(**) Disclosure: This post may contain affiliate links, meaning RealEstateCareerHQ.com will get a commission if you decide to make a purchase through the links, but at no additional cost to you.

As an escrow officer, your role is to ensure the real estate closing can be done seamlessly and accurately. You will secure the funding, review documents, and disburse them only after all required conditions are validated.

Although the profession is crucial to a real estate transaction, a major question is how much money can you make as an escrow officer? After all, without a sustainable income, you just have a hobby rather than a career.

Escrow officers make $54,903 annually on average. The income range usually falls between $46,000 to $62,000. Top earners are making $70,000 annually. (-) Earning tends to go up with work experience, productivity. Escrow officers who specialize in commercial properties also have a higher salary on average.

To prepare for this guide, I have spent several days researching, reviewing tons of data and talking to actual escrow officers.

Here, you’ll find the average income of escrow officers in different states. What makes one earn more than others? Where can you find an escrow job?

I hope they can help you to make a better informed career decision.

Source: (-) ZipRecruiter.com- Dec 15, 2020

Here’s a Table of Escrow Officers’ Average Income of Different States

| State | Escrow Officers Average Annual Salary | Commercial Escrow Officers Average Annual Salary |

|---|---|---|

| New York | $61,070 | $77,678 |

| New Hampshire | $59,175 | $75,335 |

| Vermont | $55,908 | $71,251 |

| Wyoming | $54,549 | $69,323 |

| Massachusetts | $54,820 | $68,459 |

| West Virginia | $53,067 | $67,493 |

| Pennsylvania | $52,811 | $67,167 |

| Hawaii | $53,282 | $66,694 |

| Washington | $53,387 | $66,411 |

| Montana | $51,613 | $65,504 |

| Connecticut | $52,017 | $65,263 |

| New Jersey | $51,300 | $64,837 |

| Arizona | $51,083 | $64,830 |

| Indiana | $50,755 | $64,414 |

| Rhode Island | $51,116 | $64,017 |

| Alaska | $50,697 | $63,406 |

| North Dakota | $50,370 | $63,060 |

| Nevada | $50,298 | $62,907 |

| Maryland | $50,328 | $62,733 |

| Tennessee | $49,656 | $62,559 |

| Georgia | $49,278 | $62,540 |

| Wisconsin | $49,564 | $62,534 |

| Minnesota | $49,649 | $62,510 |

| Ohio | $49,295 | $62,104 |

| Nebraska | $49,517 | $61,707 |

| South Dakota | $48,898 | $61,219 |

| Utah | $48,572 | $61,130 |

| Alabama | $48,126 | $61,078 |

| Virginia | $48,867 | $60,899 |

| Louisiana | $48,149 | $60,622 |

| Oregon | $48,169 | $60,327 |

| California | $58,569 | $60,291 |

| Kentucky | $48,294 | $60,287 |

| Kansas | $47,488 | $59,504 |

| Iowa | $47,290 | $59,455 |

| New Mexico | $47,104 | $59,439 |

| South Carolina | $47,298 | $58,983 |

| Florida | $46,444 | $58,943 |

| Colorado | $47,142 | $58,807 |

| Delaware | $47,038 | $58,636 |

| Oklahoma | $46,021 | $57,352 |

| Idaho | $55,177 | $56,429 |

| Maine | $54,162 | $56,241 |

| Mississippi | $44,492 | $55,752 |

| Arkansas | $44,282 | $55,255 |

| Michigan | $44,236 | $55,178 |

| Illinois | $44,041 | $54,954 |

| Texas | $43,787 | $54,455 |

| Missouri | $43,287 | $53,974 |

| North Carolina | $40,305 | $50,263 |

Source: ZipRecruiter.com- Dec 15, 2020

Commercial Escrow Officers Earn a Higher Income!

The type of property that you specialize in working with may also impact your income.

As I’m reviewing the income figures, Commercial Escrow Officers have a higher average annual income of $67,926. The range typically falls between $60,000 to $76,500. Some may earn as high as $82,500 per year. (-)

This is significantly higher than the escrow industry average, which is $54,903 per year.

As you see in the table above, commercial escrow officers indeed have a higher average income across different states. This is not uncommon in the real estate industry. For professions such as real estate appraiser or real estate agent, their average earnings are higher if they specialize in commercial properties rather than residential.

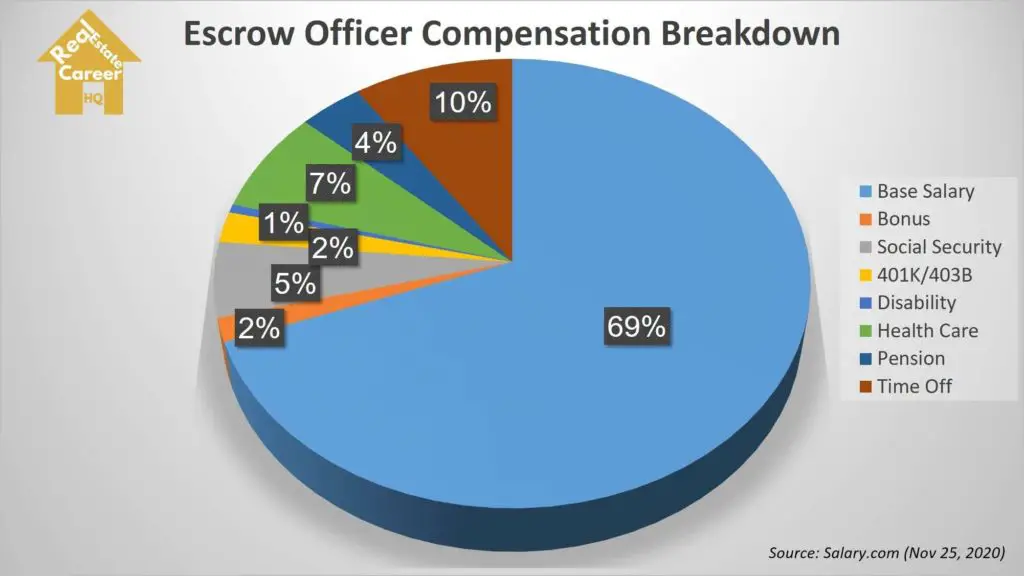

How do escrow officers get paid?

Escrow officers are typically paid with a fixed salary as most of them are employees of a title or escrow company. Some companies could offer a bonus if the escrow officer demonstrated high productivity and efficiency in handling real estate closings.

However, unlike a real estate agent, escrow officers are not paid by commission.

Some escrow firms are eager to retain talented employees. So, in addition to the base salary, they would offer health benefits, pension contributions, disability insurance, and other perks to their employed escrow officers.

Here’s a breakdown of the escrow officer’s compensation:

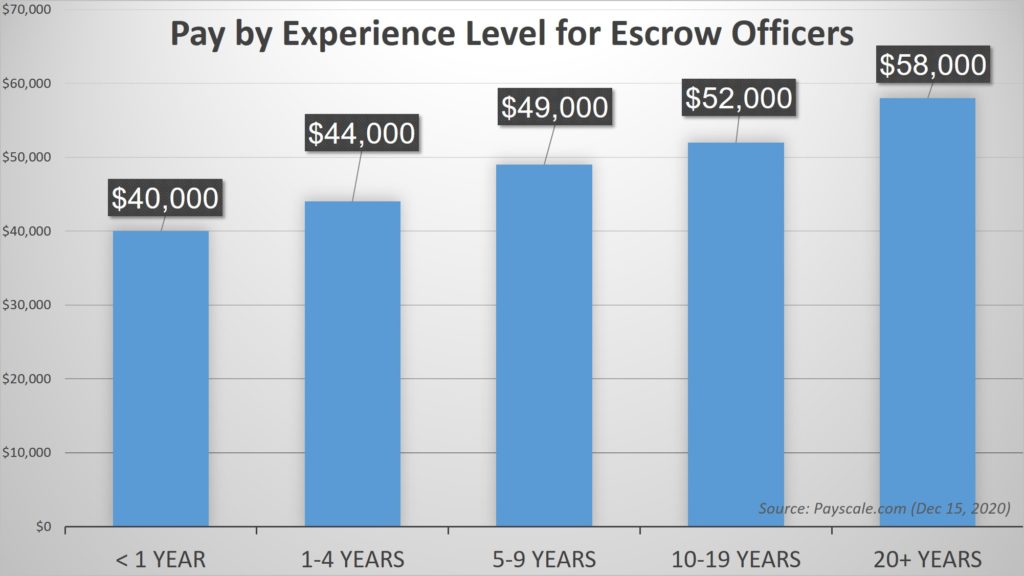

Do experienced escrow officers make more money?

