(**) Disclosure: This post may contain affiliate links, meaning RealEstateCareerHQ.com will get a commission if you decide to make a purchase through the links, but at no additional cost to you.

To become a notary signing agent in Pennsylvania, an applicant must meet the state-eligibility requirement, submit a notary public online application to the Pennsylvania Department of State, complete the 3-hour notary course, pass the exam, pay the filing fee, purchase the notary stamp and journal.

So what does a loan signing agent do in Pennsylvania? When people are getting a mortgage to purchase a house, or they need to refinance their property, there will be loan documents involved. Your role as a notary loan signing agent is to walk through the set of loan documents with the borrower and witness them in signing the paperwork.

You would also need to verify the identity of the signers, place the notary stamp on the signed documents, then send them back to the escrow company.

But keep in mind that you should NOT be providing legal advice, and you cannot explain the terms of the loan documents to the borrower.

In this guide, you’ll find the steps to become a notary loan signing agent in Pennsylvania, income updates, course content, exam and FAQ about this profession.

But that’s not all! You’ll also hear a real-life case study where “A Family Man Earns $4,000/month as a Notary Signing Agent 30 days After Taking the LSS program.” You could find it at the end of the post.

Note that this guide is for general information only and not to provide any professional advice. Although I’ve tried to put down info as accurate as I could possibly find, you should always refer back to the Pennsylvania Department of State and the State law.

Would you like to learn how to make $75 to $200 per signing appointment? You must check out the Loan Signing System from Mark Wills. (**) This is one of the best training programs for loan signing agents. Many students have achieved remarkable business success after taking this program.

8 Steps to Become a Notary Signing Agent in Pennsylvania

Step 1: Meet the basic requirement

- At least 18 years of age

- Citizen or permanent legal resident of the U.S

- Resident of Pennsylvania or employed within this Commonwealth

- Able to read and write English

- Have the honesty, integrity, competence and reliability – (i.e.: no felony, offense involving fraud, dishonesty or deceit)

Step 2: Complete the PA Notary Public Education Course

It is mandatory that you take a 3-hour course from an education provider that is approved by the Pennsylvania Department of State. The purpose is to equip you with the necessary knowledge in becoming a notary signing agent and prepare you for the notary exam.

Here is the list of approved notary education provider in PA:

| PA Notary Education Providers | Learning Options | Price for 3-Hour PA Notary Course |

|---|---|---|

| Pennsylvania Association of Notaries (PAN) | Classroom and online | $99 |

| National Notary Association (NNA) | Online | $214 to $376 (Bundle packages) |

| Online Notary Institute | Online | $49.99 |

| Blue Desk Notary Education | Online | $69 |

| Pennsylvania Automotive Association (PAA) | Online | $119 |

| Huckleberry Notary Bonding Inc. | Online | $134 (Bundle package) |

| American Safety Council – Insurance Division, Inc. | Online | $134 (Bundle package) |

| Notaries Equipment Company | Classroom and online | $79 |

| American Society of Notaries | Online | $40 |

| Notary.net | Online | $29.95 |

| Bucks County Community College | Classroom | $89 |

| Montgomery County Community College | Classroom | N/A |

| Notary Association of Pennsylvania, Co. | Online | $138 to $200 (Bundle packages) |

| Northampton Community College | Classroom | $89 |

| The PA Notary Online Training Course | Online | $99 |

| The Lawrence Institute for Notaries, Ltd. | Classroom and online | $149 |

| Keystone Notary Ed | Online | $26 |

As you could see, the notary courses’ price range varies a lot across different education providers. In addition to the basic course, some offer extra items such as notary business supplies or a surety bond. Therefore, their price could be higher.

Those are the approved schools I found on the PA Department of State website as I’m writing this post. But you should always double-check with them before enrolling. Besides just comparing their prices, looking at students’ reviews could give you a better idea of the course’s quality.

After you complete the PA notary course, most providers allow you to download the “Certificate of Course Completion” from the student portal.

Step 3: Submit the online notary application to the Pennsylvania Department of State

The Pennsylvania Department of State is the office that grants the notary commission to applicants and maintains records of all notaries public in Pennsylvania.

You need to fill out the Online Notary Application. The questions on the application are pretty strict forward—for example, your name, business address, background info.

As part of the application, they may require you to upload the following documents:

- Proof of notary education completion

- Criminal history/notary public/professional/occupational license disciplinary documentation and explanation (only if applicable)

The allowable formats are in .DOC, .DOCX, .JPG, .JPEG, .PDF, .RTF, .TIF or .TIFF format. Note that you cannot save the online application session, so you must have all the required information when you’re applying.

