(**) Disclosure: This post may contain affiliate links, meaning RealEstateCareerHQ.com will get a commission if you decide to make a purchase through the links, but at no additional cost to you.

One of my friends is getting a refinance on her home. As part of the underwriting requirement, an appraisal is needed. So the real estate appraiser showed up at her property, walked through the house, and took some pictures.

Since no one notified her that photos would be taken, she got confused about its usage and felt an invasion of her privacy.

So why do appraisers take pictures of a property? The key reasons appraiser takes photos of a home is to fulfill the lender’s requirement. They are an important supporting document and also help to develop an unbiased assessment of the subject property.

In this article, you’ll find out why appraisers must take photos, what needs to be captured, and the things to be aware of when doing so. Not only that, but I also connected with a professional appraiser. He is very kind to share his experience and insights about taking pictures for appraisal assignments.

Hopefully, this could clear the tension next time you are communicating with a homeowner.

4 Reasons Why Appraiser Need to Take Photos of the Property

1) Lender’s Requirement

Back in the old days, appraisers were only required to take photos of the front, back and street view of a subjected property. However, the appraisal requirement has become more stringent after the previous real estate meltdown.

During the financial crisis, many mortgage lenders lost tons of money. They were unable to fully recoup their loan since the collateralized properties were way overvalued. Therefore, having photos in an appraisal report is pretty much a norm nowadays.

Most people are not overly concerned when you take photos on the property exterior, so below is the interior photograph requirements from Fannie Mae and FHA for your reference.

Interior photographs – At a minimum, the report must include photographs of the following: the kitchen; all bathrooms; main living area; examples of physical deterioration, if present; and examples of recent updates, such as restoration, remodeling, and renovation, if present.

Quoted from Fannie Mae Exhibits for Appraisals

Note: Interior photographs on proposed or under construction properties may be taken by the appraiser at the time of the inspection for the Certification of Completion, and provided with the Form 1004D.

Minimum Photograph Requirement, Subject Property Interior

– Kitchen, main living area, bathrooms, bedrooms

– Any other rooms representing overall condition

– Basement, attic, and crawl space

– Recent updates, such as restoration, remodeling and renovation

– For two- to four-unit Properties, also include photographs of hallways, foyers, laundry rooms and other common areas

Quoted from FHA Minimum Photograph Requirements

[Read: What is an FHA Appraisal?]

2) Better Understanding with Vivid Pictures

Even though you might have already written descriptive words about the property, sometimes it could be difficult to visualize what you really mean. After all, most people are visual learners.

The photos become especially important when you need to make an adjustment that is out of the ordinary range. Along with the well-written description in the appraisal, images would be a great compliment to support your points.

3) Recollection for Developing the Appraisal

It’s not uncommon that you need to inspect multiple properties on the same day. By the time you walked through all the properties, it is easy to get confused with all the details.

Does property A has a renovated kitchen? Or is it property B? Which house needs to redo the driveway? If you have taken photos, it helps to bring your recollection when working on the appraisal.

Even though you could have taken notes about a property, there could be times what you wrote down could be different from what you saw.

An appraiser once told me that he wrote down there were four rooms in a subject property, but somehow he did remember there were only three. Luckily, he took pictures of each room so that he could confirm without revisiting the property.

4) Documentation for Filing

Most of your work is done after the appraisal is submitted. But there could be times you’ll need to access the file after an extended period- for instance, your work is being audited, scrutinized, or you need to provide evidence in court litigation.

One appraiser shared that he is dealing with a litigation case for a property that he inspected many months ago — the pictures on file help to serve his memory and forms a crucial piece of evidence.

The Pictures Needed in an Appraisal

1) All the Rooms

According to the FHA photograph guideline, you must take photos of each and every room. (i.e., kitchen, main living area, bathrooms, and bedrooms.) They help the appraisal readers to have a better understanding of the condition of various rooms and the structure of the properties.

