(**) Disclosure: This post may contain affiliate links, meaning RealEstateCareerHQ.com will get a commission if you decide to make a purchase through the links, but at no additional cost to you.

To become a notary signing agent in Maryland, an applicant must submit a Notary Public application to the Maryland Notary Division, complete the Notary Public Course of Study and Examination, pay the $11 filing fee, purchase the notary seal and obtain the Title Insurance Producer Independent Contractors (TIPIC) license.

Although you could work on different types of documents, the loan signing business in the real estate market seems to be a lucrative niche.

So what does a loan signing agent do? When people are getting a mortgage to purchase a house, or they need to refinance their property, there will be loan documents involved. Your role as a notary loan signing agent is to walk through the set of loan documents with the borrower and witness them in signing the paperwork.

You would also need to verify the identity of the signers, place the notary stamp on the signed documents, then send them back to the signing services company or closing attorney.

But keep in mind that you should NOT be providing legal advice, and you cannot explain the terms of the loan documents to the borrower.

In this guide, you’ll learn the steps to become a notary signing agent in Maryland, income updates, and FAQ about this profession. I will also go over a case study where “a signing agent went from carrying years of credit card debts to earning 5-figures every month.”

But before we start, I want to give a brief disclaimer. This post is not intended as legal advice or state/federal notary public training. It is for general information only. Please check with your state to be sure that loan signing agents are utilized in the closing process. Always follow your state’s notary laws and best practices.

Would you like to learn how to make $75 to $200 per signing appointment? You must check out the Loan Signing System from Mark Wills. (**) This is one of the best training programs for loan signing agents. Many students have achieved remarkable business success after taking this program.

7 Steps to Become a Notary Loan Signing Agent in Maryland

Step 1: Meet the basic requirement

- At least 18 years of age

- Living or working in Maryland

- Good character with integrity and abilities

Step 2: Complete the Maryland Notary Education and Exam

According to the Handbook of Maryland Notary Public, as of October 1, 2021, all new notary commission applicants would need to complete a notary course and pass an examination. As for renewal applicants, they must complete a Course of Study.

The National Notary Association is the approved education provider. I just checked their curriculum, it covers:

- Details on the application process, the role and responsibilities of a Maryland Notary Public.

- 5 steps in the notarization process for traditional and remote notarizations.

- What are the notarial acts that you can perform?

- What to do during unique circumstances?

- Examples of Notary misconduct, penalties involved and ways to protect your Notary practice against liability and misconduct.

The fee is $59.

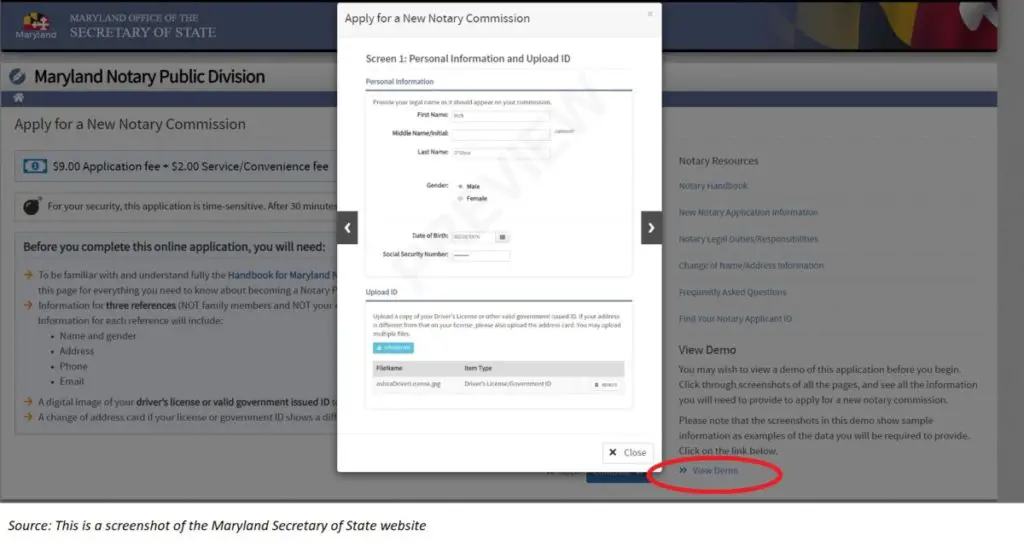

Step 3: Submit the notary commission application to the Maryland Notary Public Division

