(**) Disclosure: This post may contain affiliate links, meaning RealEstateCareerHQ.com will get a commission if you decide to make a purchase through the links, but at no additional cost to you.

To become a notary loan signing agent in Illinois, an applicant must to submit a Notary Public Application to the Illinois Secretary of State, pay the registration fee, get a surety bond and a notary seal.

So what does a loan signing agent do in Illinois? When people are getting a mortgage to purchase a house, or they need to refinance their property, there will be loan documents involved.

Your role as a notary loan signing agent is to walk through the set of loan documents with the borrower and verify the identity of the signer at the time of the signature

Then you would place the notary stamp on the signed documents, and send them back to the escrow company.

But keep in mind that you should NOT be providing legal advice, and you cannot explain the terms of the loan documents to the borrower.

In this guide, you’ll find the steps to become a notary loan signing agent in Illinois. You’ll also learn the FAQ about this profession and income updates.

Note that this guide is for general information only and not to provide any professional advice. Although I’ve tried to put down info as accurate as I could possibly find, you should always refer back to the Illinois Secretary of State and the State law.

So let’s go through the notary loan signing career in Illinois.

Would you like to learn how to make $75 to $200 per signing appointment? You must check out the Loan Signing System from Mark Wills. (**) This is one of the best training programs for loan signing agents. Many students have achieved remarkable business success after taking this program.

5 Steps to Become a Notary Loan Signing Agent in Illinois

Step 1: Meet the state-eligibility requirement

- At least 18 years of age

- U.S Citizen or an alien lawfully admitted for U.S permanent residence

- Has resided in the State of Illinois for 30 days preceding the application OR

- Resident of a state bordering Illinois that has worked or maintained a business in Illinois for 30 days preceding the application

- Able to read and write English

Step 2: Purchase a surety bond

The Illinois Secretary of State requires you to purchase a 4 years term $5,000 surety bond. You may get it from a licensed bonding or insurance company.

Note that the surety bond is to protect those for whom the notary public performs a notarization, but not you as a notary public.

If you need coverage for your professional services, you should consider getting an Error & Omission insurance (E&O).

I just checked with a surety bond issuer. The cost for a bond amount of $5,000 is $30. Their option would include $5,000 E&O coverage for resident.

If you want to increase the E&O coverage to $25,000, then the total cost would be $70. (This option already includes the $5,000 bond amount)

Step 3: Complete the Notary Public Commission Application

You need to fill out the Notary Public Application (Form 171.9). The questions on the application are pretty strict forward—for example, your name, business address, driver license, background info.

In addition to the application, you’ll need to provide a copy of the driver’s license/ state ID and surety bond. On the form, there is a section that requires the corporate seal of the surety bond company. You’ll also need the signature of their officer or authorized representative.

This form needs to be signed and stamped by a licensed Notary Public. Basically, it’s a way of showing that you swear whatever you put in the application is true and accurate. Also, you will comply according to the notary act and State Laws.

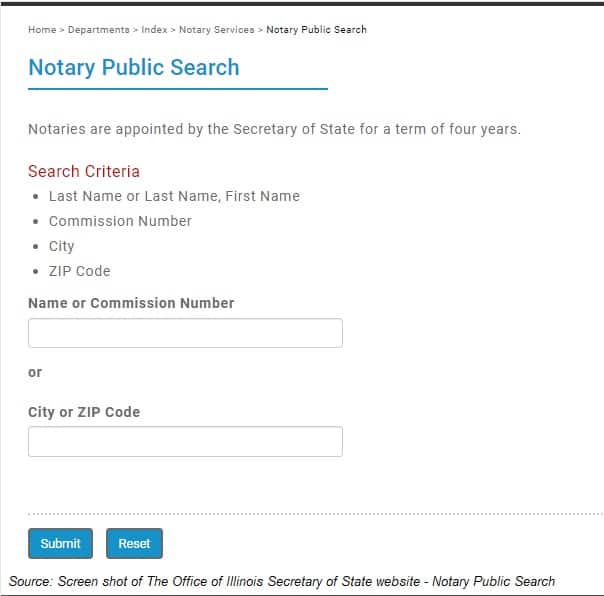

You could search for a notary public on Google. Once you locate one, it’s better to confirm their license on the IL notary public database.

