(**) Disclosure: This post may contain affiliate links, meaning RealEstateCareerHQ.com will get a commission if you decide to make a purchase through the links, but at no additional cost to you.

To become a notary loan signing agent in Texas, an applicant need to submit the Appointment Application to the Texas Secretary of State, pay the registration fee, and get the notary stamp and journal.

So what does a loan signing agent do in Texas? When people are getting a mortgage to purchase a house, or they need to refinance their property, there will be loan documents involved. Your role as a notary loan signing agent is to walk through the set of loan documents with the borrower and verify the identity of the signer at the time the signature

Then you would place the notary stamp on the signed documents, and send them back to the escrow company.

But keep in mind that you should NOT be providing legal advice, and you cannot explain the terms of the loan documents to the borrower.

In this guide, you’ll find the steps to become a notary loan signing agent in Texas, income updates. What does it take to work in this profession? And other helpful details about this career.

Note that this guide is for general information only and not to provide any professional advice. Although I’ve tried to put down info as accurate as I could possibly find, you should always refer back to the Texas Secretary of State and the State law.

So let’s go through the notary loan signing career in Texas.

Would you like to learn how to make $75 to $200 per signing appointment? You must check out the Loan Signing System from Mark Wills. (**) This is one of the best training programs for loan signing agents. Many students have achieved remarkable business success after taking this program.

Table of Contents

- 6 Steps to Become a Notary Loan Signing Agent in Texas

- Step 1: Meet the state-eligibility requirement

- Step 2: Purchase a surety bond

- Step 3: Complete the Notary Public Commission Application

- Step 4: Receive the notary public commission certificate

- Step 5: Get the notary business supplies

- Step 6: Become an Online Notary Public

- What do you need to become an online notary public in Texas?

- Online notary public registration

- Video- How to become a notary loan signing agent in Texas?

- How much do notary loan signing agents make in Texas?

- Is there demand for notary loan signing agent in Texas?

- What education do you need to become a Texas notary public?

- Is there a exam to become a notary in Texas?

- How much does it cost to become a notary in Texas?

- How long does it take to become a notary loan signing agent in Texas?

- Can a felon be a notary loan signing agent in Texas?

- How to renew notary in Texas?

- Can I notarize for a family member in Texas?

- I have more questions about being a notary loan signing agent in Texas, where could I obtain more details?

- Video- Texas Notary Fundamentals

6 Steps to Become a Notary Loan Signing Agent in Texas

Step 1: Meet the state-eligibility requirement

- At least 18 years of age

- Legal resident of Texas

- Able to read and write English

Step 2: Purchase a surety bond

The Texas Secretary of State requires you to purchase a $10,000 surety bond. You must get it from a licensed surety such as a notary bonding company, an insurance company, or a notary organization.

Note that the surety bond is to protect those for whom the notary public performs a notarization, but not you as a notary public.

If you need coverage for your professional services, you should consider getting an Error & Omission insurance (E&O).

I just checked with a surety bond issuer. The cost for a bond amount of $10,000 is $50. But this does not include any E&O coverage. If you want to add a $30,000 E&O coverage, then the total cost would be $130. (That already includes the $10,000 bond amount)

Step 3: Complete the Notary Public Commission Application

You need to fill out the Application for Appointment as Texas Notary Public Form 2301. The questions on the application are pretty strict forward—for example, your name, business address, driver license, background questions.

On the form, you’ll need to include the bond number and get an authorized person from the surety company to sign it.

If you paid by cheque or money order, make sure it is payable to the Secretary of State through a U.S bank or financial institution.

Alternatively, you could pay with a credit card by filling out the payment form . But there will be a 2.7% convenience fee.

Once everything is in good order, you may send it to Notary Public Unit, P.O. Box 13375, Austin, Texas 78711-3375 or deliver to James Earl Rudder Office Building, 1019 Brazos Austin, Texas 78701.