The Maryland Secretary of State is the office that grants the notary commission to applicants and maintains records of all notaries public in Maryland.

You need to fill out an notary commission application on the Maryland Secretary of State website. Most of the questions on the application are pretty strict forward—for example, your name, business address, background info.

In one of the questions, it will ask you to select the Legislative District. This is where the notary commission will be sent to, and it is determined by your home or work address. If you are unsure, you could find out at mdelect.net.

Also, you need to upload a copy of your driver’s license or a valid government issued ID, certificates of education completion and exam passing.

There is a $9 application fee and a $2 convenience fee. They can be paid by a credit card. Make sure the name on the application will be the same as when you are notarizing documents.

The MD Secretary of State needs to ensure you are a trustworthy person

As part of the application process, you must provide three references who could attest to your character. You need to include their name, gender, address, phone, and email. But keep in mind that they cannot be a family member or your employer. Residents of Maryland are preferable.

Whenever I put down someone as a reference, I would make sure they are okay with it and expect to be contacted.

If you are unsure how to complete the online form, they have a demo which provides you step-by-step instruction.

By the way, the online application is time-sensitive. It will log you out if after 30 minutes of activity, and the info you entered will be lost.

Step 4: Appear at the Clerk of the Circuit Court

Then the Notary Division will forward your application to be reviewed by the State Senator. Since they may contact your references, so make sure the info you put in is correct.

If your application is approved, the MD Office of the Secretary of State will issue the notary commission. They will forward it to the Clerk of the Circuit Court in the county in which you reside.

The Notary Division will notify you through email. The State Senator may also mail you a postcard regarding it. You will need to visit the Clerk’s Office to take the oath of office within 30 days.

There will be a fee of $11 to the Clerk. Some office may only accept cash, so make sure to bring the exact change.

After you receive the Notary Commission Certificate, you should review and make sure all the details are correct. (e.g., your name, county of residence, commission dates).

Step 5: Get a notary seal

To start the notary signing business in Maryland, you must have a notary seal. This helps you to include specific info in every document so you won’t leave out any required details.

You may purchase the notary seal from office supplies store. Also, its design must comply with the regulatory rules.

The official stamp of a notary public shall include:

Quote from Handbook for Maryland Notaries Public

• The name of the notary public as it appears on the notary’s commission;

• The words “Notary Public”; and

• County (or City of Baltimore) in which the notary was commissioned. For notaries public who reside in Maryland, this will more than likely be the county (or Baltimore City) of residence. For notaries public who reside out of state, this will always be the county (or Baltimore) where the notary public was commissioned.

• Expiration date of the notary’s commission, unless the expiration date is part of the notarial certificate or affixed to or logically associated with the record being notarized;

You must keep the notary seal in a locked and secured area, where only you have direct and exclusive control of it. (e.g. a locked drawer or cabinet.)

Step 6: Maintain a notary journal

As a notary signing agent in Maryland, the State law requires you to keep a fair register of all official acts.

Maintaining a good record of your notary acts is an essential part of good business practice. It could serve as proof that you have taken reasonable steps to identify the signer of a document. That is why many notaries would keep a business journal.

It is better to have one bounded with pre-printed pages. You may find it at stationery, office supply stores, or through notary associations.

A notary public must maintain a journal, previously known as a fair register, of all notarial acts. Each notary public shall maintain a journal which chronicles each the notary public’s notarial acts. The notary must enter each notarization into their journal, even if a notary public notarizes for the same people on a regular basis. The notary public shall retain the journal for 10 years after the performance of the last notarial act.