There is a filing fee of $10. That could be paid with a credit card. You could also pay with a cheque or money order, payable to the Secretary of State.

Once all the required documents are in good order, you can mail them to: Secretary of State Index Department, 111 E. Monroe, Springfield, IL 62756.

Step 4: Receive the notary public commission certificate

Once Illinois Secretary of State approves your application, they will send it to the county clerk of your residence.

Then the county clerk will notify you. You may request them to mail the commission certificate to you, or you can go pick up from the county clerk’s office.

If you choose the mailing office, there is a $10 fee, and you’ll need to provide a specimen of your signature. For in-person pick up at the county clerk’s office, it will only be $5, and you could do the signature recording right at the spot.

Note that you’ll have to respond to the county clerk within 30 days that they notified you. If no action is taken, they will send you another reminder. But after another 30 days, they will cancel your notary public commission.

After you receive the certificate, it’s better to review and confirm all the details are correct. (e.g., your name, county of residence, commission dates).

Step 5: Get the notary business supplies

Notarize documents with a standardized seal

You may purchase the notary seal from office supplies store. If you do, then usually they would mail it along with your notary public commission certificate.

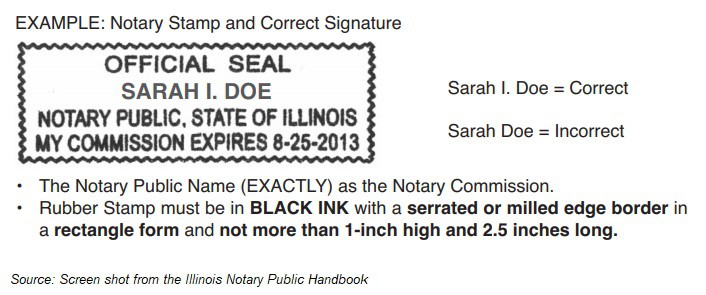

According to the Illinois Notary Public Handbook, Article 3-101, the rubber stamp seal must have the following:

- The words “Official Seal;”

- The words “Notary Public,” “State of Illinois” and “My commission expires ________________ <- The expiry date of your commission

- (Note that the expiry date must be imprinted on the seal and cannot be handwritten)

- Your official name;

- The seal needs to have a serrated or milled edge border in rectangular form. Also, it cannot be more than 1 inch in height by 2.5 inches in length surrounding the information.

- You must use the notary seal with black ink

Maintain a good record of business practice

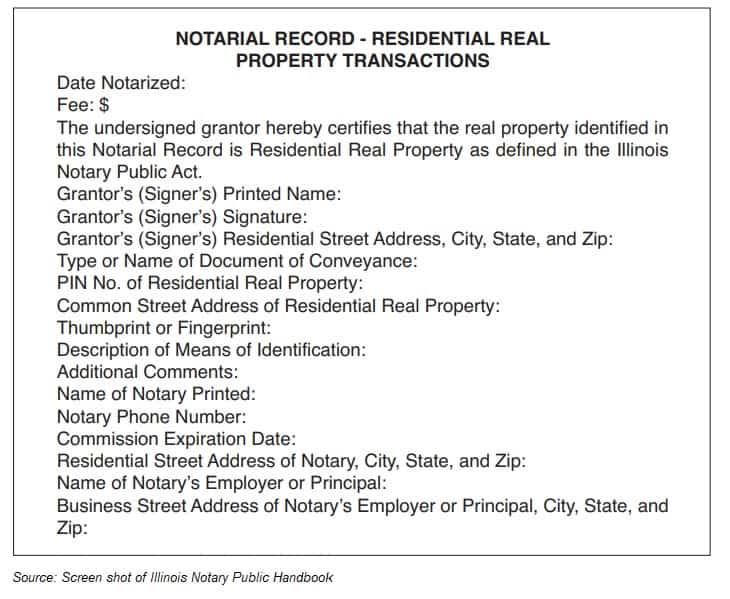

As I’m reading the Illinois Notary Public Handbook, it states that the IL Secretary of State does not require you to keep a logbook or journal. However, in section 3-102, it also says that you need to have Notarial Record for Residential Real Property Transactions.

What seems even more confusing is that it also states, “No copies of the original Notarial Record may be made or retained by the Notary.” Therefore, I suggest you to check out with the IL Secretary of State for more clarity or refer to the IL Notary Public Handbook.

But generally speaking, maintaining a good record is an essential part of good business practice. It also acts as proof that you have taken reasonable steps to identify the signer of a document.

If you are going to keep a journal, it is better to one that is permanently bounded because their pages are more difficult to remove or lose than loose-leaf pages. It also should be in numbered pages. The entries should consist of :

- What is the method you verify the signer’s identity?

- What is the date and time of the notarization?

- What is the document or act being notarized?

- What is the full name, address, and signature of each person requesting the notarization?

You may find it at the office supply stores, or through notary organizations. Be sure to keep both the seal and book record in a locked and secured area, where only you have direct and exclusive control of it. (e.g. a locked drawer or cabinet.)

Can you notarize an electronic signature in Illinois?

e-Notarization is where the borrowers sign the documents electronically. But in most states, you are still required to meet the signers in person.

To my understanding, Illinois is still in the process of implementing rules for e-Notarization. They have a Task Force trying to come up with Best Practices and Verification Standards.

At the time I’m writing this post, Illinois temporarily allows for remote notarization. This is where you verify the signer’s identity through an audio and video conference. However, I believe this is just a temporary measure, and it could be changed anytime.

How much can a notary loan signing agent in Illinois?

The average annual income of Loan Signing Agent in Illinois is $41,573. The income typically ranges between $26,293 to $53,462. Top earning loan signing agents in Illinois are making over $79,756.

As mentioned earlier, you could work on different documents, but the loan signing in the real estate market could be a lucrative niche.

Top 10 Highest Paying Cities for Loan Signing Agents in Illinois

| City | Annual Salary |

|---|---|

| Round Lake Beach | $51,918 |

| Joliet | $49,286 |

| Champaign | $47,857 |

| Aurora | $47,024 |

| Chicago | $46,536 |

| Rockford | $45,827 |

| Bloomington | $45,682 |

| Naperville | $45,158 |

| Peoria | $44,964 |

| Elgin | $44,800 |

Can you make over $10,000/month as a loan signing agent? Be sure to check out our notary earning guide. You’ll find a case study where a loan signing agent has built her business to such a successful figure.

source: ZipRecruiter – March 11, 2022

Is there demand for notary loan signing agent in Illinois?

As long as people are obtaining mortgages or refinancing their homes, there would be a demand for notary loan signing agents in Illinois.

All originated mortgages in Illinois

| YEAR | All originated mortgages |

|---|---|

| 2017 | 265,490 |

| 2016 | 317,597 |

| 2015 | 284,551 |

| 2014 | 232,557 |

| 2013 | 344,172 |

| 2012 | 424,748 |

| 2011 | 319,004 |

| 2010 | 378,335 |

| 2009 | 432,707 |

| 2008 | 339,543 |

| 2007 | 470,592 |

Source: Consumer Financial Protection Bureau – Home Mortgage Disclosure Act (HMDA) (April 17, 2020)

Furthermore, some states are “Attorney states,” which means only an attorney can handle the closing paperwork. Whereas, others are “Escrow States” where a loan signing agent can do the work.

According to the First American Title, Illinois is a not an “Attorney State,” which is good news if you are interested in starting a notary loan signing business.

What education do you need to become a Illinois notary public?

There is no official education requirement to become a notary public in Illinois. However, it would be extremely helpful to learn about the proper notary act.

The first thing you could do is to read over the “Illinois Notary Public Handbook.” (You’ll find its link at the reference section at the end of this post.)

This is a 31-pages guide which covers:

- ILLINOIS NOTARY PUBLIC ACT

- General Provisions

- Appointment Provisions

- Duties-Fees-Authority

- Change of Name or Move from County

- Reappointment as a Notary Public

- Notarial Acts and Forms

- Liability and Revocation

- Repealer and Effective Date

- APPLICATION FOR COMMISSION AS A NOTARY PUBLIC

- Avoiding Processing Delays

- Reminders for Completing Your Appointment

- Notaryʼs Responsibility

- FREQUENTLY ASKED QUESTIONS

- Notary Appointment Procedure

- Performing Notarizations

- Notarial Records

- Notarization Procedures/Rules

- Non-Resident Commissions

- Miscellaneous Questions

- COUNTY CLERKS

If you want to succeed in the loan signing industry, you must check out this loan system training program. If you review the testimonials of his students, you’ll be amazed at how the notary career changes their life after they learned from Mark Wills. (**)

Is there a exam to become a notary in Illinois?

