(**) Disclosure: This post may contain affiliate links, meaning RealEstateCareerHQ.com will get a commission if you decide to make a purchase through the links, but at no additional cost to you.

To become a notary in Hawaii, an applicant must:

- Meet the state eligibility requirement;

- Prepare a letter of character recommendation and justification;

- Submit an application to the Hawaii Department of the Attorney General’s Notary Office;

- Study the Notary Public Manual;

- Pass the notary exam;

- Pay the fees ($140);

- Obtain a $1,000 surety bond;

- Purchase the notary seal and other business supplies

Although you could work on different types of documents, the loan signing business in the real estate market seems to be a lucrative niche.

So what does a loan signing agent do? When people are getting a mortgage to purchase a house, or they need to refinance their property, there will be loan documents involved. Your role as a notary loan signing agent is to walk through the set of loan documents with the borrower and witness them in signing the paperwork.

You would also need to verify the identity of the signers, place the notary stamp on the signed documents, then send them back to the signing services company or closing attorney.

But keep in mind that you should NOT be providing legal advice, and you cannot explain the terms of the loan documents to the borrower.

In this guide, you’ll find out the steps to become a notary in Hawaii, income updates, and FAQ about this profession.

But before we start, I want to give a brief disclaimer. This post is not intended as legal advice or state/federal notary public training. It is for general information only. Please check with your state to be sure that loan signing agents are utilized in the closing process. Always follow your state’s notary laws and best practices.

Would you like to learn how to make $75 to $200 per signing appointment? You must check out the Loan Signing System from Mark Wills. (**) This is one of the best training programs for loan signing agents. Many students have achieved remarkable business success after taking this program.

8 Steps to Become a Notary in Hawaii

Step 1: Meet the eligibility requirement

- At least age 18 of age

- Resident of Hawaii

- U.S citizen/ National or permanent resident who is seeking to apply for U.S citizenship

Step 2: Submit the application to the Notary Office

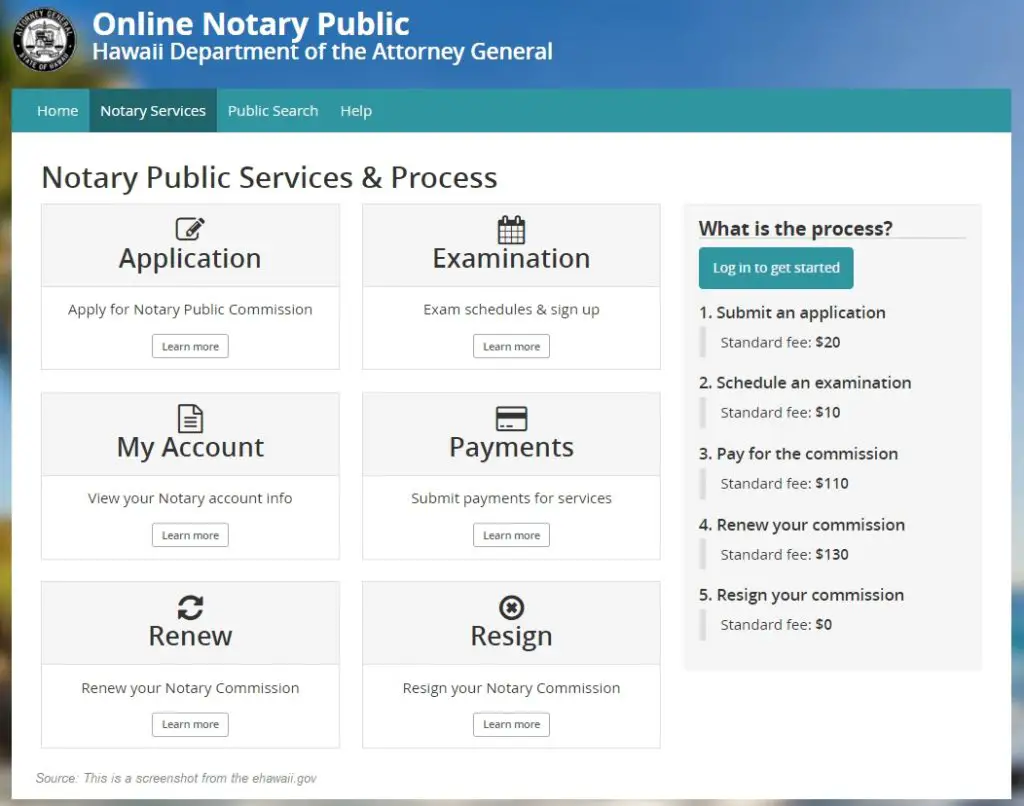

The Hawaii Department of the Attorney General’s Notary Office is responsible for appointing and commissioning notaries. You need to fill out the application through the eHawaii website.