Quote from Handbook for Maryland Notaries Public – Part VI (NOTARY RECORDKEEPING)

Step 7: Obtain a Title Insurance Producer License

To become a loan signing agent in Maryland, you will need more than just the notary commission. You also need the Title Insurance Producer Independent Contractors (TIPIC) license.

This is because the state requires another layer of protection for consumers against the improper conduct and negligence of title insurance producers.

To obtain such a license, you must complete the required pre-licensing education, pass an exam, submit the application, and pay the registration fee. You may check with the Maryland Insurance Administration for more details. I will also leave their link in the reference section at the end of the post.

Remote notarization in Maryland

One thing I really like about this industry in Maryland is the option for notary to work digitally. Doing so could bring you great convenience to streamline your notary practice.

But let me first explain the difference between “Electronic notarization” and “Remote notarization.”

“Electronic notarization,” sometimes known as “e-notary,” is where you meet the signer in person, but the documents are signed and notarized digitally.

On the other hand, “Remote notarization” is also being done digitally. But you are not physically present with the signer. Instead, you would verify their the signer’s identity through video and audio conference.

As I’m writing this post, the latest update is that both electronic and remote notarization are allowed in Maryland. You should confirm with the Maryland Secretary of State before proceeding any remote notarial acts.

But keep in mind that when performing a remote notarial act, you are still required to be physically located in Maryland.

How to become a remote notary in Maryland?

To become a remote notary in Maryland, you must first be registered as a notary public in the state. Then you need to complete the Remote Notary Notification Form. There is no fee to apply.

Furthermore, you would need an electronic platform to conduct the e-notarization. This may include fingerprinting, digital signing pads, cloud-based and encryption processes.

According to the Maryland Notary Public Handbook, when performing remote notarization, you cannot use technology that is primarily designed for video conferencing (such as Skype, Microsoft Teams, Google Meet, etc.)

So make sure to choose an authorized vendor that complies with the regulatory rules. It must offer a high level of reliability and security to a notarized document.

When you are filling out the remote notary notification form, you also need to provide the technology vendor’s name. Here is a list of technology companies I found on the Maryland Secretary of States website:

- Digital Delivery, Inc.

- DocVerify

- eNotaryLog

- LenderClose

- Notarize

- NotaryCam

- Pavaso

- Safedocs

- SIGNiX

- Simply Secure Sign

- World Wide Notary

You may also contact local associations for more info about technology vendors. Here are a few for your reference.

- National Notary Association

- Maryland Bankers Association

- Maryland Realtors Association

- Maryland Land Title Association

A real life story of a successful notary public and loan signing agent

What’s a better way to learn about the business than learning from someone actually working in it! Here is an exclusive interview I conducted with Luisa Cook. She is a successful Certified Notary Public and Loan Signing Agent.

In there, she shared her journey and business strategy in running a notary and signing business. I’m sure this could help you to understand more about the notary career.

How much do notary loan signing agents make in Maryland?

The average annual income of Loan Signing Agent in Maryland is $47,347. The income typically ranges between $30,207 to $61,422. Top earning loan signing agents in Maryland are making over $91,629.

Top 10 Highest Paying Cities for Loan Signing Agents in Maryland

| City | Annual Salary |

|---|---|

| Waldorf | $54,233 |

| Baltimore | $52,253 |

| Frederick | $50,981 |

| Salisbury | $49,547 |

| Germantown | $48,013 |

| Columbia | $47,282 |

| Silver Spring | $47,157 |

| Ellicott City | $46,392 |

| Glen Burnie | $45,933 |

| Hagerstown | $44,530 |

As mentioned earlier, you could work on different documents, but the loan signing in the real estate market could be a lucrative niche. Later on in the post, you will learn the journey where “a lady went from carrying years of credit card debts to earning 5-figures every month.”