2) Upgrades, Renovation, or Remodeling

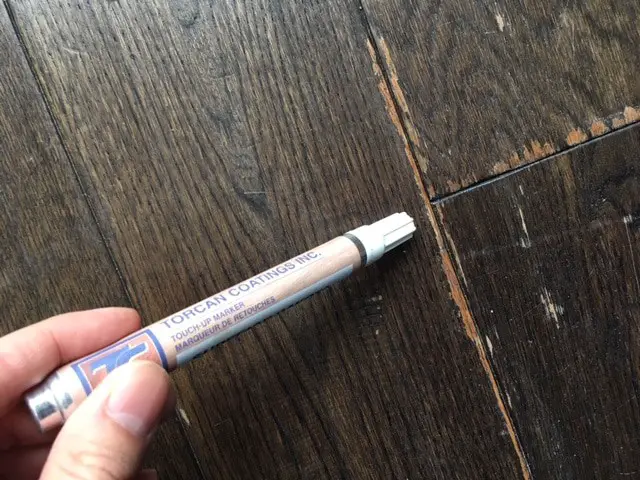

If the homeowner spent lots of money in renovating their house, then you should consider whether those improvements could enhance the appraised value. For example, a brand new kitchen counter top, a newly installed solar panel which reduces the utility bills, and an in-wall bookshelf could be a price premium factor in your assessment.

You should take additional photos of each upgrade when there is significant adjustment involved. Accompany with the renovation receipts, the images help to clarify how you come up with your value opinion.

3) Maintenance Required

Contrary to the above, when certain parts of the property are in poor condition, (i.e.: leaky ceiling, unsafe stairs, or rusted windows), you might need to make a downward adjustment to the appraised value. The images help the underwriter to understand the severity of the problem.

4) Special Features

Not all houses are identical. Even though two houses could have similar size, their unique features could lead them to different appraised values.

For instance, crown molding, entertainment center, well-maintained deck, or a heated driveway could potentially add value. Having photos of them could add credibility to your assessment.

5) Attic and Crawlspace

If a FHA loan is involved, then your appraisal must comply with the FHA guideline. One of the requirements is to perform a minimum of head and shoulder inspection in the attic and crawlspace. But how can you prove you did that? The best way is to take photos as supporting evidence.

While you are taking the pictures, you should check if there are any settlement cracks in the basement or damages in the attic.

6) External Environment

We talked about so much about taking photos on the interior of the property. Sometimes, the exterior could just be as important. I’m not just talking about the lawns, walls, driveway and the roof, but also the location of the property.

It would be nice if the property is located in a quiet neighborhood, walking distance to a park or school. However, not all properties have such an ideal location.

I have seen properties where it is built next to a gas station, a train railway, or even beside a factory. This indeed could have a negative impact on the price. Including pictures of this proximity helps the readers understand why you are discounting the value.

11 Tips for Appraisers when Taking Photos of the Property

1) Inform the real estate agent. The number one reason property owners are dissatisfied because they are not even aware that you would take photos of their home. This truly caught them off-guarded. If there’s a salesperson involved, ask them to notify their clients that pictures will be taken on every room.

2) Explain to the property owner that this is the lender’s requirement. It helps to develop an unbiased value about the property.

3) Build trust with the homeowner. Emphasize that you are a licensed real estate appraiser. All procedures you take is legit and complying with the state appraisal regulation.

4) Reinforce the images will not be publicized. So it’s not going to be posted online. It is intended to been seen by the loan underwriter or the person who orders the appraisal for evaluating purpose.

5) Explain that the pictures are to illustrate the structure of the property, and not for documenting their personal contents.

6) Suggest homeowners remove any personal items or put them into storage. (i.e., family photos, prescription drugs, bill statements, undergarment)

7) Do not take photos of people even including yourself. Although it might not be your intention, this could accidentally happen through a mirror reflection. If so, you should blur out the person’s face.

8) Never take photos inside a drawer. This is a severe invasion of other’s privacy.

9) Beware of a home office. It could include confidential details of the homeowner’s clients. Once again, ask them to store their filings in a locked cabinet.