Step 4: Receive the notary public commission certificate

Once Texas Secretary approves your application, they will send you the notary public commission certificate through email (notarypubliccommission@sos.texas.gov). Note that they will not send you a physical mail, so be sure to include your email address in the application form.

After you receive the certificate, it’s better to review and confirm all the details are correct. (e.g., your name, county of residence, commission dates).

Step 5: Get the notary business supplies

You may purchase the notary seal from office supplies store. If you do, then usually they would mail it along with your notary public commission certificate.

But make sure that their seal would meet the Texas Secretary’s requirement.

1. A notary public shall provide a seal of office that clearly shows, when embossed, stamped, or printed on a document, the words “Notary Public, State of Texas” around a star of five points, the notary public’s name, and the date the notary public’s commission expires. Notaries public commissioned for the first time on or after January 1, 2016, and notaries public renewing their commissions on or after that date must have their notary ID number on their seal of office. See Section 406.013 of the Texas Government Code as amended by HB 1683 (PDF). The notary public shall authenticate all official acts with the seal of office.

2. The seal may be a circular form not more than two inches in diameter or a rectangular form not more than one inch in width and 2½ inches in length. The seal must have a serrated or milled edge border.

3. The seal must be affixed by a seal press or stamp that embosses or prints a seal that legibly reproduces the required elements of the seal under photographic methods. An indelible inkpad must be used for affixing by a stamp the impression of a seal on an instrument to authenticate the notary public’s official act.

4. Subsection (c) does not apply to an electronically transmitted authenticated document, except that an electronically transmitted authenticated document must legibly reproduce the required elements of the seal.

Quote from Tex. Gov’t. Code Ann. § 406.013

Texas Secretary of States require you to maintain a book of record. Not only it is an essential part of good business practice, but it also acts as proof that you have taken reasonable steps to identify the signer of a document.

Below is the information you should include in your business journal.

A notary public other than a court clerk notarizing instruments for the court shall keep in a book a record of:

(1) the date of each instrument notarized;

(2) the date of the notarization;

(3) the name of the signer, grantor, or maker;

(4) the signer’s, grantor’s, or maker’s residence or alleged residence;

(5) whether the signer, grantor, or maker is personally known by the notary public, was identified by an identification card issued by a governmental agency or a passport issued by the United States, or was introduced to the notary public and, if introduced, the name and residence or alleged residence of the individual introducing the signer, grantor, or maker;

(6) if the instrument is proved by a witness, the residence of the witness, whether the witness is personally known by the notary public or was introduced to the notary public and, if introduced, the name and residence of the individual introducing the witness;

(7) the name and residence of the grantee;

(8) if land is conveyed or charged by the instrument, the name of the original grantee and the county where the land is located; and

(9) a brief description of the instrument.

Tex. Gov’t. Code Ann. § 406.014

Furthermore, you must maintain the record for the longer of the term of the commission in which the notarization occurred; or three years following the date of notarization.

Consider using a permanently bound journal because their pages are more difficult to remove or lose than loose-leaf pages. You may find it at the surety bond company, office supply stores, or through notary organizations.

You must keep both the seal and book record in a locked and secured area, where only you have direct and exclusive control of it. (e.g. a locked drawer or cabinet.)

Step 6: Become an Online Notary Public

One thing I really like about this industry in Texas is the availability of Online Notary. Doing so could bring you great convenience to streamline your notary practice.

Rather than meeting the signer in physically at the time of the notarization, being an online notary public allows you to do so remotely using an audio-visual conference.

Not only that, this is a lot more convenient for record-keeping and delivery of completed documents, but less paper usage is good for the environment too.

To become an online notary public, you are required to obtain a verifiable X.509 compliant digital certificate. It would include your electronic signature. You will also need to provide a copy of your electronic seal. The acceptable file format could be JPEG, BMP, PNG, or TIF.

What do you need to become an online notary public in Texas?