Can you make over $10,000/month as a loan signing agent? Be sure to check out our notary earning guide. You’ll find a case study where a loan signing agent has built her business to such a successful figure.

Source: ZipRecruiter – March 12, 2022

Is there demand for notary loan signing agent in Maryland?

As long as people are obtaining mortgages or refinancing their homes, there would be a demand for loan signing agents.

All originated mortgages in Maryland

| YEAR | Originated Mortgages in Maryland |

|---|---|

| 2017 | 144,610 |

| 2016 | 171,556 |

| 2015 | 152,541 |

| 2014 | 118,429 |

| 2013 | 187,825 |

| 2012 | 219,387 |

| 2011 | 159,707 |

| 2010 | 182,102 |

| 2009 | 210,794 |

| 2008 | 162,234 |

| 2007 | 261,984 |

Source: Consumer Financial Protection Bureau – Home Mortgage Disclosure Act (HMDA) (July 14, 2020)

Some states are “Attorney States,” which means only attorneys can coordinate the closing paperwork. Whereas, others are “Escrow States” where escrow companies would handle the mortgage closing.

According to the First American Title, Maryland is a an “Attorney State.” Here is a post that talks more about the differences escrow states and attorney states. And how would it impact the loan signing business?

Furthermore, as I’m browsing on the MD Notary Database, there are 65,796 active notaries. But I also see that there are only 1,472 registered as a remote online notary. To gain a competitive edge in your notary business, becoming a RON is certainly worth considering.

If you want to succeed in the loan signing industry, you must check out this loan system training program. If you review the testimonials of his students, you’ll be amazed at how the notary career changes their life after they learned from Mark Wills. (**)

What education do you need to become a Maryland notary signing agent?

By October 1, 2021, all new notary commission applicants would need to complete the Notary Public Course of Study and Examination.

A good resource to learn about this profession is the “Handbook for Maryland Notaries Public.” It is a 48 pages guide which covers the following topics:

- APPLYING, RENEWING, COMMISSIONING, NAME AND ADDRESS CHANGES

- ENFORCEMENT

- POWERS, AUTHORITY AND JURISDICTION, CONFLICT OF INTEREST AND OTHER RESTRICTIONS IDENTIFICATION OF PERSON APPEARING BEFORE THE NOTARY AND COMPETENCE

- NOTARY PUBLIC’S OFFICIAL STAMP

- NOTARY RECORDKEEPING

- NOTARIAL CERTIFICATES

- HOW TO PERFORM THE DIFFERENT NOTARIAL ACTS

- ELECTRONIC NOTARIZATIONS

- REMOTE NOTARIZATION

- CHARGES AND FEES

- PUBLIC INFORMATION

- REMOTE ONLINE NOTARY VENDOR QUALIFICATIONS

- DEFINITIONS

- FREQUENTLY ASKED QUESTIONS

- CLERKS OF THE CIRCUIT COURT IN MARYLAND

- LOCAL ELECTION BOARDS

How much does it cost to become a notary in Maryland?

It costs approximately $113 to become a notary in Maryland.

Here’s a breakdown of the costs to start a notary signing business

| Notary Application | $11 |

| Clerk Registration Fee | $11 |

| Notary Stamp | $17 |

| Journal | $15 |

| Notary Course and Exam | $59 |

There could be other expenses involved, E&O insurance, travel expenses, car maintenance, auto insurance, remote notary technology, laptop and other business supplies.

If you want to become a loan signing agent in Maryland, you need to account for the pre-licensing course, exam, and license fees.

Can a felon be a notary signing agent in Maryland?

Having a conviction for a felony may impact the application to become a notary signing agent in Maryland. The MD Secretary of State needs to make sure that you are a person with credibility, truthfulness, and integrity to fulfill the responsibilities of the position.

But having a felony does not necessarily mean your application will automatically be declined. It depends on the severity and nature of the conviction. The Maryland Secretary of State would review it on a case-by-case basis.