No, there is no examination requirement to become a notary public in Illinois.

How much does it cost to become a notary loan signing agent in Illinois?

It costs approximately $117 to become a notary loan signing agent in Illinois.

Here’s the breakdown:

- Application fee ($10)

- Notary Bond with E&O coverage ($75)

- Notary seal ($17)

- Business journal ($15)

There could be other expenses involved, such as travel expenses, printer and other business supplies.

How long does it take to become a notary signing agent in Illinois?

Assume all required documents and payment are in good order, then I expect it should take around 3 to 4 weeks to to become a notary loan signing agent in Illinois.

Can a felon be a notary loan signing agent in Illinois?

Having a conviction for a felony may impact the application to become a notary loan signing agent in Illinois. The Illinois Secretary of State needs to make sure that you are a person with credibility, truthfulness, and integrity to fulfill the responsibilities of the position.

Therefore, they would reject application for anyone who committed a felony or applicant who have their notary public appointment revoked or suspended during the past 10 years.

On the Notary Public application, you need to take an oath that you have never convicted a felony. But if you have any doubt, the best would be to contact the IL Secretary of State for clarification.

How to renew the notary public certificate in Illinois?

You are required to renew the notary commission every four years. To do so, you need to fill out the Form 171.9. That’s basically the same Notary Public Application that you filled out initially.

The IL Secretary of State will notify you 60 days before your current notary appointment expire. To avoid an interrupted business period, don’t wait too close to the last minute.

Once again, you’ll need to get a $5,000 surety bond and pay the filing fee. Upon renewal, you’ll need to get a new notary seal and destroy the old one so that it would not be misused.

Can I notarize for a family member in Illinois?

You must not notarize any documents where you have any financial or beneficial interest in the transaction. Therefore, notarizing a document for any family member could call into question, and such practice should be avoided.

I have more questions about being a notary loan signing agent in Illinois, where could I obtain more details?

You may contact the Illinois Secretary of State:

- 800-252-8980

- Secretary of State Index Department, 111 E. Monroe, Springfield, IL 62756.

Disclaimer: The information in this post is for general information only, and not intend to provide any advice. They are subjected to change without any notice, and not guaranteed to be error-free. Some of the posts on this site may contain views and opinions from individual not related to JCHQ Publishing. They do not necessarily reflect our view or position.

(**) Affiliate Disclosure: Please note that some of the links above are affiliate links, and at no additional cost to you. Our company, JCHQ Publishing will earn a commission if you decide to make a purchase after clicking on the link. Please understand that we include them based on our experience or the research on these companies or products, and we recommend them because they are helpful and useful, not because of the small commissions we make if you decide to buy something through the links. Please do not spend any money on these products unless you feel you need them or that they will help you achieve your goals.

Reference:

- First American Title- Your Guide to Real Estate Customs by State (Source)

- Office of Illinois Secretary of State- Notary Public (Source)

- Illinois Notary Public Handbook (Source)

- Guidance for Remote Notaries and Consumers (Source)

- Notarization Task Force on Best Practices & Verification Standards to Implement Electronic Notarization (Source)

- Salary.com – Notary Signing Agent Salary in Illinois (Source)

- ZipRecruiter – Loan Signing Agent Salary in Illinois (source)

- Consumer Financial Protection Bureau – Home Mortgage Disclosure Act (HMDA) (Source)

- Suretybonds.com – Illinois Notary Bond (Source)

Content of this article is so helpful in me making my decision to become a Illinois Loan Signing Agent.

I’m glad you find this article helpful, Lois. I wish you all the best in the loan signing career.

Thanks so much for the information. My wife and I are ready to work for ourselves and begin our journey as Notary Signing Agents. I understand there’s no test required for agents but is there a course that you recommend or should I just call up a title company to get started.

Best,

Rod

You’re very welcome, Rod. I’m glad that you enjoy it.

I strongly suggest you take a look at the Loan Signing System (LSS) from Mark Wills.

I talked to many loan signing agents and they highly recommended it. It really helped them in put their business on the right track.

Here’s the review. In there, you can find feedback from actual signing agents who took the program. https://realestatecareerhq.com/loan-signing-system-review/