This account is a very helpful tool. It allows you to submit the online application, schedule the exam, make payments, view your notary commission status, and renew it.

Most of the questions on the application are pretty strict forward—for example, your name, business address, background info. It’s better to check that the name on the application will be the same as when you are notarizing documents.

The Notary Office needs to ensure that you will be a trustworthy notary

To protect the public’s interest and that you will serve the public with integrity, the Notary Office requires letters to prove that you are a person of good moral character and the reason why you are applying for the notary commission.

A completed application shall include:

…

(2) A letter of character recommendation from a person residing in this State, who is not a relative or an employer of the applicant and who can attest to the applicant’s honesty, trustworthiness, financial integrity, and moral character; and(3) A letter of justification from the applicant’s employer, or if the applicant is self-employed, from the applicant, explaining in detail the reasons why the commission is being sought. The letter shall also contain a statement by the employer or applicant, if the applicant is self–employed, acknowledging that a notary public is a public officer and that the applicant would be permitted to serve the general public in such capacity during the employer’s or applicant’s normal business hours.

Quote from Amendment and Compilation of Chapter 5-11

Hawaii Administrative Rules – §5-11-2 1

There is a $20 application fee. You can pay with a credit card such as VISA, MasterCard, Discover, American Express.

Step 3: Pass the Hawaii notary exam

After the Attorney General approves your application, you need to pass a notary exam. It is a closed-book exam testing your knowledge on the statutory laws, administrative rules, duties, and responsibilities for notaries public.

Once again, you would register for the exam at the eHawaii.gov website. There is a $10 fee.

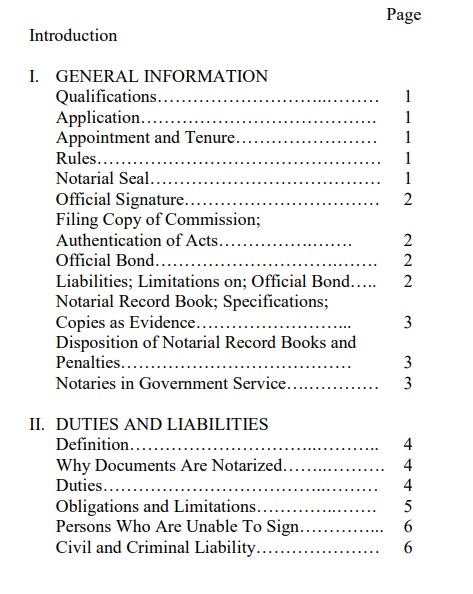

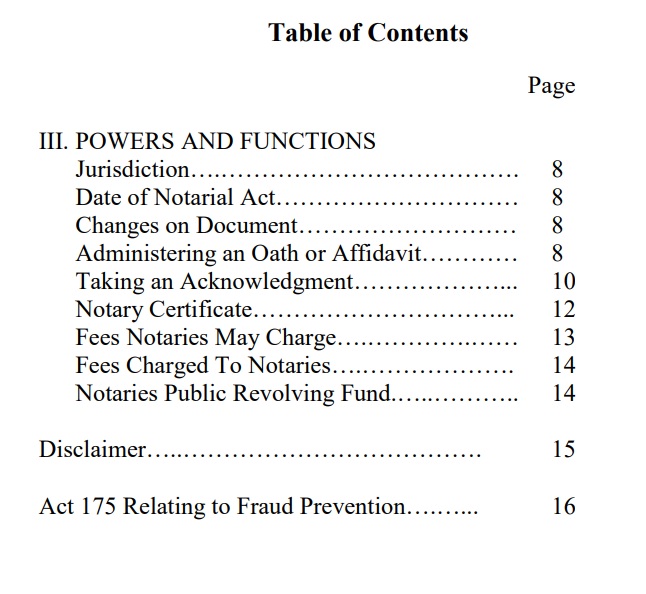

The passing score is 80 percent or more. A helpful way to prepare for the exam is to study the Notary Public Manual. It is a 23-pages PDF file that covers most of the topics you need to know about being a notary public.

Here is the table of contents from the Notary Public Manual.

Step 4: Receive the notary commission certificate

Once you pass the exam, you will pay a $110 fee to the Attorney General for issuance of the notary commission.

It is better to review and make sure all the details on the commission are correct. (e.g., your name, county of residence, commission dates).