As I’m reading the Notary Public Application, it has the following questions:

Have you ever had a Notary Public Commission revoked in any state?

Have you ever been convicted of a crime other than a minor traffic violation?

Have you ever had any civil judgments in the last 7 years, satisfied or not?A thorough background check is conducted. If yes to any or all questions, please explain the nature of crime and/or civil

Quote from Maryland Notary Public Application

judgment and the date of occurrence, on a separate sheet of paper, and attach to this application.

If you answer ‘yes’ to any of the above questions, you will need to explain the nature of crime and/or civil judgment and the date of occurrence about the offense. Also, the Maryland Secretary of State would conduct a thorough background check on you.

How long does it take to become a notary signing agent in Maryland?

That would depend on whether the MD Secretary of State needs to perform a criminal background check and how quickly you register the notary commission at the Clerk office.

So my guess is it should only take a few weeks to become a notary signing agent in Maryland.

How to renew notary commission in Maryland?

To renew the notary commission in Maryland, you need to reapply every 5 years. You can do so within 60 days of the expiration date of your current commission. It can be done on the Maryland Secretary of State website.

Once they approve your renewal application, they will notify you. Then you need to appear in the Clerk of the Court within 30 days to pay for the $9 renewal fee.

By then, you would need to get a notary seal with a new expiry date.

To avoid an interrupted business period, begin the renewal process in advance. Don’t wait till your current notary commission is expired.

Can I notarize for a family member in Maryland?

You must not notarize any documents where you have any financial or beneficial interest in the transaction. Therefore, notarizing a document for any family member could call into question, and such practice should be avoided.

I have more questions about being a notary loan signing agent in Maryland, where could I obtain more details?

You may contact the Maryland Notary Division:

- Email: dlnotary_sos@maryland.gov

- Tel: (410) 974-5520 / Fax: (410) 974-5527

- Work hours: 8:00am-4:00pm

- Address: 16 Francis Street, Annapolis, MD 21401

Case Study of a Successful Loan Signing Agent – From Years of Credit Card Debts to Making Over 5-Figures Every Month

To help you better understand the loan signing business’s potential in Maryland, I just watched an inspiring 40 minutes interview from Mark Wills, a top-notch notary coach, to one of his students, Donyale Mills.

But before we start, I want to remind you that this post is not intended as legal advice or state/federal notary public training. It is for general information only. Please check with your state to be sure that loan signing agents are utilized in the closing process. Always follow your state’s notary laws and best practices.

This is why Donyale started in the loan signing business

Donyale used to have another full-time job. Like many people, she was living paycheque to paycheque and had a considerable amount of credit card debts. She was frustrated about this financial situation for years. Not able to pay off the debts really gave her a sense of failure.

Rather than being pessimistic and whined about it, Donyale had the desire to improve her financial well-being. She came across Mark Will’s Loan Signing System and decided to give it a try.

Slow and steady win the race

Unlike many other get-rich-quick schemes, her journey is a lot more real and believable. Her success did not come overnight. It took her two years of hard work to reach over the $10,000/month milestone.

In the first six months of being a loan signing agent, she made less than $2,000 per month, which was an okay amount, given that this was only a side hustle for her.

Sometimes, success requires full commitment

After six months, Donyale decided to quit her job and went full-time in the loan signing business. I was quite surprised when I heard that part in their interview.

Although Donyale did make some income as a signing agent in the first few months, frankly, this was not an extraordinary result. Besides, her previous job should be paying more than her loan signing business.

However, Donyale explained that she did not like the idea of having a plan B. She rather burns all the bridges, then commits fully in making the notary signing business work.

I am a conservative person, so I cannot foresee myself taking such a chance if I were her. But I truly admire her determination, faith, and courage.

Is the glass half-empty or half-full?

In the next six months, Donyale’s monthly earning increased to $2,500 to $3,500. Although some readers might think this wasn’t a satisfying result after a year of hard work, Donyale was happy to see her income was increasing.