There is a $42 application fee and can be paid by a credit card.

Step 4: Pass the Pennsylvania notary exam

Then you’ll receive an email from Pearson VUE with the exam details in around 4 to 6 weeks. On a side note, Pearson Vue is one of the well-known administers for real estate salespeople and appraisers exams in many states.

On the day of the exam, you must bring two IDs to the testing center. One of them must be photo-bearing – for example, U.S State driver’s license, passport. Just make sure that they are not expired.

The exam fee is $65. It can be paid by credit card or debit card.

There are 30 questions on the test. 25 of them will be scored, while 5 others are pretest items.

Here is the notary exam content outline and weighting

- Obtaining notary commission (4)

- Performing notarial acts (15)

- Managing notary commission (6)

After you write the PA notary exam…

The exam result will be converted into scaled scores range between 0 to 100. The required passing score is 75. Therefore, when you are preparing the exam, you may want to focus more on parts that weigh the most.

Upon passing the exam, it would take around 30 days for the PA Department of State to process your notary commission appointment. Then you’ll receive the Notice of Appointee letter.

If you fail the exam, you may schedule a retake after 24 hours.

Step 5: Purchase a surety bond

The Pennsylvania Department of State requires you to purchase a $10,000 surety bond. You must get it from a licensed surety such as a notary bonding company, an insurance company, or a notary organization. You could search for them online.

Note that the surety bond is to protect those for whom the notary public performs a notarization, but not you as a notary public.

If you need coverage for your professional services, you should consider getting an Error & Omission insurance (E&O).

I just checked with a surety bond issuer. Below is their premium structure.

| Coverage | Premium | |

| $10,000 bond without E&O coverage | $50 | |

| $10,000 bond with $10,000 E&O coverage | $90 | |

| $10,000 bond with $20,000 E&O coverage | $110 | |

| $10,000 bond with $30,000 E&O coverage | $130 |

Step 6: File bond and take an oath of office

Your next step is to bring the surety bond to the county clerk in the county that you reside. In there, you will take an oath of office. The county clerk will certify the bond and oath for filing and record.

You are also required to register your signature with the prothonotary of your county within 45 days.

Step 7: Review the notary certificate of appointment

Once everything is in good order, the recorder of deeds will send you the notary commission certificate and a wallet card. You should review and make sure all the details are correct. (e.g., your name, county of residence, commission dates).

To ensure your notary commission is registered correctly, it’s better to check on the PA notary search website that your profile appears on it.

Step 8: Get the notary business supplies

Notarize documents with a standardized stamp

To start the loan signing business in Pennsylvania, you must have a notary seal. This helps you to include specific info in every document so you won’t leave out any required details.

You may purchase the notary seal from office supplies store. If you do, then usually they would require the details on your notary public commission certificate.

Also, the stamp’s design must comply with the regulatory rules. For instance, it needs to be a rubber stamp seal with a plain border. The maximum height of 1 inch and width of 3 ½ inches.

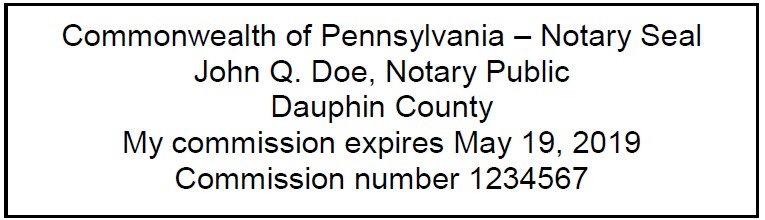

The stamp/seal must contain, in the following order:

– The words “Commonwealth of Pennsylvania”

– The words “Notary Seal”

– The name as it appears on the commission of the notary public and the words “Notary Public”

– The name of the county in which the notary public maintains an office

– The date the notary public’s commission expires

– The notary commission number

Quote from Pennsylvania Department of State – Notary Public Equipment

Here’s an example of a RULONA-compliant stamp. Note that the stamp no longer needs to contain the municipality of notary’s office.

Source: Pennsylvania Department of State – Notary Public Equipment

You must keep the notary seal in a locked and secured area, where only you have direct and exclusive control of it. (e.g. a locked drawer or cabinet.)

Maintain a notary journal

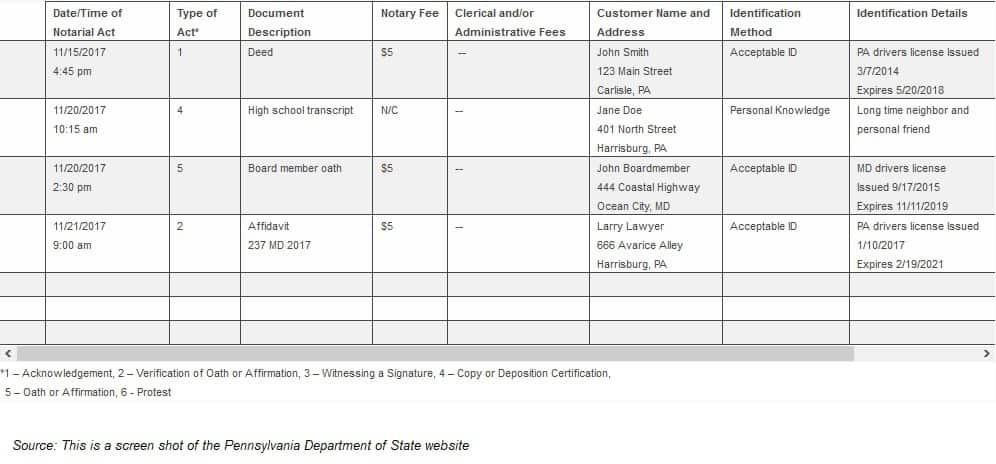

As a loan signing agent in Pennsylvania, you are required to keep a notary journal, or sometimes, referred to as, notary register.

Maintaining a good record of your notary acts is an essential part of good business practice. It could serve as proof that you have taken reasonable steps to identify the signer of a document.

It is mandatory hat the journal to be bounded with pre-printed pages. The entries must be recorded in chronological order. You may find it at stationery, office supply stores, or through notary associations.

Journal entries shall be made contemporaneously with performance of the notarial act and contain all of the following information:

– The date and time of the notarial act.

– A description of the record, if any, and type of notarial act.

– The full name and address (city and state) of each individual for whom the notarial act is performed.

– If identity of the individual is based on personal knowledge, a statement to that effect.

– If identity of the individual is based on satisfactory evidence, a brief description of the method of identification and any identification credential presented, including the date of issuance and expiration of an identification credential.

– The fee charged by the notary public.

Quote from Pennsylvania Department of State – Notary Public Equipment

Here’s an example of notary journal:

To protect the signers, you cannot include confidential details, such as their complete Social Security numbers, drivers’ license numbers, or account numbers. However, for clarification purposes, you may include the last four digits of the numbers.

Furthermore, besides keeping a physical journal, you could also maintain one in electronic format. Make sure it is tamper-evident and complies with the regulatory standard.

How to become a remote notary in Pennsylvania?

One thing I really like about this industry in Pennsylvania is the option for notary to work digitally. Doing so could bring you great convenience to streamline your notary practice.

But let me first explain the difference between “Electronic notarization” and “Remote notarization.”

“Electronic notarization,” sometimes known as “e-notary,” is where you meet the signer in person, but the documents are signed and notarized digitally.

On the other hand, “Remote notarization” is also being done digitally. But you are not physically present with the signer. Instead, you would verify their the signer’s identity through video and audio conference.

Sometimes, remote notarization is also referred to as webcam notarization, online notarization, or virtual notarization.

The Pennsylvania Department of State allows both electronic and remote notarization.

However, the approval of remote notarization could be a temporary measure. Although going paperless is a global trend, I’m unsure whether the PA state will keep the remote notarization by the time you’re reading this post.

So it’s better to confirm with the PA Department before you proceed further with the application.

Step 1: Submit the eNotary application

Your first step is to fill out the online eNotary application. In addition to some basic personal information, you also need to provide your commission ID and expiry date. Once again, the session cannot be saved. So it’s better to prepare all the necessary details and documents before you start.

Both electronic and remote notary are using the same form. Once the PA Department approves your application, they will send you an email notification. Even when you are approved with both electronic and remote notarization, the status will only indicate “electronic notarization.”

You’ll have until to the end of your current commission term to practice the e-notary.

Step 2: Select a PA approved technology vender

You would need an electronic platform to conduct the e-notarization. To ensure that the technology you’re using would comply with the regulatory standard, you must choose one from the PA Department approved list.

Here’s the list of PA approved electronic and remote notary solution vendors

| PA approved notary technology venders | Solution choices (In person, remote) |

|---|---|

| DocVerify, Inc. | Both |

| Safedocs Inc | Both |

| WWNotary, LLC d/b/a World Wide Notary | In person |

| CSC | In person |

| Pavaso | Both |

| DocuSign, Inc. | In person |

| Marketron Broadcast Solutions | In person |

| SimplySecureSign | Both |

| Nexsys Clear Sign | Both |

| Notarize | Remote |

| NotaryCam | Both |

| SIGNiX | Both |

Source: PA Department of State

Once you have selected a technology provider, they will inform the PA Department of State. When you search in their database, you will see the name of the technology company. Also, the status will appear as “e-notary capable.”

Want to earn money as a loan signing agent while enjoy working from home? Here’s another post on how you could do that.

How much can you make as a notary signing agent in Pennsylvania?

The average annual income of Loan Signing Agents in Pennsylvania is $47,270. The income typically ranges between $28,122 to $57,181. Top earning loan signing agents in Pennsylvania are making over $85,303.

source: ZipRecruiter – March 13, 2022

Can you make over $10,000/month as a loan signing agent? Be sure to check out our notary earning guide. You’ll find a case study where a loan signing agent has built her business to such a successful figure.

If you want to succeed in the loan signing industry, you must check out this loan system training program. If you review the testimonials of his students, you’ll be amazed at how the notary career changes their life after they learned from Mark Wills. (**)

Is there demand for notary loan signing agent in Pennsylvania?

As long as people are obtaining mortgages or refinancing their homes, there would be a demand for notary loan signing agents in Pennsylvania.

All originated mortgages in Pennsylvania

| YEAR | All originated mortgages |

|---|---|

| 2017 | 249,620 |

| 2016 | 273,334 |

| 2015 | 254,361 |

| 2014 | 222,765 |

| 2013 | 328,425 |

| 2012 | 369,571 |

| 2011 | 297,874 |

| 2010 | 334,150 |

| 2009 | 374,957 |

| 2008 | 322,031 |

| 2007 | 427,955 |

Source: Consumer Financial Protection Bureau – Home Mortgage Disclosure Act (HMDA) (June 12, 2020)

Furthermore, some states are “Attorney states,” which means only an attorney can handle the closing paperwork. Whereas, others are “Escrow States” where a loan signing agent can do the work.

According to the First American Title, Pennsylvania is a not an “Attorney State,” which is good news if you are interested in starting a notary loan signing business.

What education do you need to become a Pennsylvania notary public?

To become a notary public in Pennsylvania, you’ll need to complete a 3-hour notary course from an authorized education provider.

On the other hand, to become an electronic or remote notarization in Pennsylvania, there is no additional education requirement.

Is there an exam to become a notary in Pennsylvania?

You need to pass an exam to become a notary in Pennsylvania. It consists of 30 questions and the required passing score is 75 or higher.

Whereas, to become an electronic or remote notary in Pennsylvania, there is no additional exam requirement.

How much does it cost to become a notary in Pennsylvania?

It would cost approximately $296 to $419 to become a notary in Pennsylvania.

Here’s a breakdown of the costs to start a notary signing business

| Notary Application | $42 |

| PA Notary Exam | $65 |

| PA Notary Course | $26 to $150 |

| Surety Bond with E&O | $130 |

| Notary Stamp | $17 |

| Journal | $15 |

There could be other expenses involved, such as travel expenses, car maintenance, auto insurance, remote notary technology, laptop and other business supplies.

How long does it take to become a notary signing agent in Pennsylvania?

After you send it the application, it could take 4 to 6 weeks to schedule the exam writing. Upon passing the exam, it could another 30 days.

So it could take 8 to 10 weeks to become a notary signing agent in Pennsylvania.

Can a felon be a notary loan signing agent in Pennsylvania?

Having a conviction for a felony may impact the application to become a notary loan signing agent in Pennsylvania. The Pennsylvania Department of State needs to make sure that you are a person with credibility, truthfulness, and integrity to fulfill the responsibilities of the position.

(a) Authority.–The department may deny, refuse to renew, revoke, suspend, reprimand or impose a condition on a commission as notary public for an act or omission which demonstrates that the individual lacks the honesty, integrity, competence or reliability to act as a notary public.

Quote from REVISED UNIFORM LAW ON NOTARIAL ACTS

Having a felony does not necessarily mean your application will automatically be declined. It depends on the severity and nature of the conviction. The PA Department of State would review it on a case-by-case basis.

Before you go through the study and registration, you may contact the Pennsylvania Department of State’s office to discuss your specific case.

Also, you may check out the REVISED UNIFORM LAW ON NOTARIAL ACTS, Section 323. Sanctions. It covers the different scenarios where an applicant would get declined.

How to renew notary commission in Pennsylvania?

To renew the notary commission in Pennsylvania, you need to complete a 3-hour notary continuing education within six months of your re-appointment application.

To renew the notary commission in Pennsylvania, you need to complete a 3-hour notary continuing education within six months of your re-appointment application. The course must cover topics that maintain and enhance skills, knowledge, and competency to perform notarial acts. It can be learned in a classroom setting or online.

As I’m writing the post, these are the only two approved notary CE providers.

You need to renew the notary commission every four years. To avoid an interrupted business period, begin the renewal process in advance. Don’t wait till your current notary commission is expired.

Can I notarize for a family member in Pennsylvania?

You must not notarize any documents where you have any financial or beneficial interest in the transaction. Therefore, notarizing a document for any family member could call into question, and such practice should be avoided.

I have more questions about being a notary loan signing agent in Pennsylvania, where could I obtain more details?

You may contact the Pennsylvania Department of State:

- Address: Division of Commissions, Legislation and Notaries

210 North Office Building, Harrisburg, PA 17120 - Phone: (717)-787-5280

- ST-NOTARIES@pa.gov

Real-Life Case Study: A Family Man Earns $4,000/month as a Notary Signing Agent 30 days After Taking the LSS program

To help you have a better understanding of the potential in the loan signing business, I just watched an inspiring 20 minutes video. It is where Mark Wills, a top-notch notary coach, interviewed one of his students, Enrique.

Let’s give you a bit of the background. Enrique had worked in corporate America for over 15 years. However, the job nature really took a lot of his time away from his family.

Enrique felt the responsibility to spend more time with his family, so that he decided to give the loan signing business a try. Initially, he wasn’t overly satisfied with the amount of signing appointments. Then he took the Loan Signing System course.

After 30 days of taking the LSS program, he was able to earn $4,000/month as a notary signing agent. Enrique learned the technique from the program to include his profile into databases of signing services companies.

This is where he obtained the notary businesses. Imagine how much income growth if the signing appointments were coming directly from escrow or title companies!

His secret to success is to always show gratitude to the parties that bring him business. Sometimes, even being old-school and sending a thank-you card could go a long way in building a trusted relationship.

He also said that no prior background is needed to be a successful loan signing agent. As long as you invest in yourself and keep on learning, you could succeed in the notary signing industry.

Jacob: “Here’s a review of the Loan Signing System training. In there, you will find out the course curriculum, costs, and student ratings from different sources. I have talked to several notary signing agents who took the course. They will share with you their first-hand thoughts about the LSS.“

Disclaimer: The information in this post is for general information only, and not intend to provide any advice. They are subjected to change without any notice, and not guaranteed to be error-free. Some of the posts on this site may contain views and opinions from individual not related to JCHQ Publishing. They do not necessarily reflect our view or position.

(**) Affiliate Disclosure: Please note that some of the links above are affiliate links, and at no additional cost to you. Our company, JCHQ Publishing will earn a commission if you decide to make a purchase after clicking on the link. Please understand that we include them based on our experience or the research on these companies or products, and we recommend them because they are helpful and useful, not because of the small commissions we make if you decide to buy something through the links. Please do not spend any money on these products unless you feel you need them or that they will help you achieve your goals.

Reference:

- First American Title- Your Guide to Real Estate Customs by State (source)

- Pennsylvania Department of State – Notaries (source)

- Education Providers (source)

- Notary Public Equipment (source)

- The Steps to Becoming an Electronic or Remote Notary in Pennsylvania (source)

- Approved Electronic Notary (e-notary) Solution Vendors and Approved Remote Online Notarization (RON) Vendors (source)

- NOTARIES PUBLIC (57 Pa.C.S.) CHAPTER 3 REVISED UNIFORM LAW ON NOTARIAL ACTS (source)

- Pennsylvania Notary Examination Candidate Information Bulletin (source)

- Salary.com – Notary Signing Agent Salary in Pennsylvania (source)

- ZipRecruiter – Loan Signing Agent Salary in Pennsylvania (source)

- Consumer Financial Protection Bureau – Home Mortgage Disclosure Act (HMDA) (source)

- SuretyBonds.com – Pennsylvania Notary Public Bond (source)