Step 5: Get a notary seal

To start a notary signing business in Hawaii, you must have a notary seal. It is a helpful business tool that ensures you won’t leave out any required details. It also helps prevent fraudulent acts and make the signing agent an impartial witness.

You may purchase the notary seal from office supplies store. Also, its design must comply with the regulatory rules. It must be engraved with your name commission number, the words “Notary Public”, and “State of Hawaii.”

Step 6: Purchase a surety bond

The Notary Office requires you to purchase a $1,000 surety bond with a 4 years term. You may get it from a licensed surety such as a notary bonding company, an insurance company, or a notary organization. You could search for them online.

Note that the surety bond is to protect those for whom the notary public performs a notarization, but not you as a notary public. If you need coverage for your professional services, you should consider getting an Error & Omission insurance (E&O).

I just checked with a surety bond issuer. Below is their premium structure.

| Coverage | Premium |

|---|---|

| $1,000 bond | $50 |

| $1,000 bond with $10,000 E&O coverage | $90 |

| $1,000 bond with $20,000 E&O coverage | $110 |

| $1,000 bond with $30,000 E&O coverage | $130 |

Source: Suretybonds.com (Aug 26, 2020)

Step 7: File at the Clerk’s Office

At this point, you would bring the following to be filed at a clerk of circuit court office:

- Copy of your notary commission

- An impression of the notary seal

- A specimen of your office’s official signature

There could be a charge involved, but that could vary among each clerk’s office.

Step 8: Maintain a good record of business practice with a notary journal

As a notary signing agent in Hawaii, you should maintain a journal of all the notarial acts. Keeping a good record of your notary acts is an essential part of good business practice. It could serve as proof that you have taken reasonable steps to identify the signer of a document.

If your journal is maintained in a physical format, you should have one bounded with pre-printed pages. It must be bound with a soft cover and cannot be more than 11-inches in height and 16.5 inches in width when fully opened.

You may find it at stationery, office supply stores, or through notary associations.

Whereas for a journal in an electronic format, it needs to be a permanent, tamper-evident. Make sure that it is complying with the rules of the Notary Office.

For each official act, the notary shall enter in the book:

1. The type, date, and time of day of the notarial act;

2. The title or type and date of the document or proceeding;

3. The signature, printed name, and address of each person whose signature is notarized and of each witness;

4. Other parties to the instrument; and

5. The manner in which the signer was identified

Quote from Notary Public Manual

Does Hawaii allow remote online notarization?

I like states that have the option for notaries to work digitally. Doing so could bring you great convenience to streamline your notary practice.

Remote online notarization allows you not to be physically present with the signer. Instead, you would verify their the signer’s identity through video and audio conference.

At the time I’m writing the post, there are emergency rules imposed which allows remote notarization in Hawaii. However, this could be a temporary measure. Whether they would revert to in-person notarization afterward is unknown yet. Therefore, you should check with the Notary Office.

If you want to know how can you work from home as a notary? And the tools that you’ll need in your home office. Here’s the post for you.

How much can you make as a notary signing agent in Hawaii?

The average annual income of Loan Signing Agent in Hawaii is $52,620. The income typically ranges between $31,305 to $63,653. Top earning loan signing agents in Hawaii are making over $94,958.

As mentioned earlier, as a notary, although you could work on different documents, the loan signing in the real estate market could be a lucrative niche.

source: ZipRecruiter – March 11, 2022

How’s the loan signing business? Let’s hear from the Loan System Ambassador!

” I’m in Arizona, and the average fee for signings is $150 for purchases and refi’s and $125 for seller docs. With my signing service, I bring in about $30K per month.

I’m still growing my business and hope to double that by the end of the year. It’s definitely not easy to get business and takes a lot of time, effort, and hard work. I set weekly, monthly and yearly goals for myself and my business and how I want to grow it. “

– Irene Rueda, Loan Signing Agent and Arizona Loan Signing Ambassador

What’s a better way to learn about the notary loan signing business than speaking to someone who is incredibly successful in the industry?!! Here’s an exclusive interview with Irene Rueda, where she shared her journey in the loan signing business, how she got from making $800/m to $30,000/m and her thoughts about Mark Wills’s LSS training program. Be sure to check it out!

Is there demand for notary loan signing agent in Hawaii?

As long as people are obtaining mortgages or refinancing their homes, there would be a demand for notary loan signing agents.