Even when she saw other peers making a lot more than her, she wasn’t jealous of their result, and she did not get discouraged. Instead, she found it as a reassurance that one day she could achieve the same result.

Once again, I truly kudos to her in being a real fighter.

Change in tactic, change in result.

This is just a stock photo and not a photo of Donyale

Like the old saying, you can’t expect a different result by doing the same thing. In the first year, the majority of Donyale’s business was from signing services companies. She confirmed that 75% of her loan signing works were from them.

After a year of loan signing on the road, she felt sufficient experience, knowledge, and confidence. Therefore, she decided to get business directly from attorneys and title offices. Going direct allows you to eliminate the middlemen, thus, earn a bigger chunk of the signing fee per assignment.

Despite her not having any prior sales experience, she held up the courage to start approaching more title offices. In the video, she also confirmed that no sales experience is necessary. After all, she does provide a valuable service to the title companies, so there is no need to be a pushy salesperson.

While many people might fear they would face a lot of harsh rejection, Donyale shared that she did not receive a straight “no” from any companies. All of them were acting professionally and nicely. Donyale would leave them her contact information so that they would contact her when there is a need for signing services.

Due to her persistence and dedication in building a relationship, her hard work is eventually rewarded. Her income has been increasing rapidly.

In the last six months, which was one and a half years into the business, she already made close to $50,000. This six-months of earning was already more than her full-year of previous employment’s income.

As she was doing the interview, she was at the two-year mark in the loan signing business. That month alone, she had made an incredible of $11,100! And the month wasn’t even over yet!

Every journey is different. But perseverance, effort, and consistency can win the race. I hope this helps you to understand the potential in this business.

If you are reading up to this point, I bet you must be interested in the notary signing profession. But why reinvent the wheel when there is a proven system that works? Many students had great success following the Loan Signing System (LSS) from Mark Wills. You may click here to check it out yourself. (**)

Disclaimer: The information in this post is for general information only, and not intend to provide any advice. They are subjected to change without any notice, and not guaranteed to be error-free. Some of the posts on this site may contain views and opinions from individual not related to JCHQ Publishing. They do not necessarily reflect our view or position.

(**) Affiliate Disclosure: Please note that some of the links above are affiliate links, and at no additional cost to you. Our company, JCHQ Publishing will earn a commission if you decide to make a purchase after clicking on the link. Please understand that we include them based on our experience or the research on these companies or products, and we recommend them because they are helpful and useful, not because of the small commissions we make if you decide to buy something through the links. Please do not spend any money on these products unless you feel you need them or that they will help you achieve your goals.

Reference:

- First American Title- Your Guide to Real Estate Customs by State (source)

- Maryland Secretary of State – Notary Division (source)

- Maryland Notary Public Application (source)

- Handbook for Maryland Notaries Public (source)

- Maryland Title Insurance Producer (source)

- National Notary Association – MD House Bill 1470 (source)

- Salary.com – Notary Signing Agent Salary in Maryland (source)

- ZipRecruiter – Loan Signing Agent Salary in Maryland (source)

- Consumer Financial Protection Bureau – Home Mortgage Disclosure Act (HMDA) (source)

Do i need to pass the courses on line and how much does it cost .How should i be trained to get ready for the exam.

Hi Abbas, yes, according to the Maryland Notary Public Handbook:

“Effective October 1, 2021: all new notary applicants, must complete a Course of Study and pass an examination; all renewal applicants, must complete a Course of Study”

NNA is the approved education provider. I just checked on their site and the course fee is $59.

If you want to become a loan signing agent, you also need to obtain the Title Insurance Producer Independent Contractors (TIPIC) license.

Furthermore, I strongly suggest you take a look at the Loan Signing System (LSS) from Mark Wills. I talked to many loan signing agents and they highly recommended it. It really helped them to put their business on the right track.

Here’s the review. In there, you can find feedback from actual signing agents who took the program. I hope this helps.