

| Conway | $43,578 |

| Fayetteville | $42,011 |

| North Little Rock | $41,710 |

| Little Rock | $41,604 |

| Springdale | $40,859 |

| Hot Springs | $40,482 |

(+) Source: ZipRecruiter.com – March 11, 2022

Can you make over $10,000/month as a loan signing agent? Be sure to check out our notary earning guide. You’ll find a case study where a loan signing agent has built her business to such a successful figure.

Is there demand for notary loan signing agent in Arkansas?

As long as people are obtaining mortgages or refinancing their homes, there would be a demand for notary loan signing agents in Arkansas.

All originated mortgages in Arkansas

| YEAR | RECORDS |

|---|---|

| 2017 | 62,259 |

| 2016 | 65,762 |

| 2015 | 59,384 |

| 2014 | 52,994 |

| 2013 | 73,125 |

| 2012 | 79,283 |

| 2011 | 62,549 |

| 2010 | 69,315 |

| 2009 | 78,016 |

| 2008 | 71,395 |

| 2007 | 83,327 |

Furthermore, some states are “Attorney states,” which means only an attorney can handle the closing paperwork. Whereas, others are “Escrow States” where a loan signing agent can do the work.

According to the First American Title, Arkansas is an “Escrow State,” which is good news if you are interested in starting a notary loan signing business.

However, this guide is for general information only and not to provide any professional advice. Although I’ve tried to put down info as accurate as I could possibly find, you should always refer back to the Arkansas Secretary of State.

What education do you need to become a Arkansas notary public?

There is no specific education requirement to become a “regular” notary. When I say “regular,” I mean where you would notarize the document in traditionally with ink and paper. However, there is a free course you could take to get yourself ready.

As for being an eNotary, you do need to complete an in-class training.

Another good place to learn about this profession is by reading the Arkansas Notary Public & eNotary Handbook. It is a 47 pages guide published by the Department of State Office of the Secretary of State.

This handbook would cover:

- Proper notary practices

- Notarial powers and responsibilities

- Notary supplies

- Application and renewal process

- Changes to personal information

- Proper Notarization Procedures

- Errors to avoid as a notary public

- Electronic notarization

- Text of Arkansas’s notary laws

I’ll leave a link of this handbook in the reference section at the end of this post.

Is there a exam to become a notary in Arkansas?

Yes, you’ll need to write an exam to become an Arkansas notary. This is a multiple-choice exam with 25 questions. The required passing score is 80%.

How much does it cost to become a notary in Arkansas?

It would cost approximately $196 to become a notary in Arkansas.

Here’s the breakdown:

- Surety bond – $50

- Arkansas Notary commission application fee – $20

- Professional stamp- $40

- Notary Seal Embosser – $36

- Notary Journal – $50

There could be other expenses involved, such as E&O insurance, travel expenses, and other business supplies.

How long does it take to become a AR notary signing agent?

Assume you pass the exam on the first trial, from application submission, certificate delivery; it would take approximately 3 to 6 weeks to become a notary in Arkansas.

Can a felon be a notary loan signing agent in Arkansas?

According to the qualification of the Arkansas Notary Public & eNotary Handbook, applicants cannot be convicted of a felon.

How to renew notary in Arkansas?

Every ten years, you would need to renew with the Arkansas Secretary of State, Business & Commercial Services. You must submit a renewal application, filing fees, and a new bond. You may do so 60 days before the expiration.

Can I notarize for a family member in Arkansas?

You must not notarize any documents where you have any financial or beneficial interest in the transaction. Therefore, notarizing a document for any family member could call into question, and such practice should be avoided.

I have more questions about being a notary in Arkansas, who should I contact?

You could contact the Arkansas Secretary of State, Business and Commercial Services Division

- Phone: 501-682-3409

- Email: corporations@sos.arkansas.gov

Disclaimer: The information in this post is for general information only, and not intend to provide any advice. They are subjected to change without any notice, and not guaranteed to be error-free. Some of the posts on this site may contain views and opinions from individual not related to JCHQ Publishing. They do not necessarily reflect our view or position.

(**) Affiliate Disclosure: Please note that some of the links above are affiliate links, and at no additional cost to you. Our company, JCHQ Publishing will earn a commission if you decide to make a purchase after clicking on the link. Please understand that we include them based on our experience or the research on these companies or products, and we recommend them because they are helpful and useful, not because of the small commissions we make if you decide to buy something through the links. Please do not spend any money on these products unless you feel you need them or that they will help you achieve your goals.

Reference:

- First American Title- Your Guide to Real Estate Customs by State (Source)

- Arkansas Secretary of State- Business & Commercial Services (Source)

- Arkansas Secretary of State Online Business Service Center (Source)

- Arkansas New Notary System Customer Guide (Source)

- Approved Electronic Solution Providers (Source)

- Notary Public Frequently Asked Questions (Source)

- Electronic Notary Public Frequently Asked Questions (Source)

- Arkansas Notary Public & eNotary Handbook (Source)

- Salary.com – Notary Signing Agent Salary in Arkansas (source)

- ZipRecruiter – Loan Signing Agent Salary in Arkansas (source)

- Consumer Financial Protection Bureau – Home Mortgage Disclosure Act (HMDA) (Source)

Is there anything extra besides just becoming a notary that is required to do closing documents?

Thank you for the help

Hi Olivia, that depends on the state you are located in. Some states may require notaries to have a “Title Insurance Producer’s License”. If you are just starting out, you may look into the Loan Signing System training program from Mark Wills.

I have interviewed a number of notaries who took the program and they all found it very helpful. Here’s more info: https://realestatecareerhq.com/lss