As part of the standard procedure for an online notary public, you’ll need to:

- Record the audio-visual meeting

- Get a digital signature from a third-party provider which complies with the digital certificate requirement

- An electronic seal that contains

- the words “Notary Public, State of Texas” around a star of five points; Your name; Your notary public’s identifying #; and the date that your notary public’s commission expires.

- The seal is required to have a serrated or milled edge border.

- If the seal is in a circular form, then its diameter cannot be more than two inches

- If it is in a rectangular form, then it cannot be more than one inch in width and 2-1/2 inches in length.

Online notary public registration

To register, you’ll need to fill out the online application. The submission process is similar to the one we just went through. But this time, you are required to provide:

- The compliant digital certificate

- An image file of your electronic seal. (JPEG, BMP, PNG, or TIF)

- Registration fee of $50

Note that you must already be registered as a notary public before you could become an online notary.

Video- How to become a notary loan signing agent in Texas?

How much do notary loan signing agents make in Texas?

The average annual income of Notary Loan Signing Agents in Texas is $88,649. The income typically ranges between $34,930 to $152,658. Top earning loan signing agents in Texas are making over $153,090

As a notary loan signing agent, you could work on different documents, but the loan signing in the real estate market could be a lucrative niche.

Top 10 Highest Paying Cities for Loan Signing Agents in Texas

| City | Annual Salary |

|---|---|

| Midland | $124,365 |

| Garland | $113,324 |

| Abilene | $110,850 |

| Fort Worth | $108,324 |

| Arlington | $108,097 |

| Dallas | $108,066 |

| Odessa | $107,500 |

| Austin | $106,675 |

| College Station | $105,991 |

| Round Rock | $105,192 |

Source: ZipRecruiter – July 25, 2022

Can you make over $10,000/month as a loan signing agent? Be sure to check out our notary earning guide. You’ll find a case study where a loan signing agent has built her business to such a successful figure.

Is there demand for notary loan signing agent in Texas?

As long as people are obtaining mortgages or refinancing their homes, there would be a demand for notary loan signing agents in Texas.

All originated mortgages in Texas

| YEAR | All originated mortgages |

|---|---|

| 2017 | 559,492 |

| 2016 | 613,325 |

| 2015 | 557,266 |

| 2014 | 484,747 |

| 2013 | 611,180 |

| 2012 | 594,151 |

| 2011 | 466,338 |

| 2010 | 476,566 |

| 2009 | 520,422 |

| 2008 | 473,701 |

| 2007 | 653,817 |

Source: Consumer Financial Protection Bureau – Home Mortgage Disclosure Act (HMDA) (April 17, 2020)

Furthermore, some states are “Attorney states,” which means only an attorney can handle the closing paperwork. Whereas, others are “Escrow States” where a loan signing agent can do the work.

According to the First American Title, Texas is a not an “Attorney State,” which is good news if you are interested in starting a notary loan signing business.