Escrow officers indeed earn more money as they gained work experience. This can be seen in the income figures from Payscale.

As you can see in the graph above, there is a strong positive relationship between escrow officers’ income and work experience. This finding is based on the salary data of 664 candidates.

Furthermore, as you progress in the escrow services career, you could be promoted to a senior position. According to Payscale (Dec 9, 2020), the average income of Senior Escrow Officers is $63,453, which is significantly higher than those who are not in the senior position.

Does work location have any impact on escrow officers’ earning?

The servicing region could be a factor that influences an escrow officer’s earning. For instance, the average annual income of escrow officers in Santa Clara, California, is $66,425. It is substantially higher than the national average of $54,903.

This income differential could be due to the local real estate development and population. All these factors could affect the supply and demand for the escrow officers.

Top 10 Highest Paying Cities for Escrow Officer Jobs

| City | Annual Salary |

|---|---|

| Santa Clara, CA | $66,425 |

| San Francisco, CA | $66,404 |

| Fremont, CA | $63,785 |

| San Jose, CA | $62,404 |

| Alexandria, VA | $61,944 |

| Oakland, CA | $61,729 |

| Tanaina, AK | $61,576 |

| Wasilla, AK | $61,576 |

| Sunnyvale, CA | $61,026 |

| Santa Maria, CA | $60,623 |

Out of the top ten cities with the highest pay for escrow officers, seven are in California. This comes as no surprise as California is one of the most populous states.

However, just because you’re earning more in a particular city does not always mean to be better off. Some cities could have a high cost of living, which greatly reduces your purchasing power.

Do escrow officers with higher education earn more?

As much as the general society believes a higher education may lead to greater earning, it is not the case for escrow officers.

I used the tool on Salary.com to compare the salary of escrow officers with different education levels. As I reviewed the groups with a Bachelor’s degree, Master’s Degree, or even a Ph.D., I see that their income is just about the same as the industry average.

Frankly, although some states require you to take a pre-licensing course and pass an exam to obtain the escrow officer license, it is not mandatory to have a college or university degree. In terms of the licensing requirement, having a high school diploma is good enough.

But on the other hand, as I look through different online job postings, some title/escrow companies do require their escrow officers to have a Bachelor’s degree.

It’s great that if you already have completed post-secondary education. But if you have not, you need to think about whether it is justifiable to get a degree just so that you can apply for an escrow officer position in certain companies. After all, getting a college/university degree requires years of study and tuition. It indeed is a significant investment.

However, having relevant knowledge is always an asset. It will help if you have some fundamental understanding of real estate, finance, and accounting.

Are you interested in becoming an escrow officer? Here’s another article I wrote which covers the licensing requirement.

Related Questions about the Escrow Services Career

1) Is there a demand for escrow officers?

Some states require an attorney to handle the real estate closing and not an escrow office. If you are located in a non-attorney state, there could be more opportunities.

There were 5.34 million existing homes (+) and 682,000 newly constructed homes sold in 2019 across the country(-). As I’m writing this post now, I see many job listings for escrow officers.

As long as people buy and sell properties, the demand for escrow officers will continue.

Source: (+) National Association of REALTORS ®; (-) U.S. Census Bureau.

2) How do I get a job in escrow?

To get a job in escrow, you may search for employment through online job forums, LinkedIn groups, or join the American Escrow Association.

However, most companies tend to look for applicants with at least three years of escrow industry experience. You may get a foot in the door by working as an escrow assistant first.

Once you have accumulated adequate years of experience, you may get promoted to an escrow officer position.

Also, many title companies offer escrow services as part of the real estate closing. You may look into those firms in your area and see if they are hiring.

3) How do escrow agents make money?

An escrow agent license allows you to set up a company and recruit other escrow officers, thus running a more scalable business.

An escrow agent makes money by charging a service fee for a real estate closing. The fee is typically around 1% to 2% of the house’s price.

Reference: