(**) Disclosure: This post may contain affiliate links, meaning RealEstateCareerHQ.com will get a commission if you decide to make a purchase through the links, but at no additional cost to you.

To become a notary loan signing agent in New Hampshire, an applicant must:

- Meet the state-eligibility requirement;

- Submit the Notary Public Application, Criminal Record Release Authorization Form and $75 fee to the New Hampshire Secretary of State;

- Review the notary commission certificate;

- Take an oath of office;

- Purchase a notary seal;

- Maintain a business journal;

- Familiarize with the New Hampshire Notarial Acts;

- Keep up with notarial best practice

Although you could work on different types of documents, the loan signing business in the real estate market seems to be a lucrative niche.

So what does a loan signing agent do? When people are getting a mortgage to purchase a house, or they need to refinance their property, there will be loan documents involved. Your role as a notary loan signing agent is to walk through the set of loan documents with the borrower and witness them in signing the paperwork.

You would also need to verify the identity of the signers, place the notary stamp on the signed documents, then send them back to the signing services company or closing attorney.

But keep in mind that you should NOT be providing legal advice, and you cannot explain the terms of the loan documents to the borrower.

In this guide, you’ll find out the steps to become a notary in New Hampshire, income updates, and FAQ about this profession.

But before we start, I want to give a brief disclaimer. This post is not intended as legal advice or state/federal notary public training. It is for general information only. Please check with your state to be sure that loan signing agents are utilized in the closing process. Always follow your state’s notary laws and best practices.

Would you like to learn how to make $75 to $200 per signing appointment? You must check out the Loan Signing System from Mark Wills. (**) This is one of the best training programs for loan signing agents. Many students have achieved remarkable business success after taking this program.

A Table Summary to Become a Notary in New Hampshire

| Age | Notary Course | Exam | Surety Bond | Term of Office | Application Fee |

|---|---|---|---|---|---|

| At least 18 | No | No | No | 5 years | $75 |

8 Steps to Become a Notary in New Hampshire

Step 1: Meet the eligibility requirement

- At least age 18 of age

- Resident of New Hampshire or resident of an abutting state, but given the following conditions are met:

- Resident of Maine, Massachusetts or Vermont;

- Regularly employed or carries on a trade, business, or practice in New Hampshire at the time of applying;

- Registered as a Notary Public in your home state.

- Endorsed by two New Hampshire notary publics and a registered voter in New Hampshire

Step 2: Submit the notary public application to the New Hampshire Secretary of State

The New Hampshire Secretary of State is responsible for appointing and commissioning notaries. You need to fill out the Notary Public Application.

Most of the questions in the application are pretty strict forward—for example, your name, business address, background info. It’s better to check that the name on the application will be the same as when you are notarizing documents.

Make sure you sign the application in the presence of a New Hampshire notary public. The notary public also needs to sign the application and place a stamp/ seal on it.

There is a $75 filing fee. You may make a check payable to: Treasurer, State of New Hampshire.

The NH Secretary of State needs some reassurance that you are a trustworthy person

In the application, you need to get endorsements by two New Hampshire notary publics and a registered voter in New Hampshire. The endorsers are really giving their approval and support to you as the applicant. Therefore, they should personally know you and believe that you are a person with honesty and integrity.

The Office will conduct a background check on you

You need to fill out the Criminal Record Release Authorization Form. The form is in the same file as the Notary Public Application. Besides some general info, you also need to indicate your hair color, eye color, and driver license number.

Once again, you must sign this form in front of a notary public. The notary public will also need to sign it.

Once all the documents are in good order, you may mail them to:

- New Hampshire Secretary of State, 107 North Main Street, Room 204

Concord, NH 03301

Step 3: Review the notary commission certificate

After the Secretary of State’s office receives your application, they will forward it to the Governor and Executive Council for nomination. The process typically takes around 8 to 10 weeks.

Upon approval, you will receive the notary commission and oath office by mail within one week.

It is a good idea to review and make sure all the details on the commission are correct. (e.g., your name, city of residence, tern of commission).

Step 4: Take an oath of office

Then you must take an “Oath of Office”. This is is an affirmation that you agree to assume the duties of a notary public and will comply with the New Hampshire notary acts.

The oath must be administered by authorized officials. They could be:

- Two members of the executive council or;

- Any member of the executive council with a Justice of the Peace or;

- Any two justices of the peace or;

- Any Justice of the Peace with any Notary Public, or

- Any two notary publics.

The authorized officials will sign the oath and commission. They will also affix the official seal on them. Now, you may keep the signed commission, but must submit the signed oath to the Secretary of State for filing.

Keep in mind that you may not act as a Notary Public until you have taken the oath of office.