All originated mortgages in Hawaii

| YEAR | RECORDS |

|---|---|

| 2017 | 5,986,659 |

| 2016 | 7,036,352 |

| 2015 | 6,113,423 |

| 2014 | 4,832,425 |

| 2013 | 7,126,202 |

| 2012 | 8,298,882 |

| 2011 | 5,946,435 |

| 2010 | 6,764,902 |

| 2009 | 7,783,986 |

| 2008 | 5,526,941 |

| 2007 | 7,201,366 |

Source: Consumer Financial Protection Bureau – Home Mortgage Disclosure Act (HMDA) (Aug 26, 2020)

Some states are “Attorney States,” which means only attorneys can coordinate the closing paperwork of a real estate. Whereas, others are “Escrow States” where escrow companies would handle the mortgage closing.

According to the First American Title, Hawaii is a an “Attorney State.”

Here is a post covering the differences between escrow states and attorney states and its impact on the loan signing business. You will also find a case study where a signing agent went from barely making end needs to earning over $10,000/month in an attorney state.

If you want to succeed in the loan signing industry, you must check out this loan system training program. If you review the testimonials of his students, you’ll be amazed at how the notary career changes their life after they learned from Mark Wills. (**)

How much does it cost to become a notary in Hawaii?

It would cost approximately $302 to become a notary in Hawaii.

Here’s a breakdown of the costs to start a notary signing business

| Notary Application Fee | $20 |

| Exam fee | $10 |

| Commission fee | $110 |

| Surety bond with E&O | $130 |

| Notary Seal | $17 |

| Journal | $15 |

There could be other expenses involved, travel expenses, car maintenance, auto insurance, remote notary technology, laptop and other business supplies.

Can a felon be a notary signing agent in Hawaii?

Having a conviction for a felony may impact the application to become a notary signing agent in Hawaii. The Notary Office needs to make sure that you are a person with credibility, truthfulness, and integrity to fulfill the responsibilities of the position.

Although I tried to read through the Hawaii Notary Public Manual, I cannot find details about it.

However, in most other states, the licensing department emphasizes felony or a crime involving dishonesty or moral turpitude. In many cases, having a felony does not necessarily mean your application will automatically be declined. It depends on the severity and nature of the conviction.

I believe that the Hawaii Notary Office would review it on a case-by-case basis.

How long does it take to become a notary in Hawaii?

It should take a 6 to 8 weeks to become a notary in Hawaii. After you submit the online application and provide all the required documents, you would schedule in writing the notary exam. Upon passing the exam, the Office will notify you within 30 days. Then you would purchase the seal, surety bond, and have all required paperwork filed at a Clerk’s office.

How to renew notary commission in Hawaii?

In Hawaii, you must renew the notary commission every four years. The renewal is similar to the procedures as you were applying for the initial commission, where you will do it through their online system. There is a renewal fee of $130.

To avoid an interrupted business period, begin the renewal process in advance. Don’t wait till your current notary commission is expired.

Can I notarize for a family member in Hawaii?

You must not notarize any documents where you have any financial or beneficial interest in the transaction. Therefore, notarizing a document for any family member could call into question, and such practice should be avoided.

I have more questions about being a notary public in Hawaii, where could I obtain more details?

You may contact the Department of the Attorney General, Notary Public Office:

- Address: 425 Queen St, Honolulu, HI 96813

- Phone: (808) 586-1216

Alternatively, you may reach them by filling out their online contact form.

If you are reading up to this point, I bet you must be interested in the notary signing profession. But why reinvent the wheel when there is a proven system that works? Many students had great success following the Loan Signing System (LSS) from Mark Wills. You may click here to check it out yourself. (**)

Disclaimer: The information in this post is for general information only, and not intend to provide any advice. They are subjected to change without any notice, and not guaranteed to be error-free. Some of the posts on this site may contain views and opinions from individual not related to JCHQ Publishing. They do not necessarily reflect our view or position.

(**) Affiliate Disclosure: Please note that some of the links above are affiliate links, and at no additional cost to you. Our company, JCHQ Publishing will earn a commission if you decide to make a purchase after clicking on the link. Please understand that we include them based on our experience or the research on these companies or products, and we recommend them because they are helpful and useful, not because of the small commissions we make if you decide to buy something through the links. Please do not spend any money on these products unless you feel you need them or that they will help you achieve your goals.

Reference:

- First American Title- Your Guide to Real Estate Customs by State (source)

- State of Hawaii Department of the Attorney General

- SuretyBonds.com – Hawaii Notary Bond (source)

- Salary.com – Notary Signing Agent Salary in Hawaii (source)

- ZipRecruiter – Loan Signing Agent Salary in Hawaii (source)

- Consumer Financial Protection Bureau – Home Mortgage Disclosure Act (HMDA) (source)