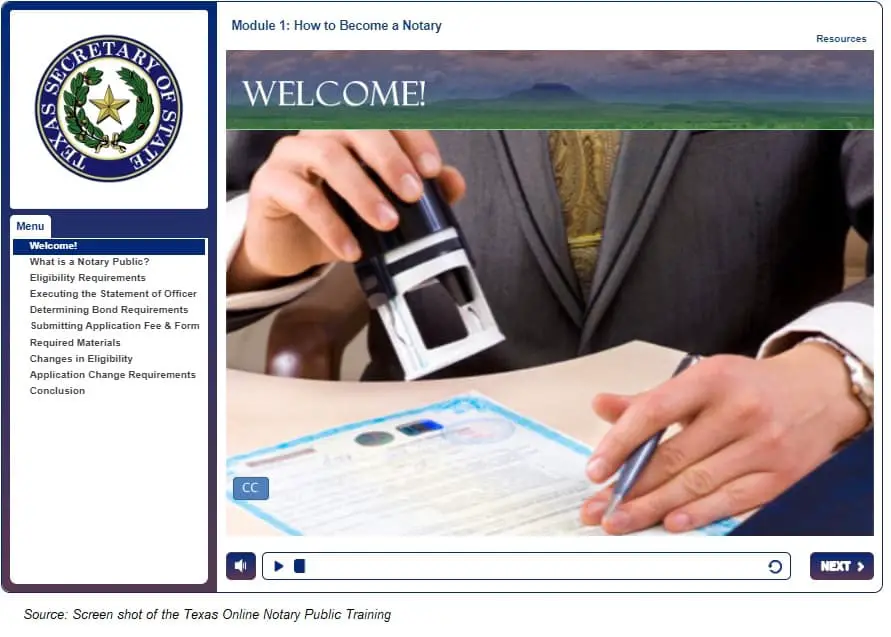

What education do you need to become a Texas notary public?

There is no official education requirement to become a notary public in Texas. However, the TX Secretary of State has a free online training program that would be extremely helpful to you.

It consists of 5 modules:

- How to Become a Notary?

- Types of Notarial Acts

- How to Perform a Notarization?

- How to Apply Fees?

- Avoiding Prohibited Acts

After each module, there would be a short quiz to test your notary knowledge. Once you complete the entire training program, you could get a certificate of completion.

Is there a exam to become a notary in Texas?

No, there is no examination requirement to become a notary public in Texas.

How much does it cost to become a notary in Texas?

It costs approximately $183 to become a notary loan signing agent in Texas. Here’s the breakdown:

- Application fee ($21)

- Notary Bond with E&O coverage ($130)

- Notary seal ($17)

- Business journal ($15)

There could be other expenses involved, such as travel expenses, and other business supplies.

Also, if you want to become an online notary public, there could be an additional registration fee, expenses for digital signature and electronic stamp.

How long does it take to become a notary loan signing agent in Texas?

It takes 10 to 14 business days to become a notary public in Texas. After the Texas Secretary of State to approve the application, they will email you the Texas Notary Public Commission Certificate.

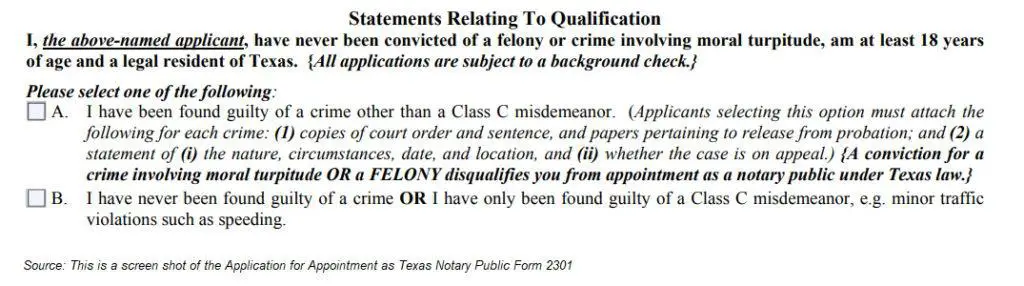

Can a felon be a notary loan signing agent in Texas?

Having a conviction for a felony may impact the application to become a notary loan signing agent in Texas. The Texas Secretary of State needs to make sure that you are a person with credibility, truthfulness, and integrity to fulfill the responsibilities of the position.

Therefore, they would reject application for anyone who committed a crime involving moral turpitude or a felony.

Having a felony does not necessarily mean your application will automatically be declined. It depends on the severity and nature of the conviction. The Secretary of State would review it on a case-by-case basis.

How to renew notary in Texas?

You need to renew the notary commission every four years. To do so, you must submit the Form 2301 within 90 days that your current notary commission expire. But to avoid an interrupted business period, don’t wait to close to the last minute.

The online notary public commission would have the same expiry date.

Once again, you’ll need to get a $10,000 surety bond and pay the $21 filing fee. Upon renewal, you’ll need to get a new notary seal and destroy the old one so that it would not be misused.

Can I notarize for a family member in Texas?

You must not notarize any documents where you have any financial or beneficial interest in the transaction. Therefore, notarizing a document for any family member could call into question, and such practice should be avoided.

I have more questions about being a notary loan signing agent in Texas, where could I obtain more details?

You may contact the Texas Secretary of State, Notary Public Unit:

- Phone: (512) 463-5705

- FAX: (512) 463-5255

- Notary Public Unit, Secretary of State, P.O. Box 13375, Austin, Texas 78711-3375

Video- Texas Notary Fundamentals

This is a video recorded at the 2019 Notary Public Conference hosted in Austin, Texas by the Texas Secretary of State. The speaker, Kathlenn Butler, is an experienced notary with decades of experience in the field.

In there, she did an incredible job covering the fundamentals of being a notary public. (i.e. Standard of professional conduct, authorized duties, oaths and affirmations, and many more.) Before you take on any signing orders, it’s better to review this video.

Career tips from Calvin Darville, an incredibly successful loan signing agent

” I would advise them to make sure they get training before entering the industry. I heard countless horror stories about the errors that incompetent notaries make.

I’ve even experienced some myself in my short span as a signing service owner. If a loan package isn’t executed correctly, it could literally blow a million-dollar deal. So my advice is definitely to get the proper training to limit errors.”

– Calvin Darville, President at Comfortable Closings

Here’s an interview I did with Calvin, where he shared his journey from being an Injured Football Player to a Successful Notary Loan Signing Agent. Be sure to check it out.

Jacob: “Here’s a review of the Loan Signing System training. In there, you will find out the course curriculum, costs, and student ratings from different sources. I have talked to several notary signing agents who took the course. They will share with you their first-hand thoughts about the LSS.“

Disclaimer: The information in this post is for general information only, and not intend to provide any advice. They are subjected to change without any notice, and not guaranteed to be error-free. Some of the posts on this site may contain views and opinions from individual not related to JCHQ Publishing. They do not necessarily reflect our view or position.

(**) Affiliate Disclosure: Please note that some of the links above are affiliate links, and at no additional cost to you. Our company, JCHQ Publishing will earn a commission if you decide to make a purchase after clicking on the link. Please understand that we include them based on our experience or the research on these companies or products, and we recommend them because they are helpful and useful, not because of the small commissions we make if you decide to buy something through the links. Please do not spend any money on these products unless you feel you need them or that they will help you achieve your goals.

Reference:

- First American Title- Your Guide to Real Estate Customs by State (Source)

- Texas Secretary of State – Notary Public (Source)

- Texas Notary Public Educational Information (Source)

- Online Notary Public Commissioning System (source)

- Salary.com – Notary Signing Agent Salary in Texas (source)

- ZipRecruiter – Loan Signing Agent Salary in Texas (source)

- Consumer Financial Protection Bureau – Home Mortgage Disclosure Act (HMDA) (Source)

- Suretybonds.com – Texas Notary Bond (Source)

I have had a 20+yr professional career in Right-Of-Way &and energy industry. I am presently a Notary & interested in Notary signing agent and home inspection. Thanks

Hi Michael, thanks for your comment. You may want to check out the “Loan System System” from Mark Wills.

I talked to many signing agents, they highly rated this training program. Here’s a review I wrote about it. https://realestatecareerhq.com/loan-signing-system-review/

As for being a home inspector, here’s a link I found on the Texas Real Estate Commission website.

https://www.trec.texas.gov/become-licensed/inspector

Hope this will be helpful to you.

On Mark Wills Course link – Sometimes he uses LSS for Loan Signing System and sometimes LLS….is this a repeating typo? Or does LLS stand for something different? thanks

Hi Janie, to my understanding, it should be LSS as this is the acronym for Loan Signing System. I’m guessing LLS is just a typo.