Step 5: Familiarize with the New Hampshire Notarial Acts

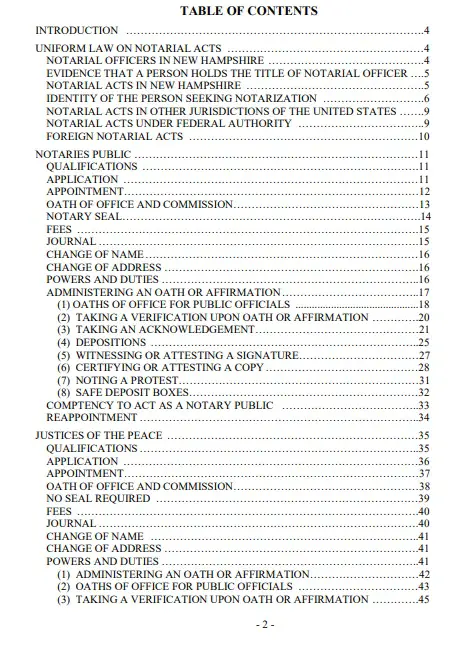

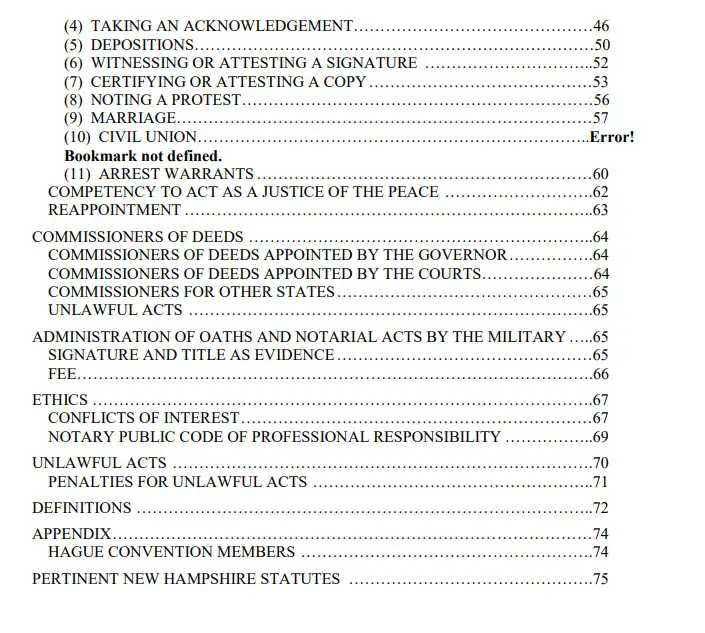

As a notary signing agent, it is important to understand the New Hampshire notary laws and regulations. After all, you must know what you can do and cannot do. A great way in getting to know the notary laws is by reading is the “Notary Public and Justice of the Peace Manual.”

Here are the topics being covered in this 80-pages comprehensive guide:

Above are screenshots from the Notary Public and Justice of the Peace Manual.

Another excellent resource is the New Hampshire Statutes Chapters 455, Notaries Public and Commissioners. This is a section within the New Hampshire Legislature, which lists out every detail about being a notary. However, its wording is more technical and formal than the ones in the manual.

But it indeed is a good reference if you want to know more in-depth about a specific topic.

I’ll leave the links of the Notary Public Manual and the New Hampshire Statutes Chapter 455 in the reference section.

Step 6: Get a notary seal

To start a signing services business in New Hampshire, you may use a notary seal. It is a helpful business tool that ensures you won’t leave out any required details. It indicates the signing agent as an impartial witness and helps to prevent fraudulent acts.

You may purchase the notary seal from office supplies store. Its design must comply with the regulatory rules. For example, it must contains the following:

- The words “Notary Public” and “New Hampshire”

- Your name as appear on the notary commission

- The expiry date of your notary commission

Since the notary seal contains the commission expiry date, you need to get a new one for each term of office.

Step 7: Maintain a notary journal

As a notary signing agent in New Hampshire, it is good to maintain a journal of all the notarial acts. Keeping a good record of your notary acts is an essential part of good business practice. It could serve as proof that you have taken reasonable steps to identify the signer of a document.

If your journal is maintained in a physical format, you should have one bounded with pre-printed pages. You may find it at stationery, office supply stores, or through notary associations. Also, you cannot have more than one active journal at any even time.

Whereas for a journal in an electronic format, it needs to be a permanent, tamper-evident. Make sure that it is complying with the rules of the Secretary of State.

In the notary journal, you should record the following items in each entry:

- What is the the date of the notarial act performed?

- What is the notarial act?

- The identifying information of the signer

- Other details which you believe would be useful when referring to this notarization

Step 8: Keep up with notarial best practice

Continuing education is critical to being a notary signing agent. Rules and regulations would change over time. Also, there will be new technology to advance your business practice. A good way is to take high-quality courses from a trusted provider.

Learn to earn as a Loan Signing Agent

Without sufficient income, you are just doing it as a hobby and not a real business. The first step you should take is to learn how to build a “PROFITABLE” notarial practice.

But this could take years of trial and error in coming up with a feasible strategy. Rather than reinventing the wheel, a MUCH better way is to learn from someone who has done it before successfully.

Mark Wills is a top-notch coach for notary signing agents. He developed the Loan Signing System (LSS) training program, where many of his students have achieved massive success. Some can earn great money as a side-gig, where some are earning over six-figures every year.

You may click here to check out his training program. (**)

Advance your credential by becoming an NNA Certified Notary Signing Agent

The National Notary Association (NNA) is one of the largest associations and most recognizable for notaries. They provide regular updates, training and networking events to the members.

Getting the NNA Certified status can show to title and escrow companies that you are maintaining a high standard as a signing agent. Thus, strengthen their trust and confidence in your signing services.

>>Here is a review I wrote about the NNA Certified Notary Signing Agent Program<<

In there, you can find an exclusive interview I had with Melina Fuenmayor. She will share with you her thoughts in obtaining the certified credential.

Does New Hampshire allow electronic notarization?

I like states that have the option for notaries to work digitally. Doing so could bring you great convenience to streamline your notary practice.

Electronic Notarization, also known as “e-notarization” is where the signings and document transmission can be done electronically. But you’ll still need to meet the signer in-person to verify their identity.

You can perform “electronic notarization” in New Hampshire. But the meeting must be conducted within the state of New Hampshire.

An electronic notarization would involve:

- Electronic document

- Digital notary seal

- Digital signatures of the notary and signer

Does New Hampshire allow remote online notarization (RON)?

Remote online notarization (RON) allows you not to be physically present with the signer. Instead, you would verify their the signer’s identity through video and audio conference.

At the time I’m writing the post, there are emergency rules imposed which allows remote notarization in New Hampshire.

However, this could be a temporary measure. Whether they would revert to in-person notarization afterward is unknown yet. Therefore, you should check with the Office of the Secretary of State.

How to become a mobile notary in New Hampshire?

Some signers cannot travel to your office in signing the documents, and they do not have the technology to perform the remote notarization. In such a situation, there would be a demand for a mobile notary. In short, a mobile notary is merely a notary that travels around in meeting signers.

To become a mobile notary in New Hampshire, you must:

- Register with the Secretary of State as a notary. This is basically the same notary commission certificate, as discussed earlier. You don’t need to get a new one.

- Have ease of transportation. It is better to have your own car so that you could conveniently drive between appointments.

- Setup essential equipment: A mobile printer and an approved electronic notarization platform allow you to work on the documents whenever and wherever.

How much do notary signing agents make in New Hampshire?

The average annual income of Loan Signing Agents in New Hampshire is $48,070. The income typically ranges between $31,722 to $64,502. Top earning loan signing agents in New Hampshire are making over $96,224.

As a notary, you could work on different documents, but the loan signing in the real estate market could be a lucrative niche.

Top 10 Highest Paying Cities for Loan Signing Agents in New Hampshire

| City | Annual Salary |

|---|---|

| Concord | $52,191 |

| Laconia | $51,552 |

| Rochester | $50,461 |

| Nashua | $48,196 |

| Portsmouth | $46,086 |

| Somersworth | $45,993 |

| Lebanon | $45,835 |

| Manchester | $45,347 |

| Keene | $44,928 |

| Dover | $44,634 |

source: ZipRecruiter (March 13, 2022)

Can you make over $10,000/month as a loan signing agent? Be sure to check out our notary earning guide. You’ll find a case study where a loan signing agent has built her business to such a successful figure.

Is there demand for notary loan signing agent in New Hampshire?

As long as people are obtaining mortgages or refinancing their homes, there would be a demand for notary loan signing agents.

All originated mortgages in New Hampshire

| YEAR | RECORDS |

|---|---|

| 2017 | 34,290 |

| 2016 | 38,262 |

| 2015 | 33,120 |

| 2014 | 26,589 |

| 2013 | 41,589 |

| 2012 | 48,098 |

| 2011 | 35,321 |

| 2010 | 40,696 |

| 2009 | 45,790 |

| 2008 | 32,850 |

| 2007 | 46,139 |

Source: Consumer Financial Protection Bureau – Home Mortgage Disclosure Act (HMDA) (Sept 18, 2020)

Since not all active notaries can perform electronic notarization or remote online notarization, you definitely should consider incorporating e-notary and RON in your practice to maintain a competitive edge.

Some states are “Attorney States,” which means only attorneys can coordinate the closing paperwork of a real estate. Whereas, others are “Escrow States” where escrow companies would handle the mortgage closing.

According to the First American Title, New Hampshire is an “Attorney State.” Here is a post covering the differences between escrow states and attorney states and its impact on the loan signing business.

If you want to succeed in the loan signing industry, you must check out this loan system training program. If you review the testimonials of his students, you’ll be amazed at how the notary career changes their life after they learned from Mark Wills. (**)

How much does it cost to become a notary in New Hampshire?

It would cost approximately $107 to become a notary in New Hampshire.

Here’s a breakdown of the costs to start a notary signing business

| Notary application fee | $75 |

| Notary seal | $17 |

| Journal | $15 |

There could be other expenses involved, travel expenses, car maintenance, auto insurance, E&O, remote notary technology, laptop and other business supplies.

Can a felon be a notary in New Hampshire?

Having a conviction for a felony may impact the application to become a notary in New Hampshire. The Secretary of State needs to make sure that you are a person with credibility, truthfulness, and integrity to fulfill the responsibilities of the position.

However, having a felony does not necessarily mean your application will automatically be declined. It depends on the severity and nature of the conviction. The New Hampshire Secretary of State would review it on a case-by-case basis.

In addition to the above qualifications, it is within the discretion of the Governor and Executive Council to find particular criminal convictions as disqualifying. Given that all applicants are statutorily required to provide a criminal background by signing a written statement under oath regarding their criminal history, this information is relevant to the appointment process and may be taken into consideration by the Governor and Executive Council during contemplation of an application.

Quote from Notary Public and Justice of the Peace Manual

How long does it take to become a notary in New Hampshire?

It takes 9 to 11 weeks to become a notary in New Hampshire. The application process would take between 8 to 10 weeks. Upon approval, you will receive the notary commission and oath of office by mail within one week.

Then you would take an oath of office, and submit it to the Secretary of State. Once everything is in good order, you can purchase the notary seal and journal.

How to renew notary commission in New Hampshire?

You must renew the notary commission every five year. The renewal steps are similar as you were applying for the initial application.

- Complete and submit the renewal application to the Secretary of State

- Pay the $75 renewal fee.

- Get a notary seal with a new commission expiry date

The renewal application will be mailed to you two months before the expiration of your current commission. But to avoid an interrupted business period, don’t wait till your current notary commission is expired.

Can a notary refuse to notarize a document in New Hampshire?

Yes, a notary may refuse to notarize a document in New Hampshire when there is a conflict of interest, or cannot identify the signer through satisfactory evidence.

Can I notarize for a family member in New Hampshire?

You must not notarize any documents where you have any financial or beneficial interest in the transaction. Therefore, notarizing a document for any family member could call into question, and such practice should be avoided.

I have more questions about being a notary public in New Hampshire, where could I obtain more details?

You may contact the Secretary of State’s Office at:

- (603) 271-3242;

- 107 North Main Street, State House, Room 204, Concord, N.H. 03301;

- elections@sos.nh.gov

How’s the loan signing business? Let’s hear from the Loan System Ambassador!

” I’m in Arizona, and the average fee for signings is $150 for purchases and refi’s and $125 for seller docs. With my signing service, I bring in about $30K per month.

I’m still growing my business and hope to double that by the end of the year. It’s definitely not easy to get business and takes a lot of time, effort, and hard work. I set weekly, monthly and yearly goals for myself and my business and how I want to grow it. “

– Irene Rueda, Loan Signing Agent and Arizona Loan Signing Ambassador

What’s a better way to learn about the notary loan signing business than speaking to someone who is incredibly successful in the industry?!! Here’s an exclusive interview with Irene Rueda, where she shared her journey in the loan signing business, how she got from making $800/m to $30,000/m and her thoughts about Mark Wills’s LSS training program. Be sure to check it out!

Disclaimer: The information in this post is for general information only, and not intend to provide any advice. They are subjected to change without any notice, and not guaranteed to be error-free. Some of the posts on this site may contain views and opinions from individual not related to JCHQ Publishing. They do not necessarily reflect our view or position.

(**) Affiliate Disclosure: Please note that some of the links above are affiliate links, and at no additional cost to you. Our company, JCHQ Publishing will earn a commission if you decide to make a purchase after clicking on the link. Please understand that we include them based on our experience or the research on these companies or products, and we recommend them because they are helpful and useful, not because of the small commissions we make if you decide to buy something through the links. Please do not spend any money on these products unless you feel you need them or that they will help you achieve your goals.

Reference:

- First American Title- Your Guide to Real Estate Customs by State (source)

- New Hampshire Secretary of State (source)

- New Hampshire Governor Emergency Orders 11 (source)

- Salary.com – Notary Signing Agent Salary in New Hampshire (source)

- ZipRecruiter – Loan Signing Agent Salary in New Hampshire (source)

- Consumer Financial Protection Bureau – Home Mortgage Disclosure Act (HMDA) (source)