10) Beware of pets. Sometimes you might want to open doors to get better lighting of the room. However, if there is a pet within the unit, there could be risks of it running away from the property. Make sure the owner will lock their pet into a secured cage. The last thing you want is to handle the frustration of an owner with a missing cat.

11) Inform Tenants ahead of Time. Sometimes the subject property is occupied by tenants rather than the owner. There could be occasions where the owner does not have direct contact with the tenants as all communication is done through a property management company. In such a scenario, you should schedule the home visit days in advance. This could give enough time for the property manager to make necessary arranging with the tenants.

Words of Wisdom from a Professional Appraiser

“… if your photos look unprofessional, it’ll make the report look unprofessional “

“Photos and the required photos have changed a lot over the years. Back in the days of 35mm, we were only required to take front, rear, and a street scene.

However, most appraisers would take some additional photos of things like views or special features. Now. with digital cameras, clients want photos of just about everything.

Lenders want front, rear, street, but also every room, bathroom, feature, any potential issues or repairs, etc. That has spilled over to just about every appraisal assignment, even non-lender work. With digital cameras, I will take a lot of photos. Not all of them will go into the report, but it’s nice to have photos to look at as I’m writing up the report.

I don’t run into too many homeowners who have an issue with taking photos. Once in a while, an owner will ask why I’m taking photos. If it’s for a lender, I’ll explain that we are required to. If it’s a non-lender appraisal, I’ll ask if it’s ok to take them and if they object, I’ll ask if I can take them just for my use in writing up the report and that they’ll not be used in the report. I haven’t run into anyone who has completely refused to take any pictures.

As far as tips for other appraisers, just make sure your photos are centered and level, that you are showing the reader of the report what you are trying to convey. When I see another appraisal report and the photos are hard to see or are cut off or off center, etc. it makes it look like the appraiser was rushing or doesn’t care about the quality of their work.

The old saying is true, a picture is worth a thousand words. So if your photos look unprofessional, it’ll make the report look unprofessional. They don’t need to be professional photographer quality, but you also don’t want them looking like a toddler took them either.”

Eric VanderWaal, Residential Real Estate Appraiser at VanderWaal Appraisal Group, LLC

In Summary

Including relevant photos is an essential step to creating a credible appraisal. Not only it helps the readers to have a thorough understanding of your value opinion, but it could also serve as a supporting document or even evidence down the road. It is a mandatory requirement requested by most lenders.

Although every appraiser knows this is part of your job, not all homeowners would understand it. Since they are not in the real estate industry and they could be clueless about fulfilling a lender’s requirements. It is reasonable for them to be confused and worry about their privacy.

As a professional real estate appraiser, you can explain to them why you’ll need to take the pictures and the usage of them. After all, not every occupant is unreasonable. Your patience and transparency would ease their concerns and make your job easier.

So did I miss anything? Is there anything you want to add to? If so, please leave us a comment below.

Taking high-quality appraisal courses allows you to keep up with the best practices and remain competitive in the industry. When choosing a real estate school to complete the CE requirement, selecting one with an excellent reputation is important. McKissock is a trustworthy real estate education provider. Check out the McKissock Appraisal CE Membership (**), where you can get unlimited access to hundreds of appraisal continuing education courses, the latest national USPAP course, specialty skills training, and niche certifications.

(**) Affiliate Disclosure: Please note that some of the links above are affiliate links, and at no additional cost to you. Our company, JCHQ Publishing will earn a commission if you decide to make a purchase after clicking on the link. Please understand that we include them based on our experience or the research on these companies or products, and we recommend them because they are helpful and useful, not because of the small commissions we make if you decide to buy something through the links. Please do not spend any money on these products unless you feel you need them or that they will help you achieve your goals.

Disclaimer: The information in this post is for general information only, and not intend to provide any advice. They are subjected to change any notice, and not guaranteed to be error-free. For full and exact details, please contact the Appraisal Board in your state and refer to the specific requirement from your lenders.

Reference: