(**) Disclosure: This post may contain affiliate links, meaning our company, JCHQ Publishing will get a commission if you decide to make a purchase through the links, but at no additional cost to you.

As a property manager, tenant screening is an important part of your job. It helps you find qualified tenants who are able and willing to make their rent payments on time each month and keep your managed property in good condition.

Out of all the steps in tenant screening, income verification plays a significant role in the process. And this is what we’ll be focusing on in this post. After all, a prospective renter could have the perfect credit score or background history, but they would not be able to afford the rent payments without sufficient income.

There are several different methods property managers can use to verify income for potential tenants. These include reviewing pay stubs and tax returns, reviewing bank statements, or even checking employment information with the applicant’s employer directly.

Yet, the prospective renters already provided you with the employment figures, and you might wonder what’s the point of going through the hassle of verification. The truth is you can’t just take everyone’s words for granted.

The income verification can help protect you from fraudulent behavior from your prospective tenants. And you can find out whether there are discrepancies between what your tenant claims they earn and their actual income.

Remember that an extra step today could save you costly evictions down the road.

But before we start, I want to give a brief disclaimer. This post is not intended as legal advice or state/federal real estate training. It is for general information only. Please always follow your State laws and best practices.

8 Proper Ways to Verify Tenants’ Income

1) Paystub

Paystub is a document that an employee receives from their employer detailing their earnings over a specific period, typically bi-weekly or monthly. This may include the base salary, overtime pay, and bonus. It will also have the following details:

- Employer’s name and contact information

- Employee’s name and address

- Gross income of the specific pay period

- Year-to-date earnings

- Deductions such as federal tax and state tax

As a property manager, you should require your applicants to provide two of their most recent pay stubs as part of the screening process.

Many companies are moving toward a digital filing system these days. They might have an employee portal where the prospective renter can download the paystubs.

But if the tenants are still receiving their payroll in the form of cheques, usually, the paystub would be attached to it.

Suppose the pay frequency is bi-weekly and the amount for each period is the same, then you just need to multiply the number by 26 to get the approximate gross annual income.

However, sometimes each payment amount could vary due to overtime and bonus. So the best is to also review the employment letter.

Here’s a clip on how to read a pay stub:

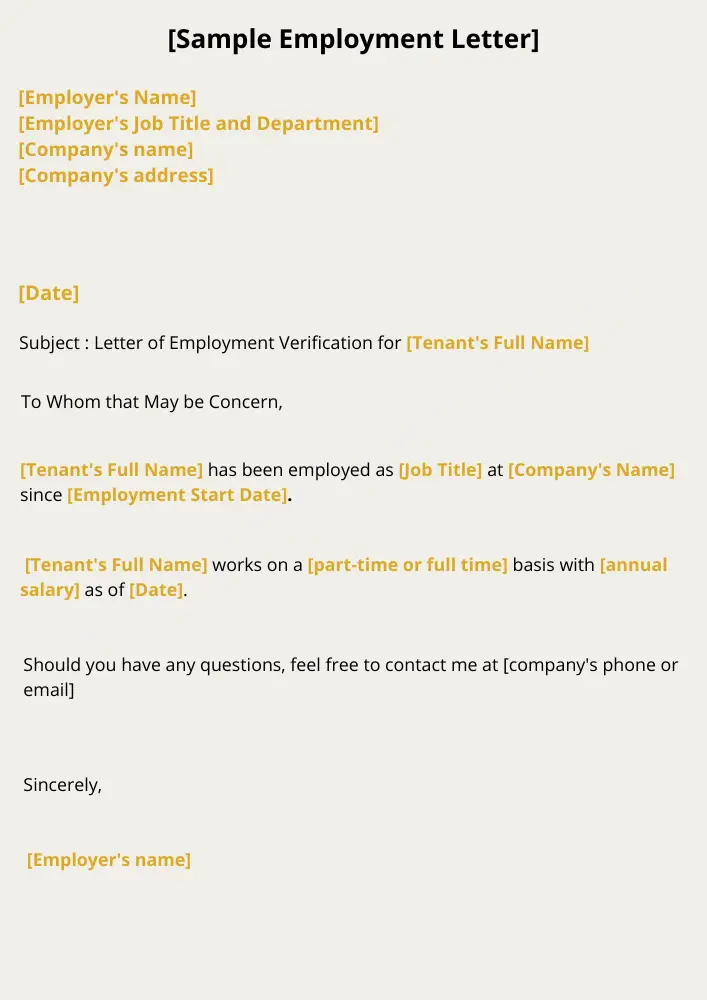

2) Employment letter

It is an official letter written by the employer, which outlines more details about the prospective renter’s employment. Typically speaking, the letter will cover:

- Employer’s name and contact information

- Employee’s name and address

- Job title

- Start date of employment

- Compensation (hourly rate or salary, and how often it is paid out)

- Length of employment, including whether the employee is on a probation period

I’ve seen employment letters where the base salary, bonus, and overtime pay are indicated separately. Since the overtime and bonus may not be applicable every year, this allows you to better understand the stability of the applicant’s income.

(Actually, some mortgage lenders only consider the year-end bonus if the applicant received them for at least two consecutive years and the overtime pay if the employer specified this is a guarantee of work hours every month. Perhaps, this could be an even more conservative way to evaluate the rent affordability.)

The tenants should be able to get it from the HR department of their workplace. For a smaller-sized company that doesn’t have a separate HR department, the business owner could be the one who provides it.

However, several real estate professionals shared with me that despite receiving pay stubs and employment letter, sometimes, they can be fabricated.

Therefore, they suggest validating the company through other means such as checking the business registration data business, the Better Business Bureau (BBB) profile, or as simple as doing some Google search of the employing company.

3) Tax returns

A tax return is also a great way to validate your applicants’ income. Although paystubs and employment letters can be forged, it is less likely people will overstate their income on the actual tax filing because this would result in paying more income tax to the government.

Carefully review the income listed on the tax return, and compare them with the figures on the employment letter and pay stubs.

But keep in mind that some common deductions may result in discrepancies between the figures. (i.e., IRA deduction, employment expenses such as license fee)

Furthermore, if you see that applicants have accumulated a lot of tax owing, this could be a sign that they have a habit of not making obligated payments.

4) Profit and Loss Statement

An incorporated business is considered a separate entity from the business owner. Therefore, unless the prospective tenant pays out the company’s profit entirely to themselves every year (which is rarely the case), the individual payroll may not totally reflect their earning situation.

I personally know many business owners who pay very little salary or dividend to themselves for tax deferral purposes while their company is making a handsome profit every year.

The company’s profit and loss statement can be used to verify the income of a self-employed business owner. This document summarizes a company’s revenue and expenses over a certain period, usually quarterly or annually.

It’s important to confirm the ownership of the company. You may do so by reviewing the company’s “Article of Incorporation” or the business registration database of the state.

Also, when reviewing the P&L statement, the best is to obtain a copy audited by a Certified Public Accountant (CPA).

Here’s a video which explains the P&L statement:

5) Social Security Benefits Statement

In addition to payroll, some tenants are collecting social security income from the government. These could be benefits that assist the elderly or disabled persons.

The applicant should be able to provide you with the “Social Security Benefit Statement” (Form SSA-1099), and they can obtain it by contacting the Social Security Administration. The statement will show the amount of social security income received in the previous year.

Unless the government cancels the program or the individual circumstances change, the income source from these benefits is relatively stable. But whether the income is large enough to justify paying rent every month will depend on the rent amount you’re charging. But it’s still a good idea to know about it.

The potential renter can download the SSA-1099 through the SSA online services. Here’s a video on how to setup the online account.

6) Court Order Agreement

Sometimes the tenant may be collecting alimony or child support from the previous marriage, and some may be receiving compensation as a result of an accident.

In all the above cases, you can review the court order agreement, which documents how much they are getting compensated on a monthly basis.

This money could be considered another source of verifiable income.

For renters who have alimony arrangements with their former spouse, they should be able to provide you with a “Divorce Decree” issued by the court or “Settlement Agreement” in order to verify their alimony payments.

For child support, you may refer to the “Notice and Acknowledgement of Receipt” (Form FL-191).

7) Statements for other income sources

Many retirees may no longer have employment income. Instead, they could be receiving pension benefits or annuity payments. You may verify them through the annual statement from the financial institutions.

Furthermore, I’ve met several people who are unable to work due to their medical conditions. And they’re receiving a disability benefit from the insurance company. These are actual payments directly deposited into their bank account every month.

Once again, you can verify them through the annual statement from the insurer.

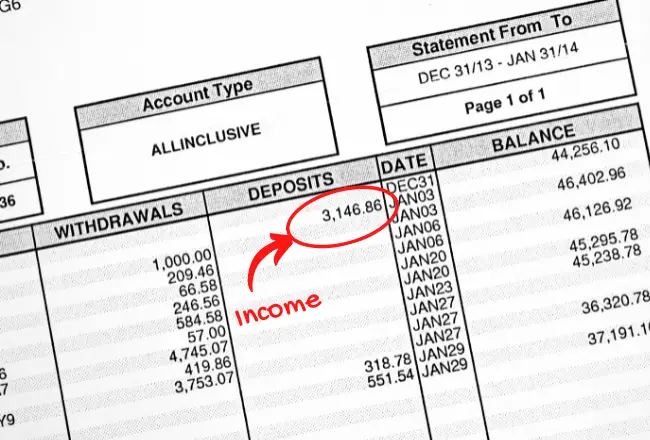

8) Bank statements

Most of the above verification methods illustrate what prospective renters are supposed to receive. But it may not be sufficient to prove that they are really getting the money.

Therefore, it’s important to review their bank statements to make sure the income is being deposited into their account, as they said. If there are any discrepancies, you’ll need to follow up with the applicant to get an explanation.

On the other hand, some people can show their income only in the bank statement, but not through other means such as tax returns or paystubs. That’s because they are receiving cash in their business or jobs, and they did not report them to the IRS.

Although they may display good cash flow now, I would think twice about whether to rent the unit to them. After all, if they are already breaking the laws through tax evasion, will you be confident that they will follow the terms of the lease agreement and pay the rent on time?

What is a good rent-to-income ratio?

The rent-to-income ratio is used to measure rental affordability. This is a tool used by property managers and landlords to evaluate whether an applicant can afford the monthly rent payments.

After all, besides paying rent, the renters need to account for other daily expenses such as utilities, groceries, clothing, insurance, and transportation.

This rent-to-income ratio is calculated by dividing the monthly rent by the applicant’s gross monthly income, typically expressed as a percentage. If the ratio is too high, the applicant may struggle to make ends meet and may have difficulty paying their rent on time each month.

To ensure that your tenants can afford the rental payments, the industry standard sets the Rent-to-Income ratio of 30% or lower.

Additional Resources for Property Managers

- How to find the RIGHT tenants?

- Should property managers use Buildium? (Read this before you subscribe!)

- How to Deal With Tenants NOT Paying Rent? (+Expert Advice from a Professional Property Manager)

- How to Write a Rental Ad that Attracts High Quality Tenants?

Buildium is an ALL-in-ONE property management software that allows you to manage rental applications, maintenance requests, payment collections, tenant screening, showings coordination, property inspections, renter insurance, and many more. It also provides you with a professionally designed website so you can effectively build your brand. If you want to streamline your property management business, you must click here to check out Buildium. (**)

Reference:

- TransUnion| SmartMove (source)

- Social Security Administration – Get a copy of your Social Security 1099 (SSA-1099) tax form online (source)

- TemplateLab – 40 Proof of Employment Letters, Verification Forms, Templates & Samples (source)

(**) Affiliate Disclosure: Please note that some of the links above are affiliate links, and at no additional cost to you. Our company, JCHQ Publishing will earn a commission if you decide to make a purchase after clicking on the link. Please understand that we include them based on our experience or the research on these companies or products, and we recommend them because they are helpful and useful, not because of the small commissions we make if you decide to buy something through the links. Please do not spend any money on these products unless you feel you need them or that they will help you achieve your goals.

Disclaimer: The information in this post is for general information only, and not intend to provide any advice. They are subjected to change without any notice, and not guaranteed to be error-free. Some of the posts on this site may contain views and opinions from individual not related to JCHQ Publishing. They do not necessarily reflect our view or position.